- United States

- /

- Consumer Durables

- /

- NYSE:NVR

NVR (NVR) Valuation: Is the Premium Justified After Recent Share Price Dip?

Reviewed by Kshitija Bhandaru

NVR (NVR) shares have edged lower recently, down about 2% over the past month as broader market sentiment for homebuilders wavers. Investors are taking note of how housing demand and elevated interest rates continue to influence the company’s performance.

See our latest analysis for NVR.

Looking back over the year, NVR’s share price return has steadily lost momentum, with a 1-year total shareholder return of -21.85% weighing on what had previously been outstanding three- and five-year figures. Even as the stock bounced around news cycles and shifting interest rate expectations, recent price stumbles suggest investors are questioning the near-term growth story. NVR’s longer-term record remains impressive.

If the market’s sudden shift in mood has you searching for fresh ideas, this could be the perfect moment to discover fast growing stocks with high insider ownership

The question now is whether recent losses have created a compelling entry point for NVR, or if the market has already factored in all the company’s future prospects and left little upside for new buyers.

Price-to-Earnings of 14.1x: Is it justified?

NVR currently trades at a price-to-earnings (P/E) ratio of 14.1x, noticeably higher than the industry average, despite recent declines in share price and earnings.

The P/E ratio measures how much investors are paying for each dollar of the company's earnings and serves as a quick gauge of market expectations. For NVR and its peers in the homebuilding sector, this multiple can reflect anticipated profit growth, perceived stability, or sector momentum.

With a 14.1x multiple, the market appears to assign a premium compared to other companies in the Consumer Durables space. Yet, compared to the industry average of 10.7x and an estimated fair P/E ratio of 12.8x, NVR looks relatively expensive. If sentiment shifts or earnings growth underwhelms, there could be downward pressure for the price-to-earnings level to revert closer to peers and the modeled fair value.

Explore the SWS fair ratio for NVR

Result: Price-to-Earnings of 14.1x (OVERVALUED)

However, ongoing declines in annual revenue and net income growth could challenge NVR’s premium valuation if market conditions do not improve soon.

Find out about the key risks to this NVR narrative.

Another View: SWS DCF Model Suggests Full Pricing

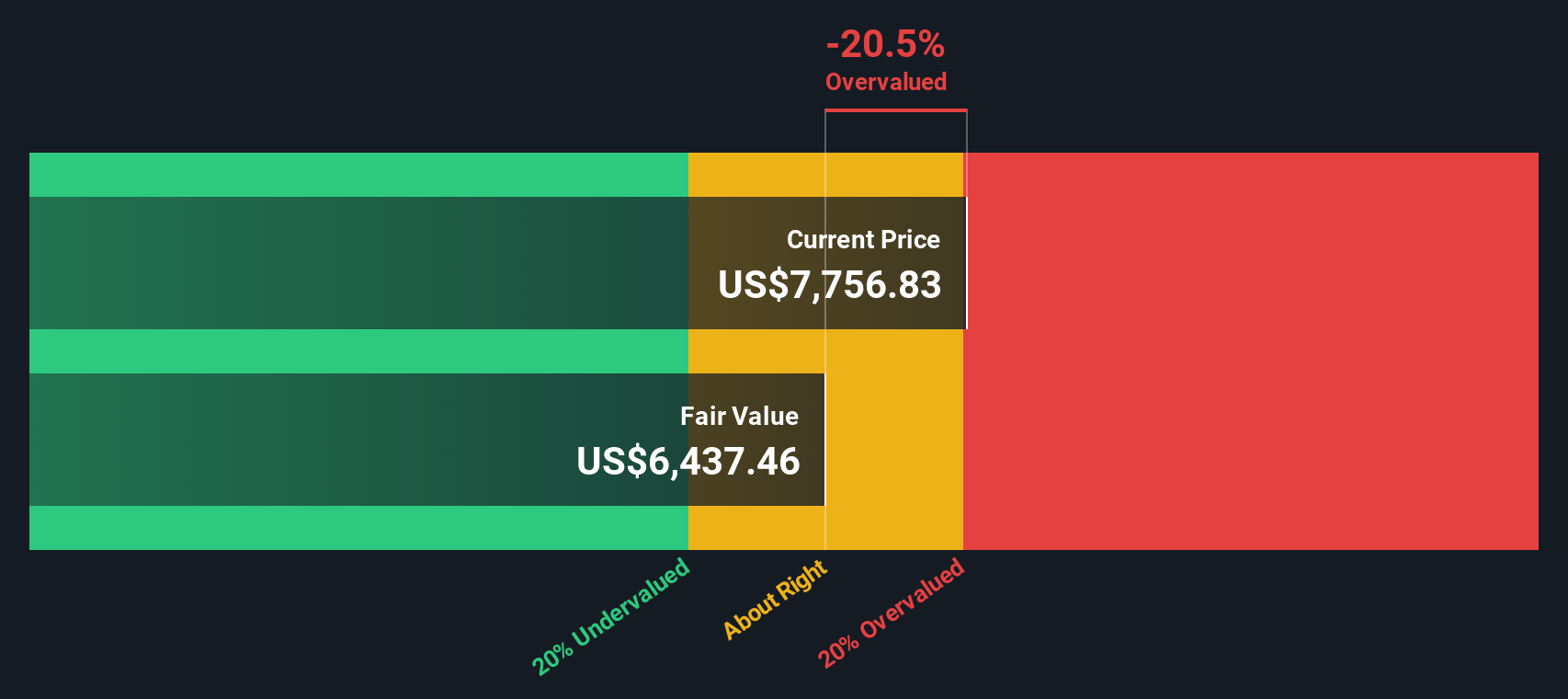

While the price-to-earnings ratio paints NVR as expensive, our DCF model also suggests little upside at today’s levels. At $7,450.90 per share, the stock currently trades about 16% above our estimated fair value of $6,445.80. Could this mean investors are too optimistic, or is something the market sees going unnoticed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVR for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVR Narrative

If you see the story differently, or want to dig into the numbers yourself, you can shape your own take in just a few minutes. Do it your way

A great starting point for your NVR research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't settle for limited choices when the market is full of opportunities. Give yourself an edge and check out these handpicked routes to smarter investing:

- Unlock potential growth by targeting these 898 undervalued stocks based on cash flows with strong fundamentals that remain overlooked by the broader market.

- Enhance your portfolio with steady income streams by reviewing these 19 dividend stocks with yields > 3% offering reliable yields above 3%.

- Stay on the frontier of innovation by examining these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVR

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives