- United States

- /

- Consumer Durables

- /

- NYSE:ETD

3 US Dividend Stocks Yielding Up To 6.9%

Reviewed by Simply Wall St

As the U.S. stock market shows modest gains in a holiday-shortened session, with major indices like the Dow Jones Industrial Average inching higher, investors are closely watching for opportunities amidst economic fluctuations and rising Treasury yields. In this environment, dividend stocks can offer a blend of income and potential stability, making them an attractive option for those seeking to balance growth with regular returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.32% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.63% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.85% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.75% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.56% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.78% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

Click here to see the full list of 158 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Devon Energy (NYSE:DVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Devon Energy Corporation is an independent energy company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of approximately $20.21 billion.

Operations: Devon Energy Corporation generates revenue primarily from its Oil and Gas Exploration and Production segment, which accounts for $14.53 billion.

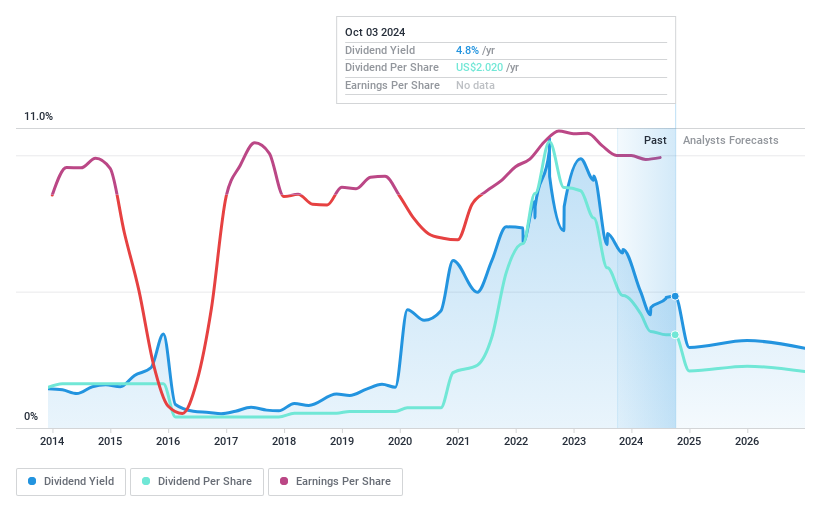

Dividend Yield: 4.7%

Devon Energy recently declared a fixed quarterly dividend of US$0.22 per share, maintaining its position among top 25% dividend payers in the US. Despite a low payout ratio of 36.9%, indicating dividends are covered by earnings, the payments are not supported by free cash flows and have been volatile over the past decade. The company has high debt levels and recent leadership changes with Clay Gaspar set to become CEO in March 2025 could impact future strategies.

- Navigate through the intricacies of Devon Energy with our comprehensive dividend report here.

- The analysis detailed in our Devon Energy valuation report hints at an deflated share price compared to its estimated value.

Ethan Allen Interiors (NYSE:ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. is an interior design company that manufactures and retails home furnishings both in the United States and internationally, with a market cap of approximately $716.62 million.

Operations: Ethan Allen Interiors Inc. generates its revenue through two primary segments: Retail, contributing $539.70 million, and Wholesale, accounting for $357.71 million.

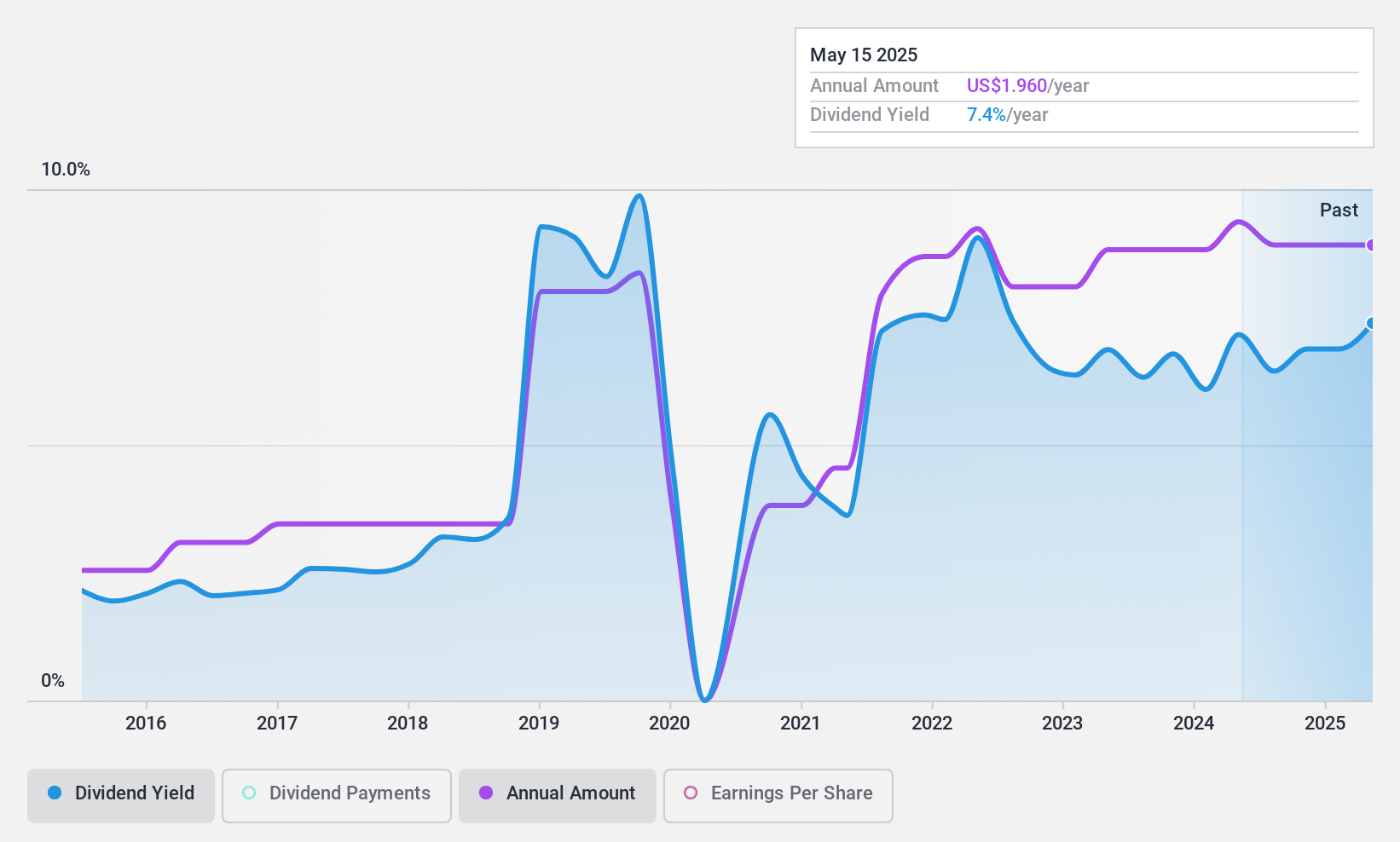

Dividend Yield: 6.9%

Ethan Allen Interiors' dividend yield is in the top 25% of US payers, with a reasonable payout ratio of 60.2%, indicating coverage by earnings. However, its dividends have been volatile over the past decade, raising concerns about reliability. Despite trading at a discount to estimated fair value and covering dividends with cash flows (72.2% cash payout ratio), recent earnings showed slight declines in sales and net income compared to last year.

- Take a closer look at Ethan Allen Interiors' potential here in our dividend report.

- Our valuation report here indicates Ethan Allen Interiors may be undervalued.

Interpublic Group of Companies (NYSE:IPG)

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Interpublic Group of Companies, Inc. is a global provider of advertising and marketing services with a market cap of approximately $10.83 billion.

Operations: Interpublic Group of Companies generates revenue through three main segments: Media, Data & Engagement Solutions ($4.29 billion), Integrated Advertising & Creativity Led ($3.62 billion), and Specialized Communications & Experiential Solutions ($1.43 billion).

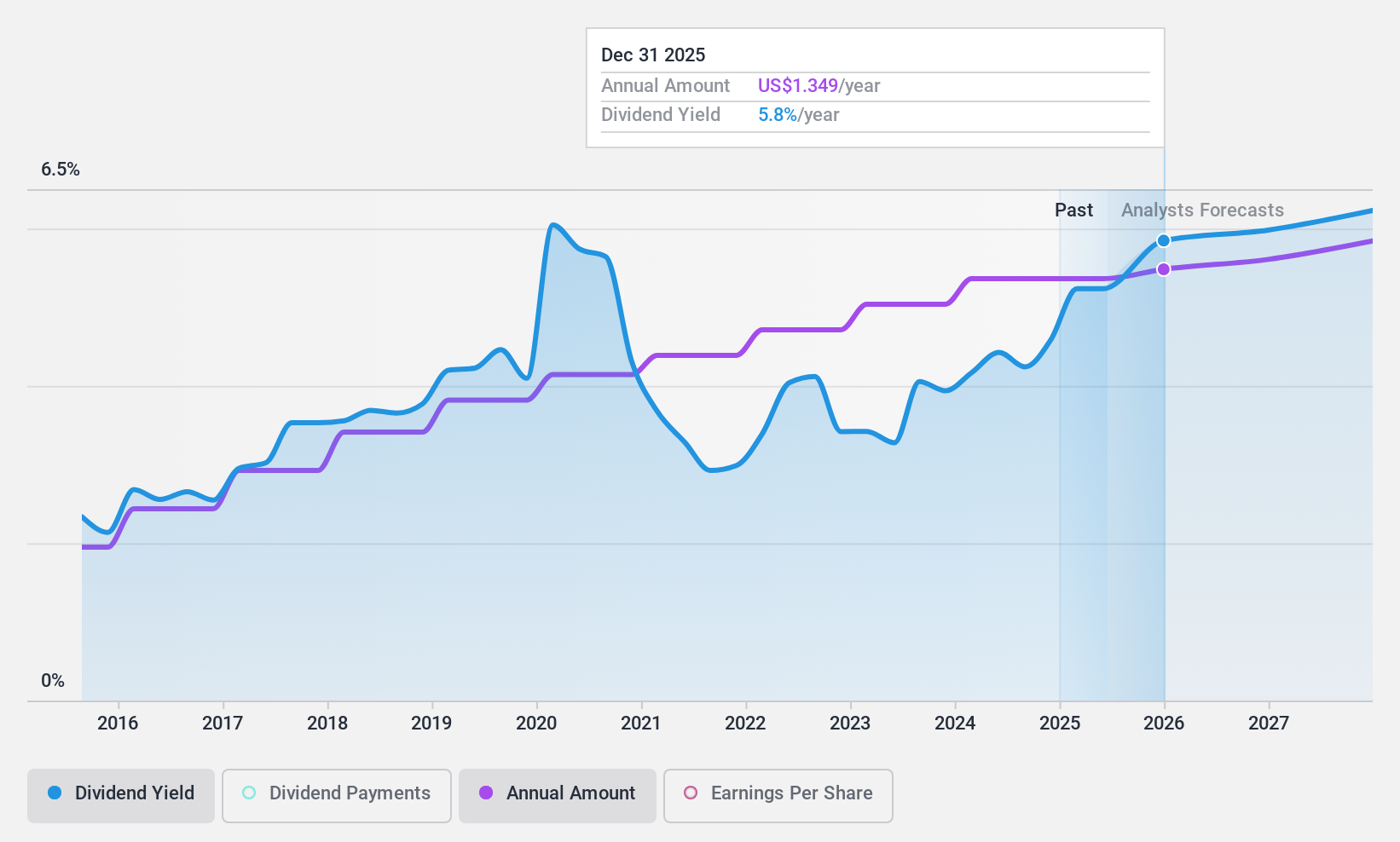

Dividend Yield: 4.6%

Interpublic Group's dividend yield is among the top 25% in the US, supported by a reasonable payout ratio of 60.7%, indicating coverage by earnings and cash flows. The company's dividends have been stable and reliable over the past decade, but recent financial results showed declines in sales and net income. A planned merger with Omnicom for $13.8 billion could impact future dividend policies as synergies are expected to enhance earnings per share for shareholders post-transaction.

- Click here to discover the nuances of Interpublic Group of Companies with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Interpublic Group of Companies' share price might be too pessimistic.

Next Steps

- Navigate through the entire inventory of 158 Top US Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ethan Allen Interiors, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ethan Allen Interiors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETD

Ethan Allen Interiors

Operates as an interior design company, and manufacturer and retailer of home furnishings in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives