- United States

- /

- Luxury

- /

- NYSE:DECK

Trump Tariffs Impact Deckers Outdoor (NYSE:DECK) With 12% Price Drop

Reviewed by Simply Wall St

Last week, Deckers Outdoor (NYSE:DECK) saw its share price decline by 12%, coinciding with a broader market drop of 4.6% amidst investor uncertainty spurred by recent economic developments. The market was disrupted by the Trump administration's decision to increase tariffs on Canadian steel and aluminum, contributing to investor anxiety and impacting various sectors. With equity markets reeling from fears of potential economic slowdown and the repercussions of tariffs on cross-border commerce, pressures were evident across the board. Deckers Outdoor's price movement reflects these broader conditions, as consumer-facing stocks and retail companies with international supply chains felt the pinch. While the S&P 500 and Nasdaq simultaneously faced significant declines, Deckers' downturn aligns with market trends seen over the past week, despite the broader market being up 9% over the past year and forecasted earnings growth of 14% annually. These external factors painted a challenging backdrop for the company's shares in the latest trading period.

See the full analysis report here for a deeper understanding of Deckers Outdoor.

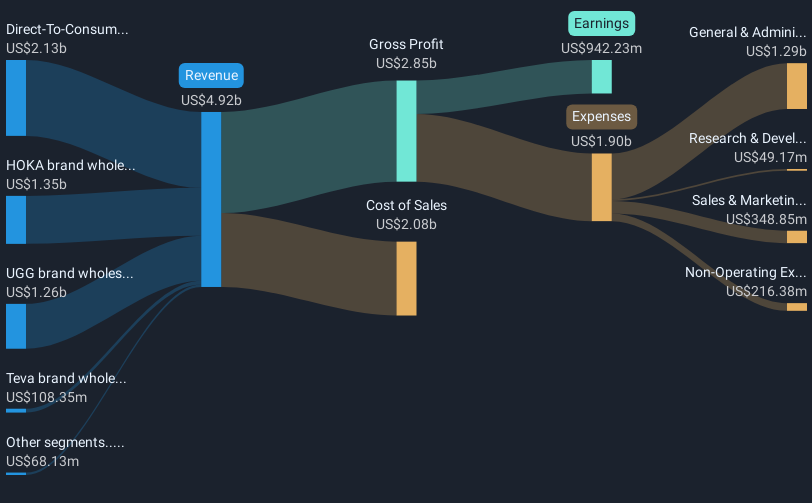

Over the past five years, Deckers Outdoor Corporation has delivered a very large total shareholder return of 552.65%. This impressive performance may be attributed to several key factors. Significantly, the company has consistently grown its earnings, with an average annual increase of 23.6%, and 30.2% over the past year alone. This accelerated profit growth has had a substantial influence on the long-term share price trajectory.

During this period, Deckers successfully executed a stock buyback program, repurchasing 4.3% of its shares for US$1.65 billion. Another critical development was a six-for-one stock split enacted in September 2024. The company's product innovations, including HOKA's Bondi 9 and UGG's new fall/winter styles, have also enhanced its market appeal. As of today's date, Deckers remains a strong entity within its industry, even though it slightly underperformed the broader US market in the past year.

- Get the full picture of Deckers Outdoor's valuation metrics and investment prospects—click to explore.

- Analyze the downside risks for Deckers Outdoor and understand their potential impact—click to learn more.

- Shareholder in Deckers Outdoor? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Deckers Outdoor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives