- United States

- /

- Chemicals

- /

- NasdaqCM:ALTO

3 US Penny Stocks With Market Caps Over $100M

Reviewed by Simply Wall St

Amid a rally in chip stocks that has lifted the S&P 500 and Nasdaq Composite, investors are exploring various avenues for growth, including penny stocks. Although the term 'penny stocks' might seem outdated, these investments continue to offer potential opportunities by focusing on smaller or newer companies with promising financial health. In this article, we examine three such penny stocks that stand out for their robust balance sheets and potential for significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80 | $5.97M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.76B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.90 | $10.89M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3021 | $12.01M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.15 | $98.88M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.77 | $47.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.86 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.04 | $88.55M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alto Ingredients (NasdaqCM:ALTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alto Ingredients, Inc. operates in the United States producing, distributing, and marketing specialty alcohols, renewable fuel, and essential ingredients with a market cap of $134.13 million.

Operations: The company's revenue is primarily derived from its Pekin Campus Production at $606.10 million, followed by Marketing and Distribution at $237.13 million, and Western Production contributing $159.33 million.

Market Cap: $134.13M

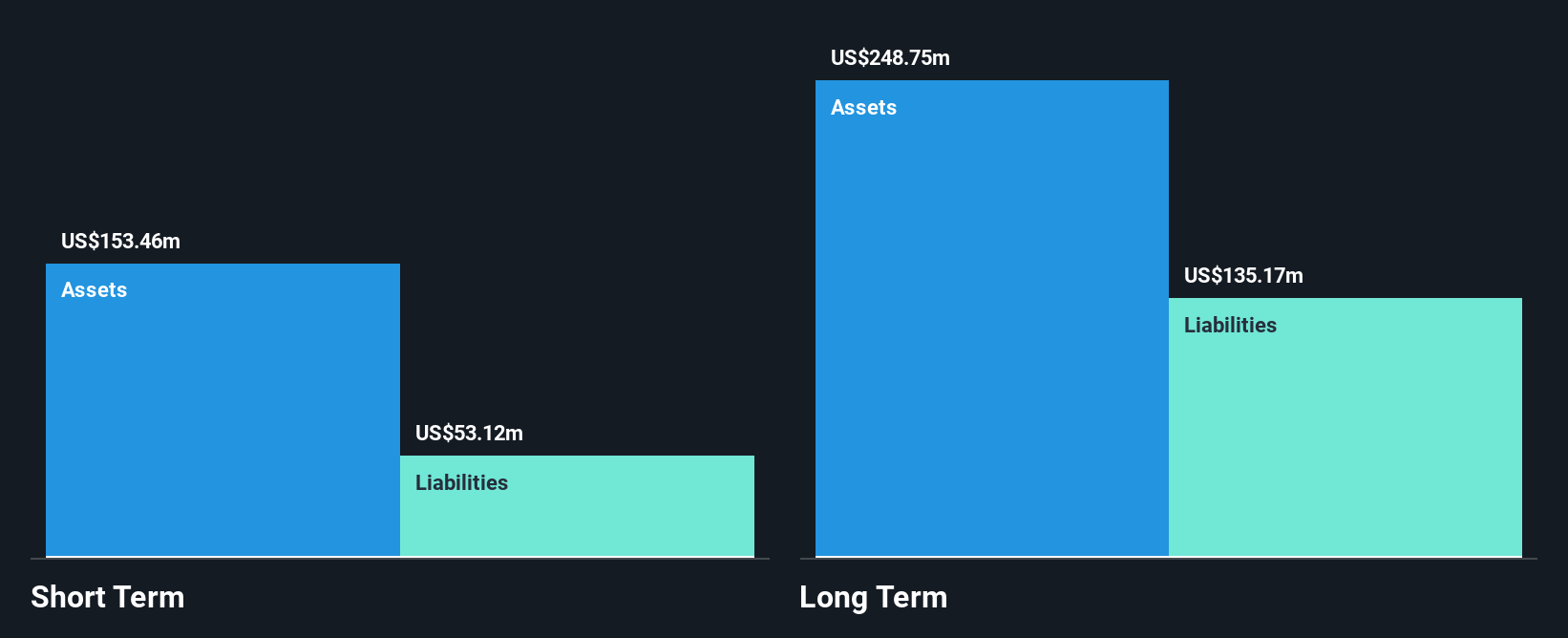

Alto Ingredients, with a market cap of US$134.13 million, is navigating challenges typical of penny stocks, including high volatility and unprofitability. Despite this, the company has made strides in reducing its debt-to-equity ratio from 92.7% to 31.6% over five years and maintains a satisfactory net debt level at 18.9%. Recent business reorganizations include idling its Magic Valley facility while enhancing operations with new technology for higher-margin products like high protein and corn oil. The company reported Q3 sales of US$251.81 million but continues to incur losses, highlighting ongoing financial pressures amidst strategic adjustments such as CO2 sequestration projects at its Pekin campus.

- Dive into the specifics of Alto Ingredients here with our thorough balance sheet health report.

- Examine Alto Ingredients' earnings growth report to understand how analysts expect it to perform.

Smart Share Global (NasdaqCM:EM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Smart Share Global Limited is a consumer tech company offering mobile device charging services in the People's Republic of China, with a market cap of approximately $184.66 million.

Operations: The company's revenue is primarily derived from its Rental & Leasing segment, which generated CN¥1.96 billion.

Market Cap: $184.66M

Smart Share Global, with a market cap of US$184.66 million, has transitioned to profitability recently and maintains high-quality earnings. The company operates without debt, eliminating concerns over interest payments and coverage. Its short-term assets of CN¥4 billion comfortably cover both short- and long-term liabilities, indicating strong financial health. Despite trading at a significant discount to estimated fair value, the stock experiences high volatility compared to most U.S. stocks. Management's seasoned experience supports strategic stability, while future earnings are forecasted to grow substantially by 43.55% annually, suggesting potential for growth despite current volatility challenges.

- Navigate through the intricacies of Smart Share Global with our comprehensive balance sheet health report here.

- Understand Smart Share Global's earnings outlook by examining our growth report.

Newegg Commerce (NasdaqCM:NEGG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Newegg Commerce, Inc. is an electronics-focused e-retailer operating in the United States, Canada, and internationally with a market cap of approximately $185.24 million.

Operations: The company generates revenue primarily through its online retail segment, which accounts for $1.39 billion.

Market Cap: $185.24M

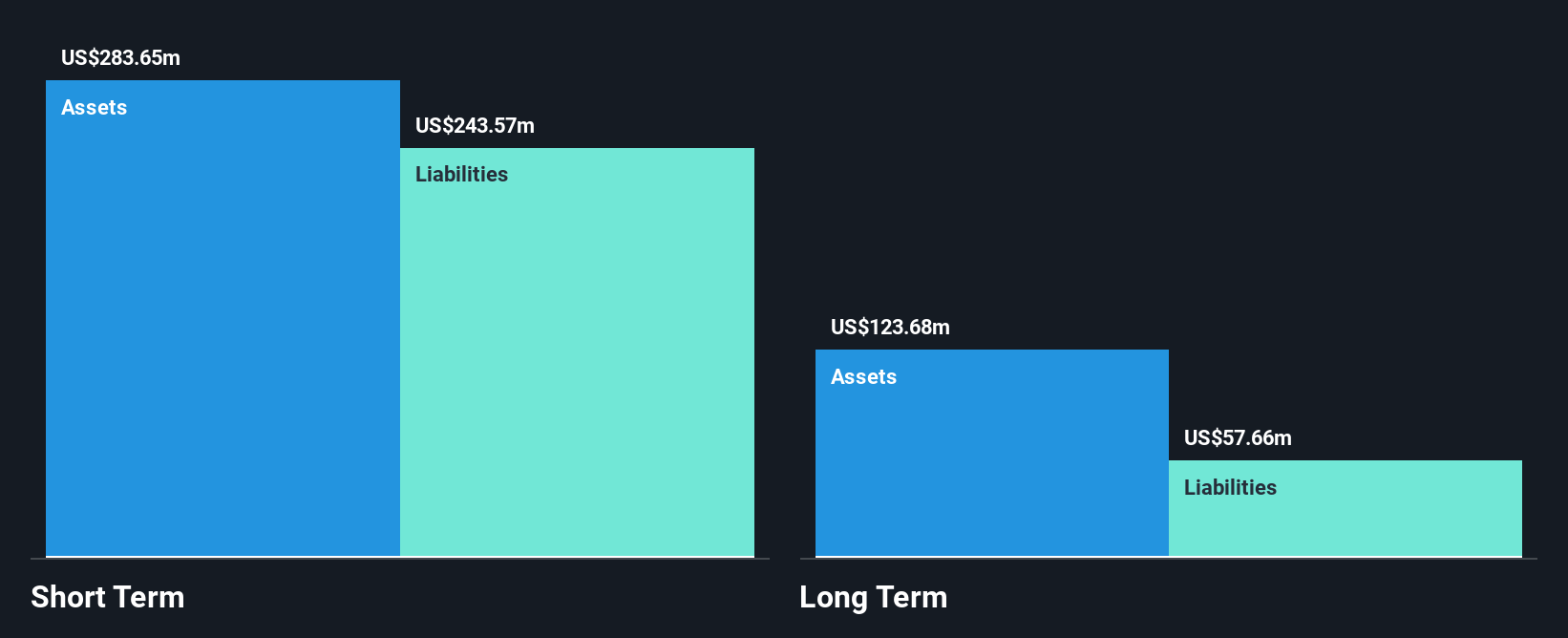

Newegg Commerce, with a market cap of US$185.24 million, operates primarily through its online retail segment generating US$1.39 billion in revenue. Despite being unprofitable and experiencing an annual increase in losses by 61.2% over the past five years, Newegg's financial position shows resilience with short-term assets of $239.2 million exceeding both short- and long-term liabilities. The company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, providing a stable runway for over three years even as free cash flow shrinks annually by 19.7%.

- Jump into the full analysis health report here for a deeper understanding of Newegg Commerce.

- Gain insights into Newegg Commerce's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 720 US Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ALTO

Alto Ingredients

Produces, distributes, and markets specialty alcohols, renewable fuel, and essential ingredients in the United States.

Flawless balance sheet and undervalued.