- United States

- /

- Luxury

- /

- NYSE:NKE

Earnings Reveal a Loss of Pricing Power and Valuation Risk for NIKE, Inc. (NYSE:NKE)

Summary:

- Nike is experiencing margin pressures and inventory build-ups, indicating challenges with their pricing power.

- The forward PE is some 24% exposed to mean reversion.

- A recovery may be slow as the company addresses headwinds, and some investors may look for better opportunities.

NIKE's (NYSE:NKE) reported earnings give investors some room to re-evaluate. The company noticed a decline in Greater China as 5x shipping cost increases are persistent, and the EBIT margin came down under pressure. In this analysis, we will pair the earnings performance and future expectations with the price to earnings exposure of the company.

Here are the key highlights from Nike's latest earnings call:

- Q1 revenue $12.2 billion, down 1% YoY. Footwear was flat, while apparel lost 6%.

- Gross margin down 0.8% to 45%.

- EBIT margin down 26%, from $1.917b to $1.414b YoY.

- Net income down 5%, from $1.509b to 1.439b.

- Authorized $18b repurchase program.

The results caution that Nike is having issues holding up the bottom line. This could be a result of inflation and supply-chain headwinds, showing up as reduced pricing power for the brand, even as they decide to rise prices by single digits on certain items.

The company struggled in Greater China, where it lost 19% of YoY sales as the inventory grew during the lockdowns and extended lead times. Nike is expecting a low double-digit sales growth percentage for the next quarter.

Nike's CFO stated: "We're paying about five times the rate that we paid pre-pandemic to put product in a container on a boat and move it from Asia to the U.S., so up 260 basis points with 100 basis points of a headwind." Indicating to investors that the 5x rise in shipping container prices is still persisting and affecting the profitability of the company.

In the next section, we will review what this means for the pricing of the stock.

Price to Earnings Exposure

Keep in mind that the company expects a margin normalization in the next few years, with a target gross margin at the high 40ties. This may indicate that the primary focus of the company in the meantime will be damage-control, e.g. trying to offset price and supply chain headwinds.

This gives us an indication that the bottom-line may take some time to recover, and investors can see their price to earnings exposure based on current performance.

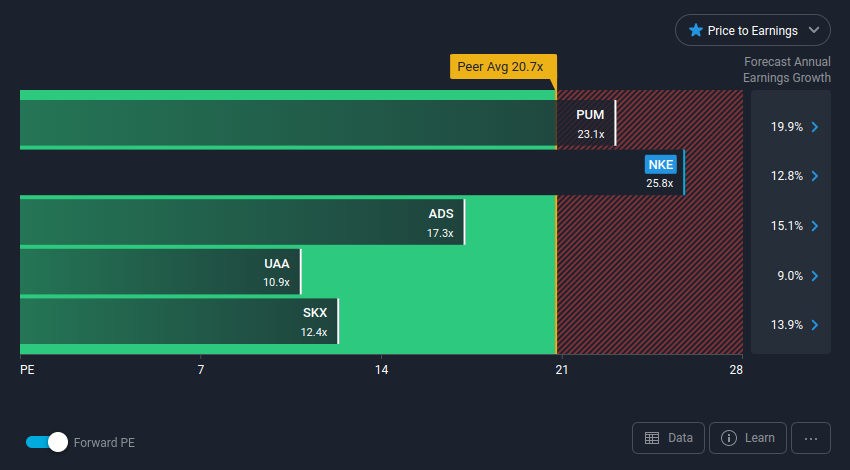

In the chart below, we can compare the pricing exposure of the company versus key peers in the industry:

We see that Nike is somewhat more exposed on a pricing basis vs peers, and as earnings are expected a slow recovery, investors may worry of a future correction in the P/E multiple. An additional factor that may contribute to this is the decline in the EBIT margin, which can signal to investors that the company is having difficulties retaining some portions of their consumer base, which may be switching to more cost-effective alternatives.

The forward P/E ratio shows that investors are paying 25.8 times the future expected earnings of the company. This is somewhat higher than the peer forward average of 20.7x, implying that Nike's stock price is exposed to a 24% mean reversion effect.

The Final Word

In order for a higher P/E to be justified in a company, investors need to have a viable expectation of future growth. This needs to be reflected both in the top and bottom line, however the priority for investors is at the bottom line as the top line may be propped up by inflationary growth as opposed to real growth. Considering the slow expected growth of the bottom line for Nike, it is reasonable to assume that investors who have a shorter investment horizon, may be discouraged by the expected performance of the company and the stock valuation may suffer.

We also fond 1 warning sign for NIKE that you need to be mindful of.

If these risks are making you reconsider your opinion on NIKE, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:NKE

NIKE

Engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives