- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

Discovering Undiscovered Gems PC Connection And 2 Other Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

The market has climbed by 3.0% over the past week, with every sector up and the Information Technology sector leading the way. In the last year, the market has climbed 25%, and earnings are expected to grow by 15% per annum over the next few years. Amidst this robust performance, identifying stocks with strong fundamentals becomes crucial for investors looking to capitalize on growth opportunities. This article explores three small-cap stocks, including PC Connection, that stand out as potential undiscovered gems in today's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Innovex International | 12.24% | 18.91% | 15.98% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

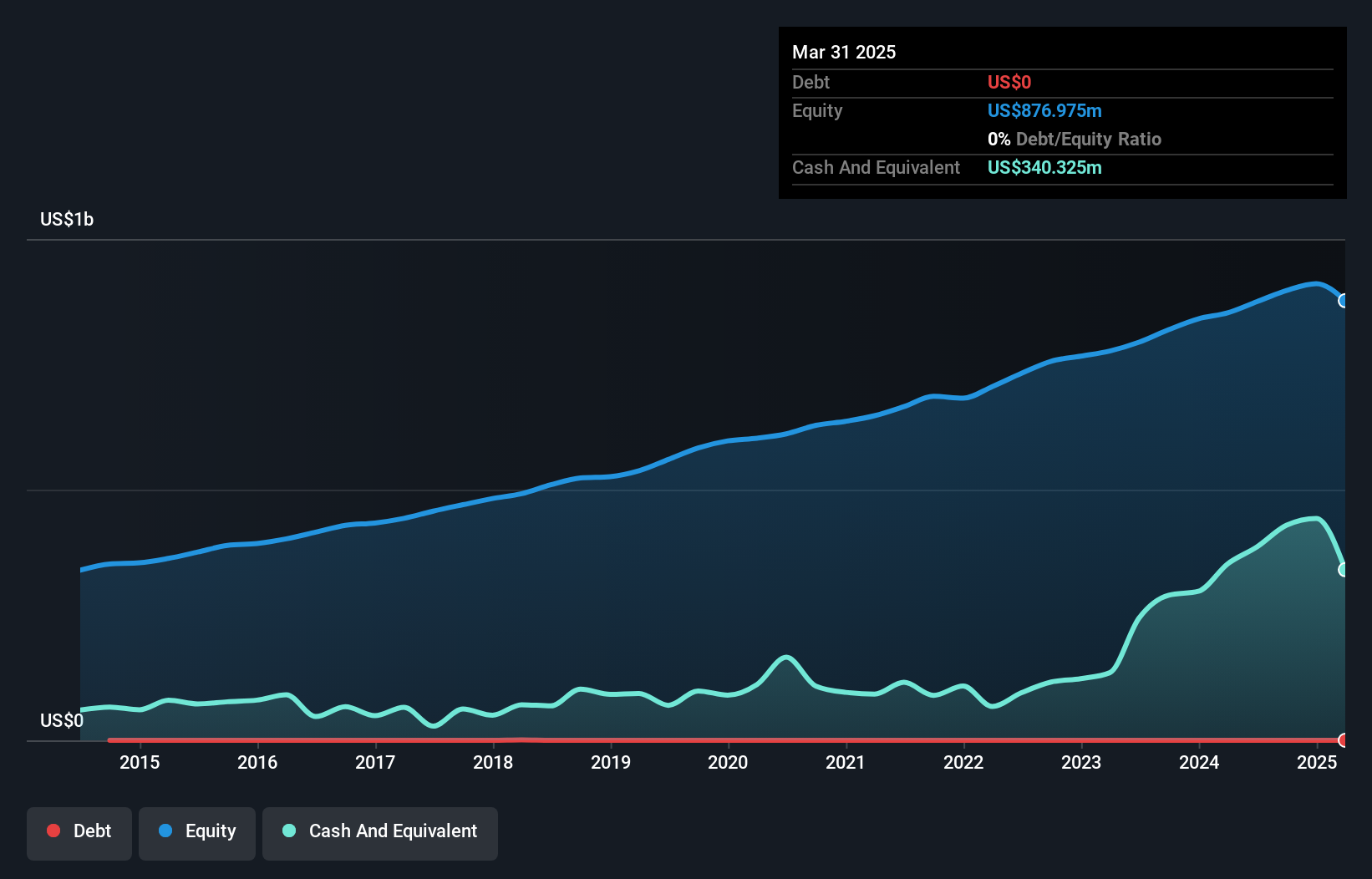

Overview: PC Connection, Inc., together with its subsidiaries, provides various information technology (IT) solutions worldwide and has a market cap of $1.91 billion.

Operations: The company generates revenue primarily through its Business Solutions ($1.08 billion), Enterprise Solutions ($1.18 billion), and Public Sector Solutions ($501.03 million) segments.

PC Connection, a notable player in the electronics industry, reported US$736.48 million in Q2 2024 sales, slightly up from US$733.55 million last year. Net income for the quarter was US$26.16 million compared to US$19.7 million previously, with basic earnings per share rising to $0.99 from $0.75 a year ago. The company repurchased 56,716 shares worth US$3.64 million recently and declared a quarterly dividend of $0.10 per share payable on August 30, 2024.

- Delve into the full analysis health report here for a deeper understanding of PC Connection.

Explore historical data to track PC Connection's performance over time in our Past section.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

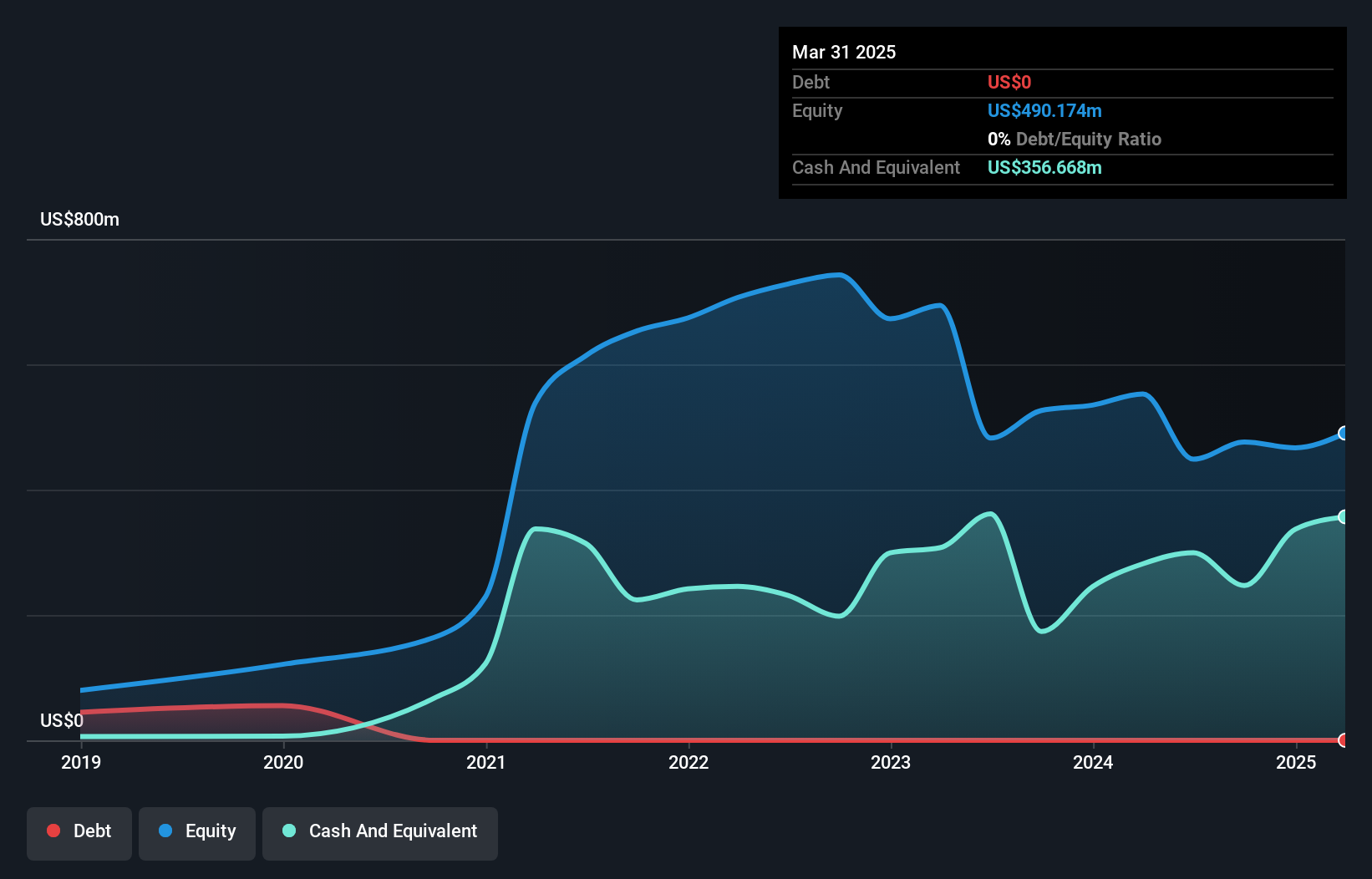

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform that allows users to create professional-looking handmade goods, with a market cap of $1.31 billion.

Operations: Cricut generates revenue primarily through the sale of its creativity platform and related products. The company reported a market cap of $1.31 billion.

Cricut, Inc. presents an intriguing opportunity with its recent addition to multiple Russell indices and trading at 46.3% below fair value estimates. Despite a 22.7% annual decline in earnings over the past five years, the company saw a significant 40.2% growth last year, outperforming its industry’s -2.1%. Cricut's debt-free status and positive levered free cash flow of US$287 million as of September 2023 further bolster its financial health, while recent buybacks of 1.41 million shares for US$8.86 million indicate confidence in future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Cricut.

Evaluate Cricut's historical performance by accessing our past performance report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★☆☆

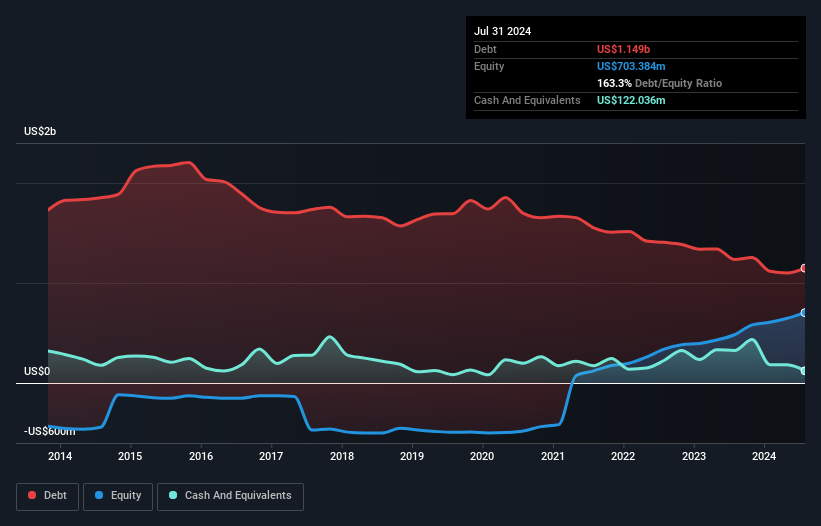

Overview: Hovnanian Enterprises, Inc., through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States with a market cap of approximately $1.31 billion.

Operations: Hovnanian Enterprises generates revenue primarily from its homebuilding operations across the West ($1.37 billion), Northeast ($989.39 million), and Southeast ($474.97 million) regions, with additional income from financial services ($70.40 million).

Hovnanian Enterprises has shown notable improvement, with earnings growing 51.3% over the past year, significantly outpacing the Consumer Durables industry. The company reported a net income of US$72.92 million for Q3 2024, up from US$55.76 million a year ago, and repurchased 82,753 shares for US$11.49 million recently. Despite having high net debt to equity ratio (145.9%), Hovnanian's EBIT covers interest payments by 7.6 times and its P/E ratio stands at an attractive 5.9x compared to the market's 18x.

Turning Ideas Into Actions

- Click here to access our complete index of 209 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet with solid track record.