- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Discovering Hidden Stock Gems In The United States September 2024

Reviewed by Simply Wall St

The market has climbed by 3.0% over the past week, with every sector up. Over the past 12 months, the market is up 25%, and earnings are forecast to grow by 15% annually. In this flourishing environment, identifying stocks that have strong fundamentals and growth potential can be particularly rewarding for investors looking to uncover hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Innovex International | 12.24% | 18.91% | 15.98% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

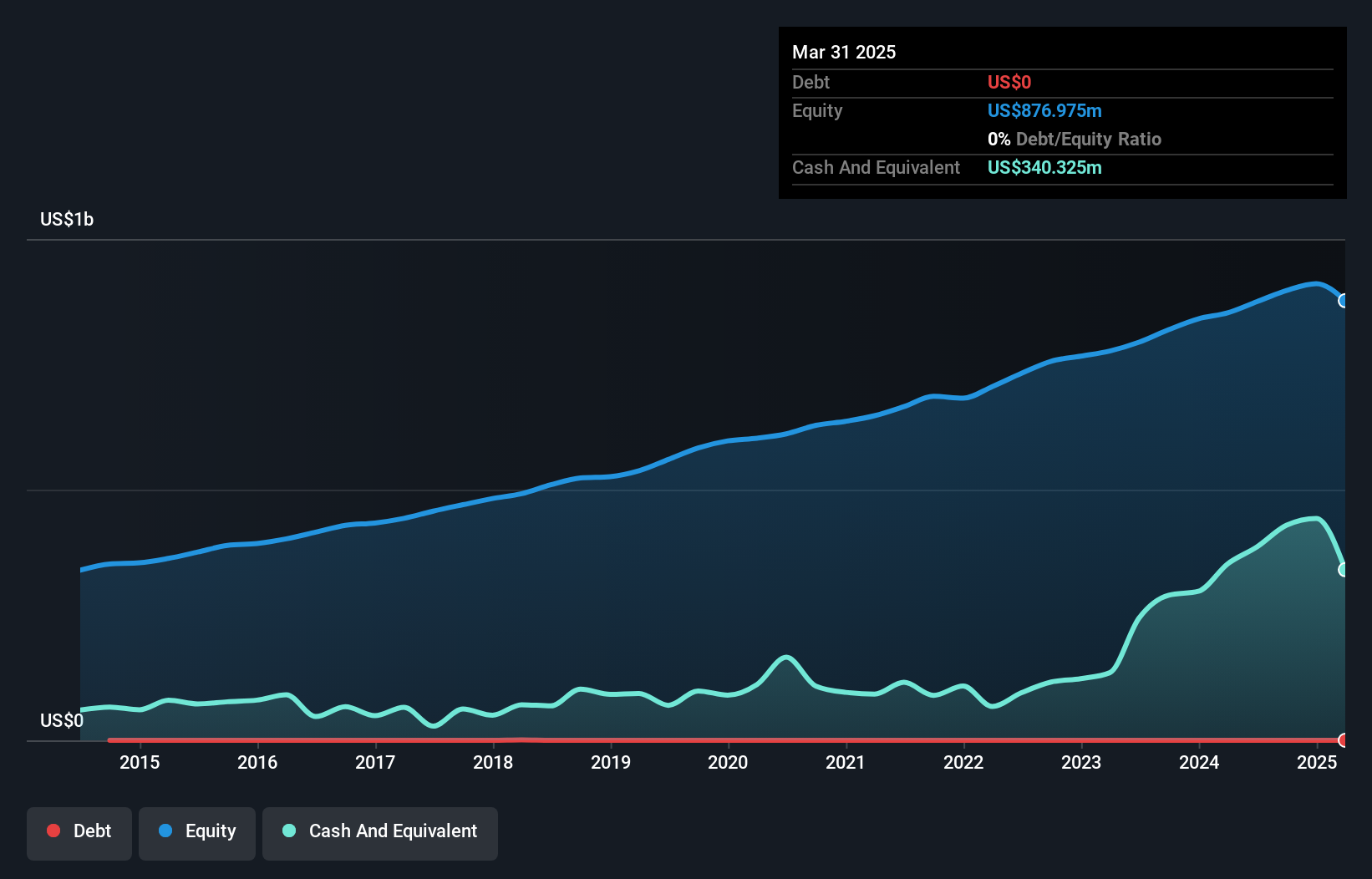

Overview: PC Connection, Inc. provides a range of information technology solutions worldwide and has a market cap of approximately $1.91 billion (NasdaqGS:CNXN).

Operations: The company generates revenue from three primary segments: Business Solutions ($1.08 billion), Enterprise Solutions ($1.18 billion), and Public Sector Solutions ($501.03 million).

PC Connection, Inc. has shown impressive growth with earnings increasing by 16.8% over the past year, outpacing the Electronic industry’s -9.3%. The company is debt-free and trades at 3.9% below our fair value estimate. In Q2 2024, PC Connection reported US$736.48 million in sales and net income of US$26.16 million, up from US$19.7 million a year ago; basic EPS rose to $0.99 from $0.75 last year while repurchasing shares worth $3.64 million during this period.

- Delve into the full analysis health report here for a deeper understanding of PC Connection.

Explore historical data to track PC Connection's performance over time in our Past section.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

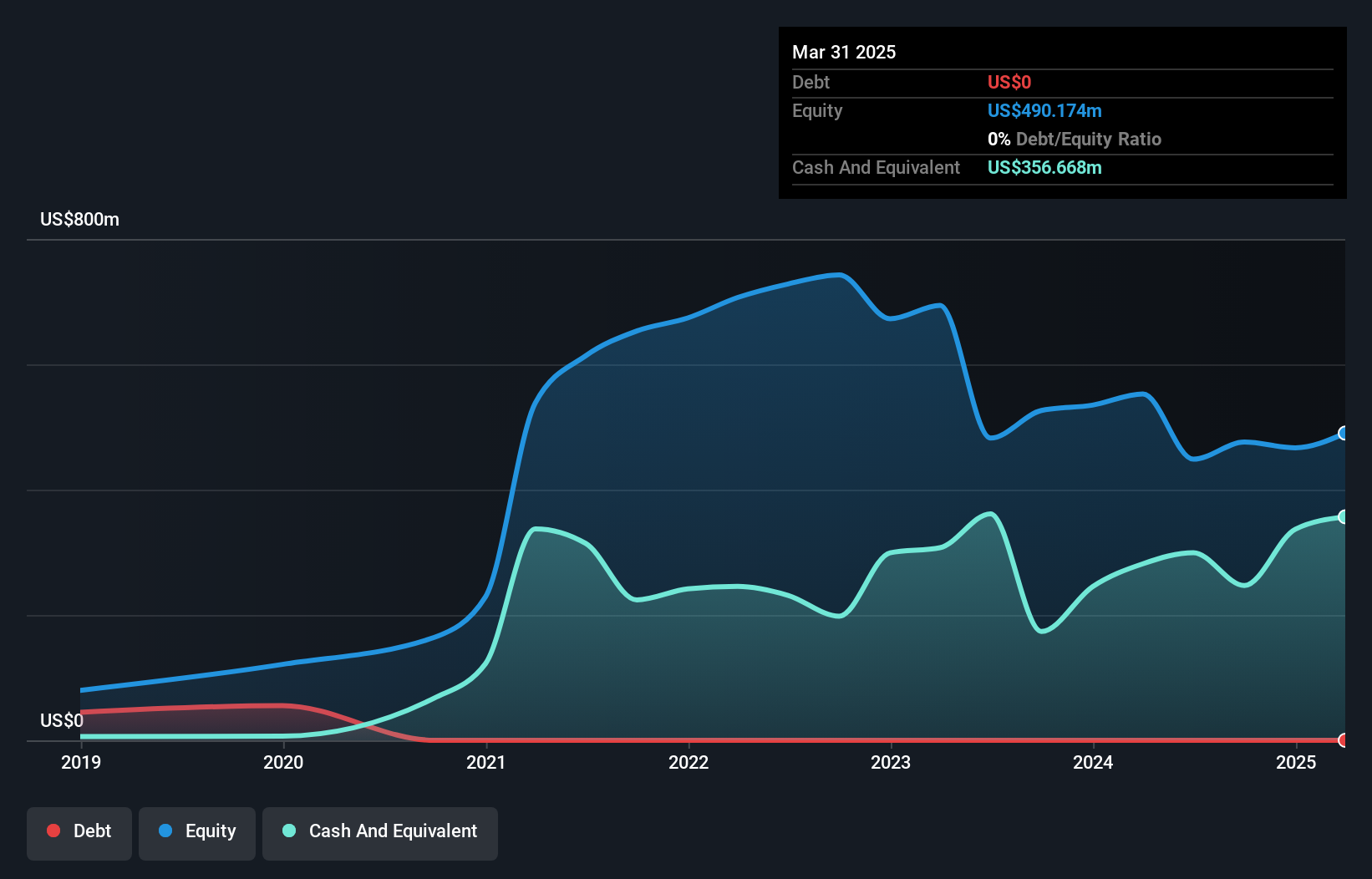

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform that allows users to create professional-looking handmade goods and has a market cap of approximately $1.31 billion.

Operations: Cricut generates revenue primarily from the sale of connected machines, accessories, materials, and subscriptions. The company has a market cap of approximately $1.31 billion.

Cricut has shown a mixed performance recently, with earnings growing by 40.2% over the past year, significantly outpacing the Consumer Durables industry’s -2.1%. The company is debt-free, which eliminates concerns about interest coverage. Despite trading at 46.3% below its estimated fair value, earnings have declined by 22.7% annually over the past five years. In recent news, Cricut repurchased 1.41 million shares for US$8.86 million and reported Q2 revenue of US$167.95 million with net income rising to US$19.77 million from US$16.02 million a year ago.

- Click to explore a detailed breakdown of our findings in Cricut's health report.

Understand Cricut's track record by examining our Past report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★☆☆

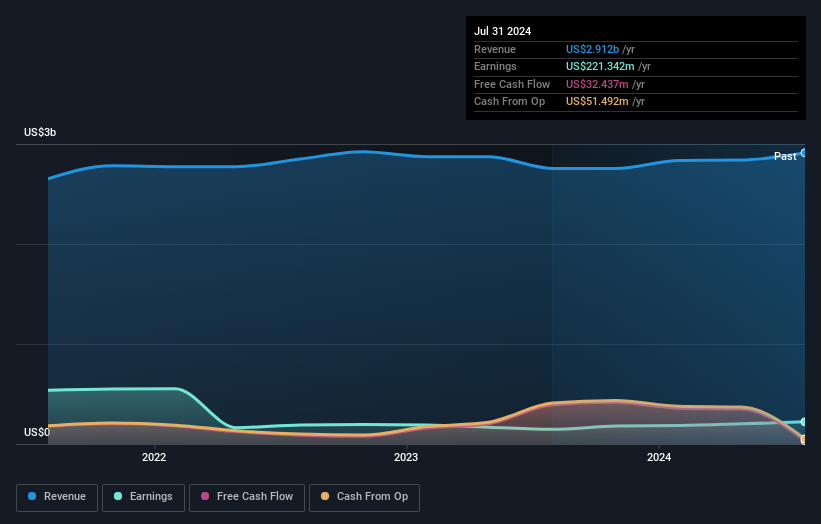

Overview: Hovnanian Enterprises, Inc., through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States with a market cap of approximately $1.31 billion.

Operations: The company's primary revenue streams come from its homebuilding operations in the West ($1.37 billion), Northeast ($989.39 million), and Southeast ($474.97 million) regions, along with financial services contributing $70.40 million.

Hovnanian Enterprises, a notable player in the Consumer Durables sector, has shown impressive earnings growth of 51.3% over the past year, surpassing the industry average of -2.1%. With a price-to-earnings ratio of 5.9x compared to the US market's 18x, it offers attractive valuation metrics. The company repurchased 82,753 shares for US$11.49 million recently and reported Q3 revenue at US$722.7 million with net income of US$72.92 million, highlighting robust financial performance and shareholder value initiatives.

Next Steps

- Investigate our full lineup of 209 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.

Solid track record with adequate balance sheet.