- United States

- /

- Luxury

- /

- NYSE:NKE

Fundamental Review for NIKE (NYSE:NKE) - Why the Stock may be Trading Around Intrinsic Value

NIKE, Inc. (NYSE:NKE) just reported earnings results and guidance. In order to get a better picture for the stock, we will review their fundamentals and see where the stock might be headed in the future.

Q3 results just came in and here are the highlights:

- Q3 Sales US$10.87b, 4.96% YoY growth and beating expectations by 2.5%

- Q3 Net Income US$1.396b, US$-3.65% YoY

- TTM Sales US$46.82b, 21.6% YoY

- TTM Net Income US$6.1b, 78.4% YoY

- TTM Profit margin 13.1%

As per their guidance, the company continues to expect revenue for the full year to grow mid-single digits versus the prior year.

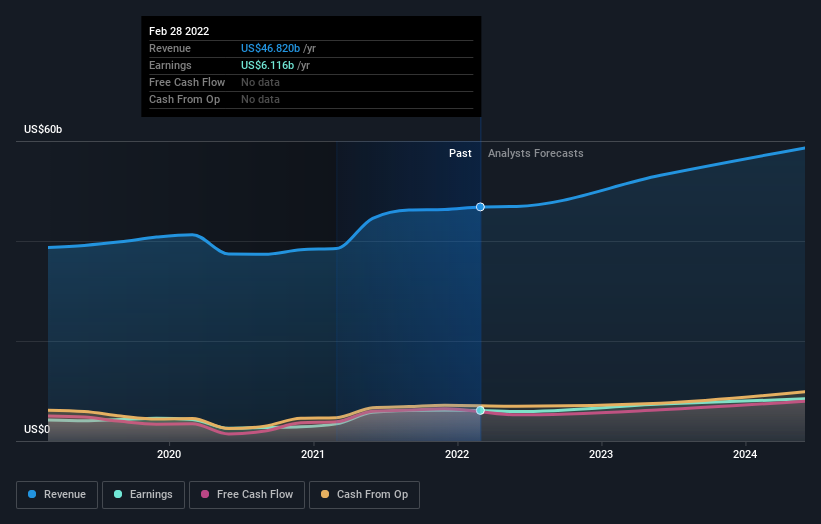

Looking at the historical performance, we can see that Nike is posting growing income at the top and bottom line. Compared to the stock movement, we can see that the price is down to about US$133, vs the highs of US$177.5 in November 2021. This may indicate that investors are worried about future performance or are possibly diverting funds elsewhere.

As a company, Nike has a strong, world recognized brand, and with that comes some pricing power that can shield the company in "bad" times. This was evident in the first 2020 drop, when Nike's top and bottom line declined 9.3% and 41.1% respectively from the previous quarter - One can argue that this also stress tested the company's digital presence.

Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for NIKE

After the latest results, the 31 analysts covering NIKE are now predicting revenues of US$53.1b in 2023. If met, this would reflect a decent 13% improvement in sales compared to the last 12 months.

Statutory earnings per share are predicted to go up 21% to US$4.68, reflecting a net income of US$7.38b. Comparing to pre-pandemic numbers, we can see that Nike is expected to significantly increase free cash flows from US$3.46b in 2020 to US$6.24b in 2023.

Before this earnings report, analysts have been forecasting earnings per share (EPS) of US$4.79 in 2023. The analysts seem to have become a little more negative on the business after the latest results, given the small dip in their earnings per share numbers for next year.

This has led the consensus price target to fall 5.5% to US$169, with the analysts clearly linking lower forecast earnings to the performance of the stock price.

The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on NIKE, with the most bullish analyst valuing it at US$195 and the most bearish at US$132 per share. We can see that Nike is currently trading on the lower end of price targets, implying that the stock has possibly 27% upside according to the average price target.

Another way to make sense of Nike's performance is to compare it with a model for valuing future cash flows and come up with an intrinsic value for the company. Our general model values the company at US$140.7 per share - so we can see that the cash flows are closer to the conservative price targets for Nike.

Key Takeaways

Nike is continuing reliable and strong fundamental performance with record earnings, and expected bottom line growth in 2023. However, analysts have modified their view on the value of the company's bottom line and revised the price target.

Our general valuation model seems to be more in-line with the lower end of price targets, and implies that the stock is trading around fair value. See the assumptions and details of the model HERE.

Overall, Nike is a strong performer, which continues to increase in value as cash flows keep growing. The company is also a worldwide recognized brand that has some protections of economic downturns.

And what about risks? Every company has them, and we've spotted 1 warning sign for NIKE you should know about.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives