- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Garmin (GRMN) Unveils Advanced Smartwatch And Handheld Navigator For Adventure Enthusiasts

Reviewed by Simply Wall St

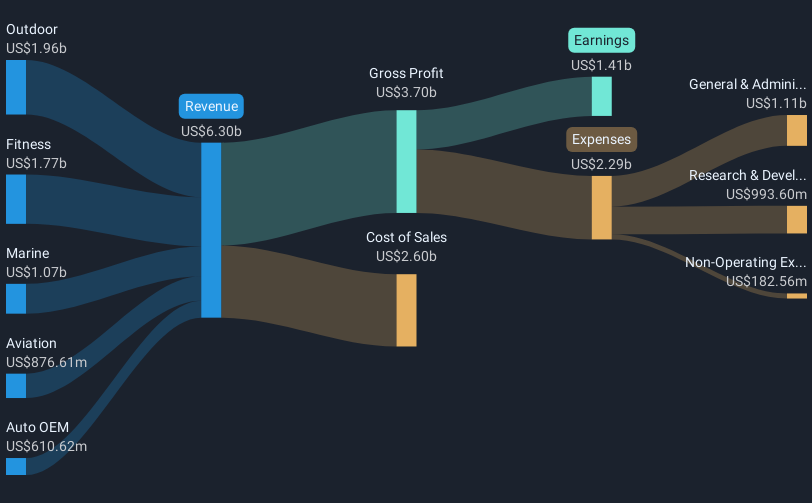

Garmin (GRMN) has witnessed noteworthy developments, such as the launch of the fenix 8 Pro series and GPSMAP H1i Plus, driving innovation with features like satellite connectivity and MicroLED displays. These product announcements may have bolstered Garmin's attractiveness, contributing to the company's 14% share price increase over the last quarter. Meanwhile, Garmin's strong second-quarter earnings, with sales growing to $1,815 million, and a positive outlook on revenue guidance reinforced investor confidence. As tech markets experienced an upswing, Garmin's key moves and financial performance likely complemented broader market trends favorably.

We've spotted 1 warning sign for Garmin you should be aware of.

The recent developments at Garmin, notably the launch of the fenix 8 Pro series and GPSMAP H1i Plus, have the potential to significantly influence the company's future performance. These innovations in satellite connectivity and display technology could drive increased demand, potentially boosting revenue growth and enhancing Garmin's competitive positioning in the tech industry. Over the past three years, Garmin's total return, including share price and dividends, amounted to 185.74%. This robust performance illustrates Garmin's ability to deliver shareholder value, surpassing many peers in the US Consumer Durables industry.

However, when looking at the past year alone, Garmin exceeded the US Market, which returned 15.7%, while also outpacing the US Consumer Durables industry, which saw a 3.5% decline. Given the strong second-quarter earnings and market enthusiasm around new product launches, Garmin's revenue and earnings forecasts could see upward adjustments as consumers respond to these innovations. Despite a current share price of $234.29, Garmin is trading above the consensus analyst price target of $213.83, indicating market optimism. Investors might perceive a potential share price correction if future performance aligns more closely with analyst expectations. The focus remains on whether Garmin can sustain its growth trajectory amid market dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives