- United States

- /

- Luxury

- /

- NYSE:NKE

In Contrast to Institutional Opinion, NIKE (NYSE:NKE) Might not be as Far from its Fair Value

After an exceptional performance in Q4 2021, NIKE, Inc. (NYSE: NKE) led the market decline, shedding almost one-third of its value. It was unquestionably, influenced by the fresh concerns about the latest COVID-related shutdowns in China.

While institutions are taking a positive stance, our valuation analysis shows that the stock isn't that far from its fair value.

Check out our latest analysis for NIKE

Some Supply-Chain Issues Still Remain

After fighting through the various issues, including Vietnamese factories shutdowns and port congestions in North America, Nike seems to be back on track after beating the latest earning report.

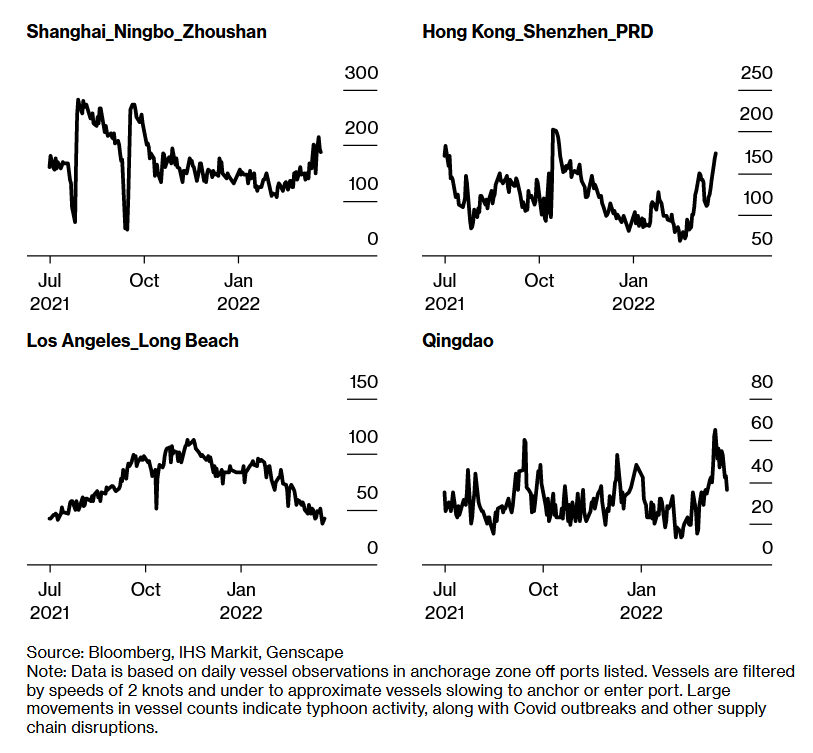

While there are positive developments on the demand side – including a rise in outdoor activities, some supply issues remain. There is traffic congestion on the other side of the Pacific, as container ship congestion disrupts the shipping lines once again.

You can compare the traffic between the Chinese ports and Los Angeles – which peaked in Q4 2021.

Institutions Remain Optimistic

JPMorgan reiterated an Overweight rating with a US$164 price target quoting improvements in China despite the impact of COVID-related restrictions.

Furthermore, after talking to Nike's management, UBS reiterated a Buy rating with a price target of US$173. Thir analyst Jay Sole believes that the demand, particularly in digital channels, remains strong and that potential issues in China have been contemplated in Nike's guidance.

What is NIKE worth?

According to our valuation model, NIKE seems to be fairly priced at around 1.26% above the intrinsic value, which means if you buy NIKE today, you’d be paying a relatively reasonable price for it.

While the stock remained flat over the last few weeks, in our revision of Nike's fundamentals, the valuation was at US$140; thus, it is slightly decreasing. If you believe the company’s true value is $131.80, there’s only a minor downside when the price falls to its real value. Furthermore, NIKE’s low beta implies that the stock is less volatile than the wider market.

Can we expect growth from NIKE?

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a cheap price.

The graph above synthesizes the expectation from analysts that the earnings could steadily grow as the annual forecast sits at around +14.6%.

What this means for you:

At the moment, Nike seems like a mixed bag with pros and cons balanced against one another. The stock is showing signs of bottoming, the balance sheet looks strong, margins are healthy, and the return on equity is outstanding. On top of it, institutions are reiterating their optimism. It can be valuable to consider what analysts expect from NIKE from their most recent forecasts. So feel free to check out our free graph representing analyst forecasts.

On the other hand, supply chain risks are still present, growth is in-line with industry expectations, and the dividend is not notable. Finally, we must consider that even after a noticeable decline from its highs, the stock still trades at a hefty price-to-earnings ratio of 34.3x.

If you are no longer interested in NIKE, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives