- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Discovering August 2024's Hidden Gems in the United States

Reviewed by Simply Wall St

The market has climbed 3.1% in the last 7 days, led by a gain of 4.4%. In the last year, the market has climbed 25%, with earnings forecast to grow by 15% annually. In this thriving environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors looking to capitalize on current trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.32% | 6.73% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| San Juan Basin Royalty Trust | NA | 39.20% | 40.92% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Associated Capital Group | NA | -7.78% | 8.48% | ★★★★★★ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Merchants Bancorp (NasdaqCM:MBIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merchants Bancorp operates as a diversified bank holding company in the United States, with a market cap of approximately $1.99 billion.

Operations: The company generates revenue primarily from Banking ($324.39 million), Mortgage Warehousing ($132.25 million), and Multi-Family Mortgage Banking ($155.67 million).

Merchants Bancorp, with total assets of $18.2 billion and equity of $1.9 billion, has reported significant earnings growth of 40.6% over the past year, outpacing the industry average of 12.5%. Total deposits stand at $14.9 billion while loans are at $10.9 billion with a net interest margin of 3.1%. However, it has an insufficient allowance for bad loans at 1.3% and shareholders faced dilution in the past year despite trading well below fair value estimates by 60%.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company that provides display imaging processing technologies across China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States with a market cap of $1.03 billion (USD).

Operations: Himax Technologies generates revenue from its display imaging processing technologies across various regions, including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States. The company's market cap is $1.03 billion (USD).

Himax Technologies, a small-cap semiconductor player, reported second-quarter 2024 sales of US$239.62 million, up from US$235.03 million last year. Net income surged to US$29.63 million from US$0.89 million in the same period. The company’s price-to-earnings ratio stands at 13.9x versus the broader market's 17.9x, indicating good value relative to peers and industry standards. With earnings growth of 16% over the past year and a satisfactory net debt to equity ratio of 27%, Himax showcases robust financial health and promising future prospects in its sector.

- Get an in-depth perspective on Himax Technologies' performance by reading our health report here.

Evaluate Himax Technologies' historical performance by accessing our past performance report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hovnanian Enterprises, Inc., with a market cap of $1.19 billion, designs, constructs, markets, and sells residential homes in the United States through its subsidiaries.

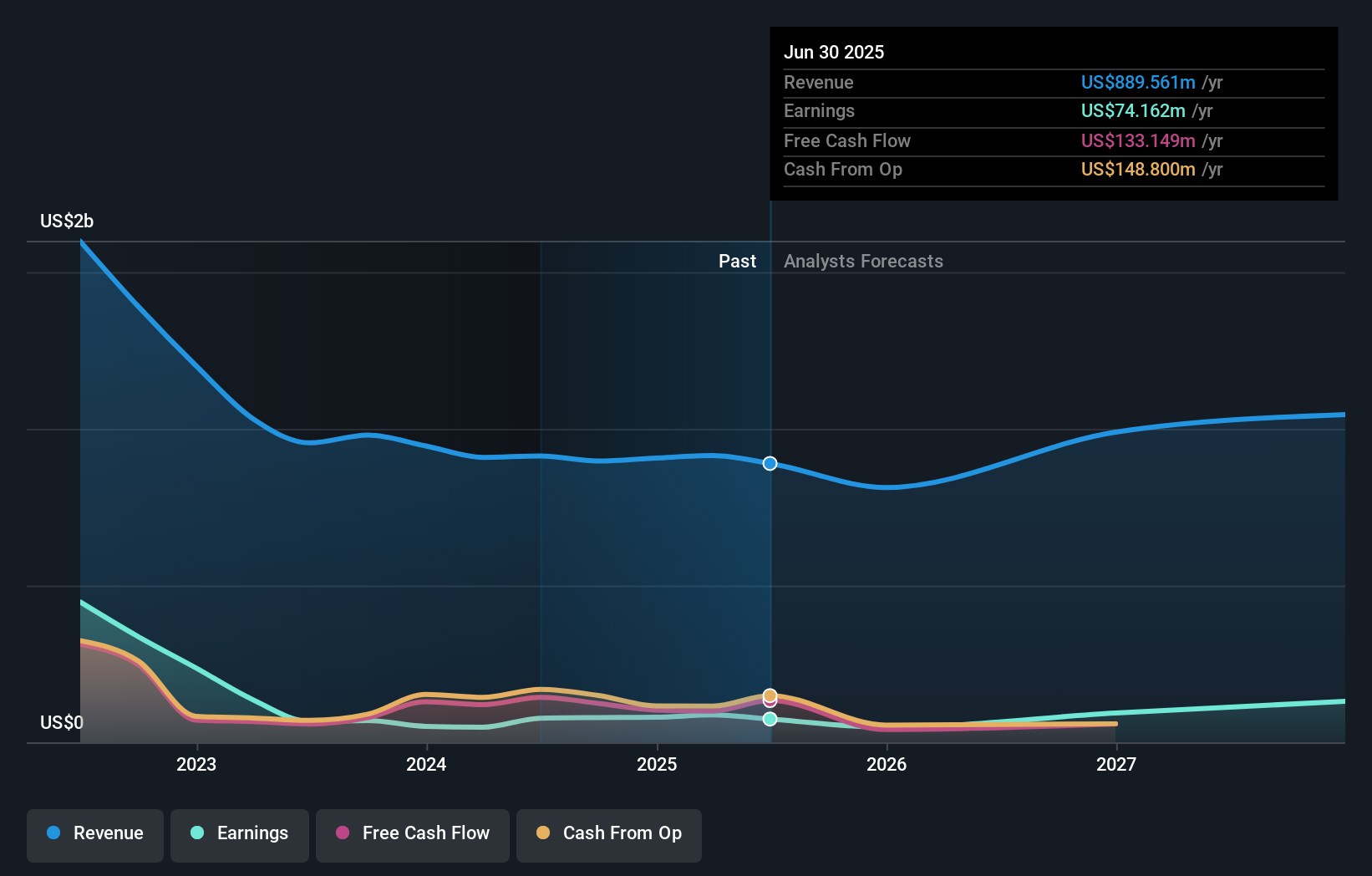

Operations: Hovnanian Enterprises generates revenue primarily from its Homebuilding segments, with significant contributions from the West ($1.35 billion), Northeast ($935.87 million), and Southeast ($480.25 million) regions, alongside a smaller portion from Financial Services ($66.16 million).

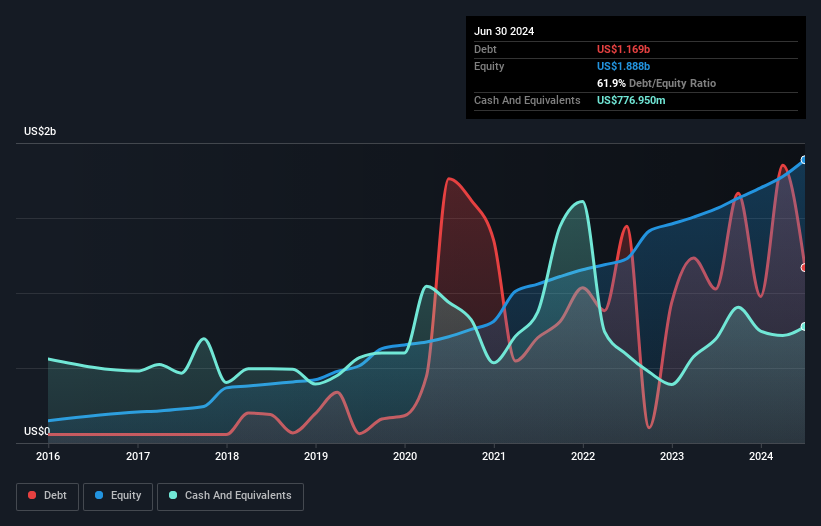

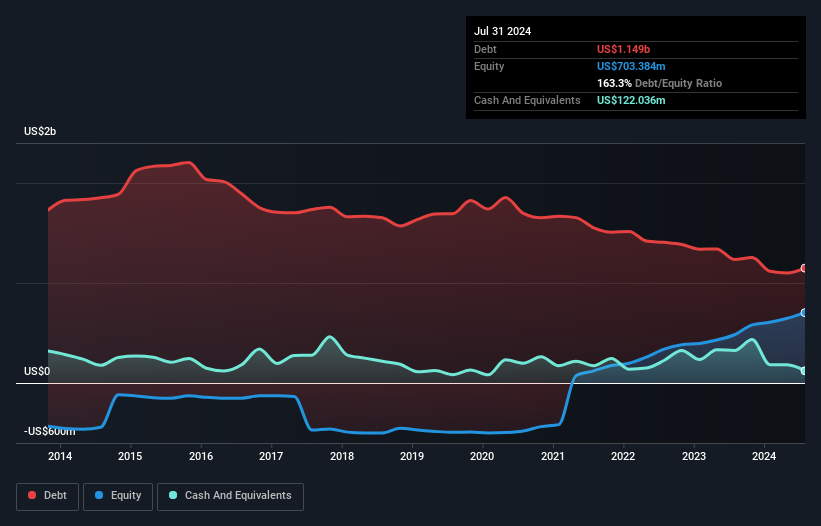

Hovnanian Enterprises, a notable player in the homebuilding sector, has shown significant earnings growth of 20.3% over the past year, outpacing its industry. The company’s net debt to equity ratio stands at 141.9%, which is high but manageable given their EBIT covers interest payments 6.5 times over. Hovnanian recently repurchased 106,047 shares for US$15 million and reported Q2 revenue of US$708 million with net income rising to US$50.84 million from US$34.15 million last year.

Where To Now?

- Access the full spectrum of 224 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives