- United States

- /

- Luxury

- /

- NYSE:NKE

NIKE (NYSE:NKE) sheds US$4.9b, company earnings and investor returns have been trending downwards for past three years

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term NIKE, Inc. (NYSE:NKE) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 54% decline in the share price in that time. The more recent news is of little comfort, with the share price down 28% in a year. Furthermore, it's down 10% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since NIKE has shed US$4.9b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for NIKE

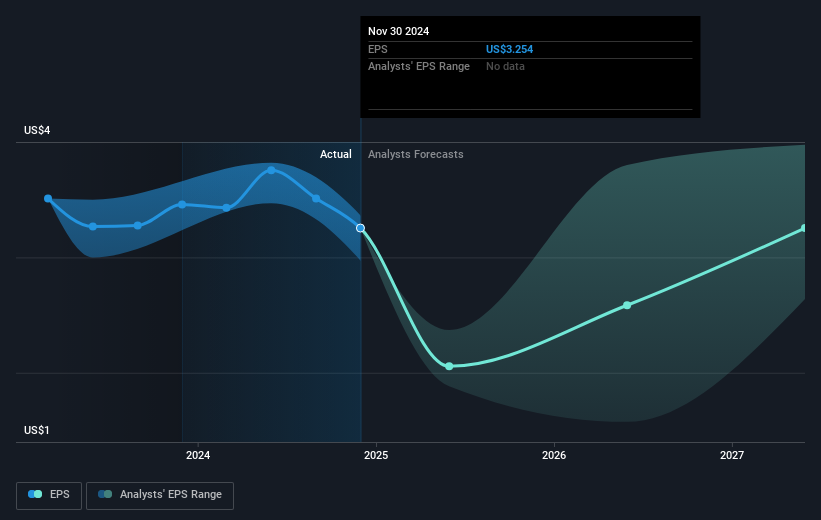

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

NIKE saw its EPS decline at a compound rate of 5.6% per year, over the last three years. The share price decline of 23% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on NIKE's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

NIKE shareholders are down 27% for the year (even including dividends), but the market itself is up 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on NIKE you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives