- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

3 US Stocks Estimated To Be Undervalued By Up To 49%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, highlighted by recent declines in technology shares and a pause in the post-election rally, investors are keenly observing economic indicators and Federal Reserve actions for clues on future market directions. In this context of uncertainty, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | $72.03 | $142.69 | 49.5% |

| NBT Bancorp (NasdaqGS:NBTB) | $50.08 | $99.93 | 49.9% |

| UMB Financial (NasdaqGS:UMBF) | $126.05 | $242.94 | 48.1% |

| West Bancorporation (NasdaqGS:WTBA) | $23.99 | $46.82 | 48.8% |

| Five Star Bancorp (NasdaqGS:FSBC) | $33.16 | $63.88 | 48.1% |

| Symbotic (NasdaqGM:SYM) | $23.995 | $47.05 | 49% |

| Privia Health Group (NasdaqGS:PRVA) | $21.66 | $43.16 | 49.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.50 | $30.26 | 48.8% |

| Intuitive Machines (NasdaqGM:LUNR) | $14.45 | $28.59 | 49.5% |

| Snap (NYSE:SNAP) | $11.61 | $22.75 | 49% |

Let's review some notable picks from our screened stocks.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform facilitating connections between merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $74.36 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, which generated $10.15 billion.

Estimated Discount To Fair Value: 27.2%

DoorDash is trading at US$178.44, notably below its estimated fair value of US$244.95, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution and insider selling, DoorDash's revenue is forecast to grow 14.3% annually, outpacing the broader market. Strategic partnerships with Walmart Canada and InComm Payments enhance its service offerings and customer reach, potentially bolstering future cash flows as it aims for profitability within three years.

- Our growth report here indicates DoorDash may be poised for an improving outlook.

- Dive into the specifics of DoorDash here with our thorough financial health report.

Levi Strauss (NYSE:LEVI)

Overview: Levi Strauss & Co. designs, markets, and sells apparel and related accessories for men, women, and children worldwide with a market cap of approximately $6.66 billion.

Operations: The company's revenue is primarily derived from three geographical segments: Americas with $3.09 billion, Europe with $1.56 billion, and Asia with $1.06 billion.

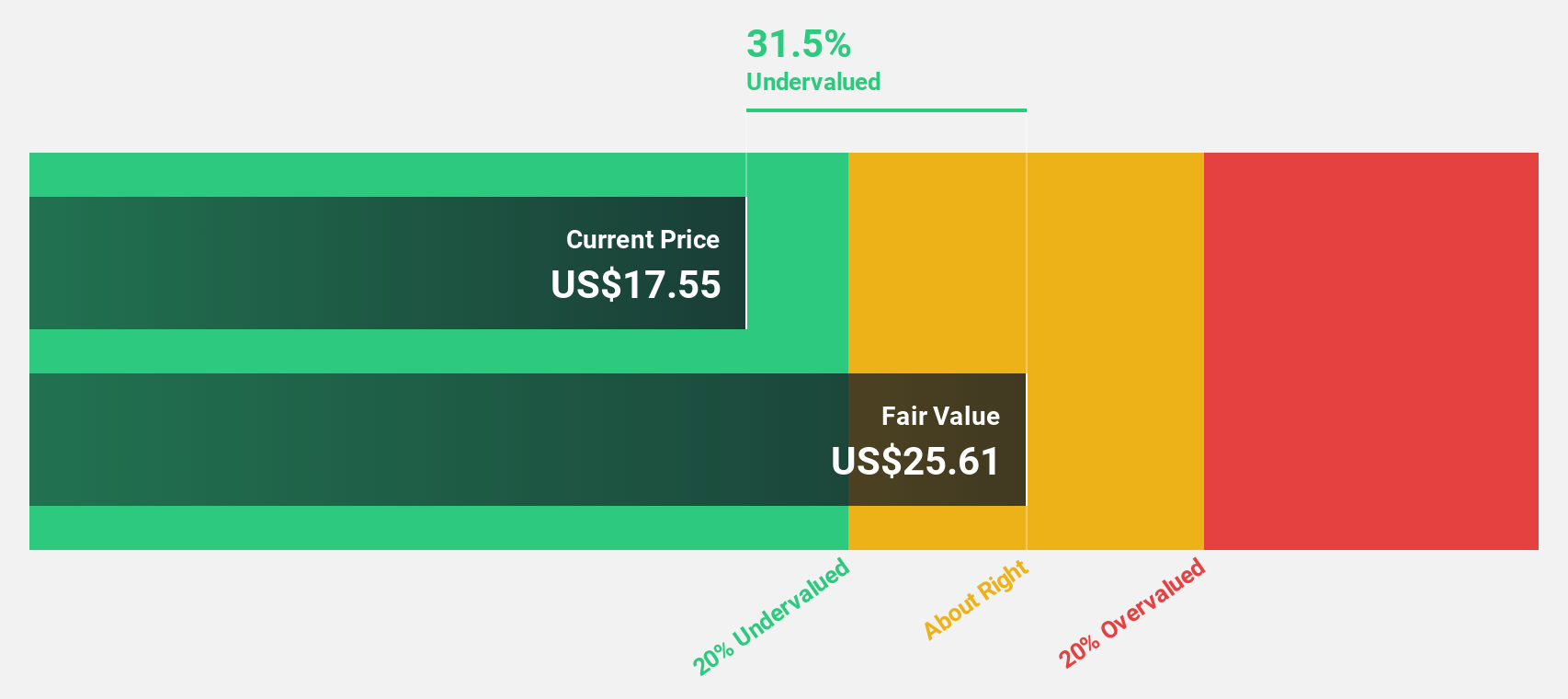

Estimated Discount To Fair Value: 31.5%

Levi Strauss is trading at US$16.91, significantly below its estimated fair value of US$24.7, making it potentially undervalued based on cash flows. Despite a strategic review of its underperforming Dockers brand and slower revenue growth forecasts compared to the market, Levi's earnings are expected to grow substantially at 45.4% annually over the next three years. However, current profit margins have declined from last year, and dividends remain inadequately covered by earnings.

- Upon reviewing our latest growth report, Levi Strauss' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Levi Strauss with our comprehensive financial health report here.

Snap (NYSE:SNAP)

Overview: Snap Inc. is a technology company that operates in North America, Europe, and internationally with a market cap of $19.46 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $5.17 billion.

Estimated Discount To Fair Value: 49%

Snap is trading at US$11.61, well below its fair value estimate of US$22.75, suggesting it is undervalued based on cash flows. Despite slower revenue growth forecasts compared to optimal levels, earnings are expected to grow significantly at 64.84% annually over the next three years. Recent insider selling raises concerns, but Snap's share repurchase program worth up to US$500 million could potentially enhance shareholder value as it aims for profitability within three years.

- Our comprehensive growth report raises the possibility that Snap is poised for substantial financial growth.

- Take a closer look at Snap's balance sheet health here in our report.

Taking Advantage

- Embark on your investment journey to our 191 Undervalued US Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

High growth potential with excellent balance sheet.