- United States

- /

- Luxury

- /

- NYSE:DECK

Evaluating Deckers After Latest 45% Price Drop and Supply Chain Update in 2025

Reviewed by Simply Wall St

If you are sitting on the fence about Deckers Outdoor stock, you are definitely not alone. It is a name that has rewarded long-term believers with triple-digit returns, yet recent moves have gotten folks talking, whether the stock’s best days are behind it or if opportunity is knocking louder than ever. In the last week, shares pulled back by 5.6%, seeming to echo traders’ shifting risk appetite across the consumer sector. Zoom out, though, and the view gets fascinating: over three years, Deckers Outdoor is up 110.7%, and in five years, returns soar to more than 200%. The past year, however, has not been gentle, with the stock down 27.4% and a sharp drop of 45.2% since the start of the year. This mix of highs and lows leaves investors weighing recent headwinds against the undeniable history of growth.

So, is Deckers Outdoor undervalued right now, or is the recent drop a warning sign? According to a simple valuation score, the company checks off 3 out of 6 boxes for being undervalued, putting it right in the middle of the pack and leaving plenty of room for debate. The real key is how you assess that value. Up next, we will walk through the most common valuation frameworks investors use to weigh a stock like Deckers Outdoor, but stay tuned, at the end, I will introduce a smarter, more holistic approach that could change how you see valuations altogether.

Why Deckers Outdoor is lagging behind its peersApproach 1: Deckers Outdoor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to today’s dollars. In other words, it tries to calculate what all of Deckers Outdoor's expected future profits are really worth right now.

For Deckers Outdoor, the latest twelve month Free Cash Flow (FCF) sits at $864.4 million. Analysts have issued estimates for Deckers’s FCF over the next five years, with projections ranging from $828.8 million in 2026 to $998.0 million in 2027, and up to $934 million by 2030. Beyond the analyst horizon, further cash flows are extrapolated based on trends, with FCF expected to taper off gradually according to available models.

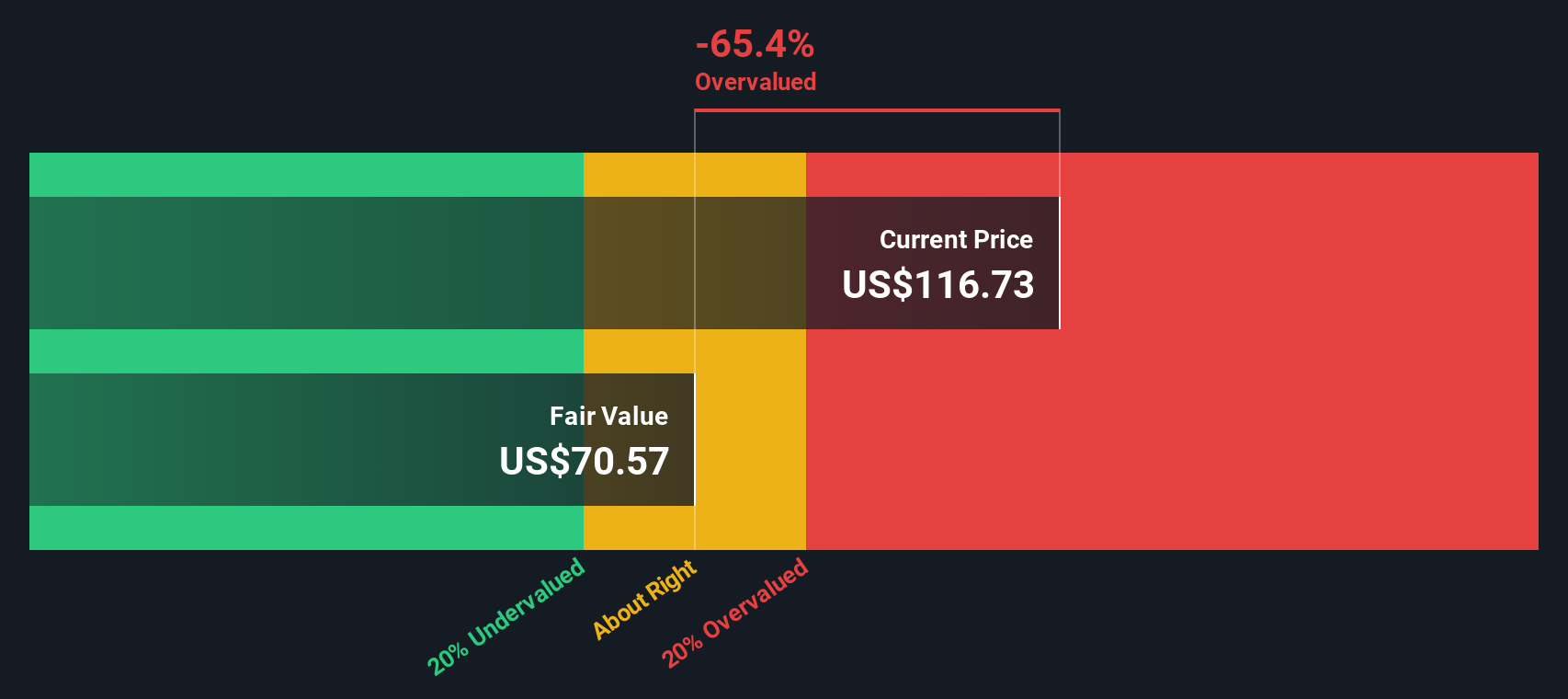

Using these projections, the DCF model suggests an intrinsic fair value of $70.45 per share. Against the current share price, this calculation reveals that Deckers Outdoor is roughly 59.0% overvalued.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Deckers Outdoor.

Approach 2: Deckers Outdoor Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it directly links a company’s market value to its actual earnings. For established firms like Deckers Outdoor that consistently generate profit, the PE ratio offers a simple, at-a-glance benchmark for how much investors are willing to pay for each dollar of earnings.

It is important to note that what counts as a “normal” or “fair” PE ratio depends on two main things: growth expectations and risk. In general, companies expected to grow earnings faster and those considered lower risk can justify a higher PE ratio. Slower-growing or riskier firms tend to trade at lower multiples.

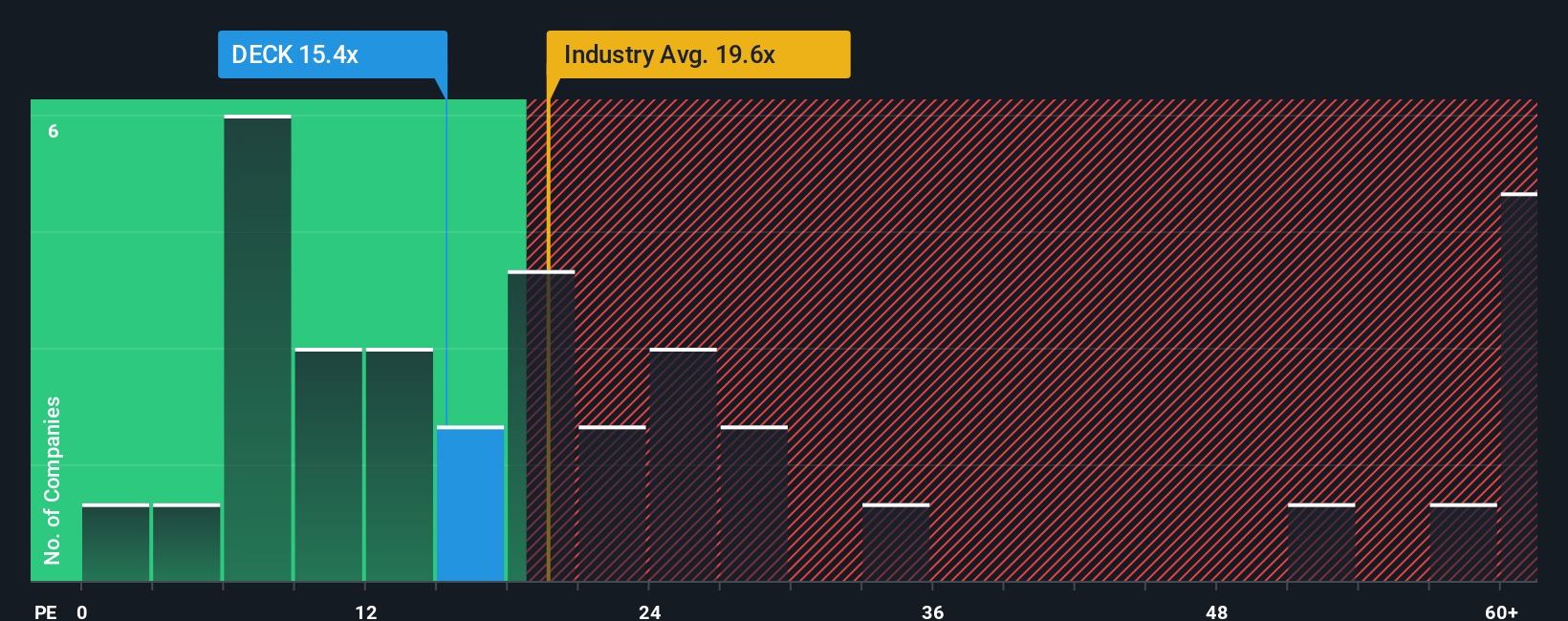

Currently, Deckers Outdoor trades at a PE ratio of 16.8x. For context, the luxury industry average sits at 21.2x and the average among peers is even higher at 40.3x. This puts Deckers’s multiple well below both industry and peer levels.

Simply Wall St’s proprietary “Fair Ratio” for Deckers Outdoor stands at 18.5x. Unlike a plain industry or peer comparison, the Fair Ratio takes a holistic approach by factoring in not just earnings growth and risk but also profit margins, the company’s size, its industry, and more. This provides a more nuanced view of valuation tailored to the specifics of Deckers Outdoor.

With its current PE ratio of 16.8x so close to the Fair Ratio of 18.5x, the valuation suggests the stock is priced about right relative to its unique fundamentals and outlook.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Deckers Outdoor Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story or viewpoint behind a company’s numbers, where you outline what you believe about Deckers Outdoor’s prospects, such as its fair value and your assumptions about future revenues, earnings, and profit margins.

Unlike traditional models that just crunch numbers, Narratives connect your perspective on what’s ahead for the company with an actionable financial forecast and an estimated fair value. On Simply Wall St’s platform, Narratives are a user-friendly tool available within the Community page, trusted by millions of investors to make their decisions clearer and more personal.

By using Narratives, you can easily compare your fair value to the actual market price, helping you decide if now is the right moment to buy or sell. Plus, Narratives stay up to date automatically whenever new news, earnings reports, or market information becomes available, so your view is always current.

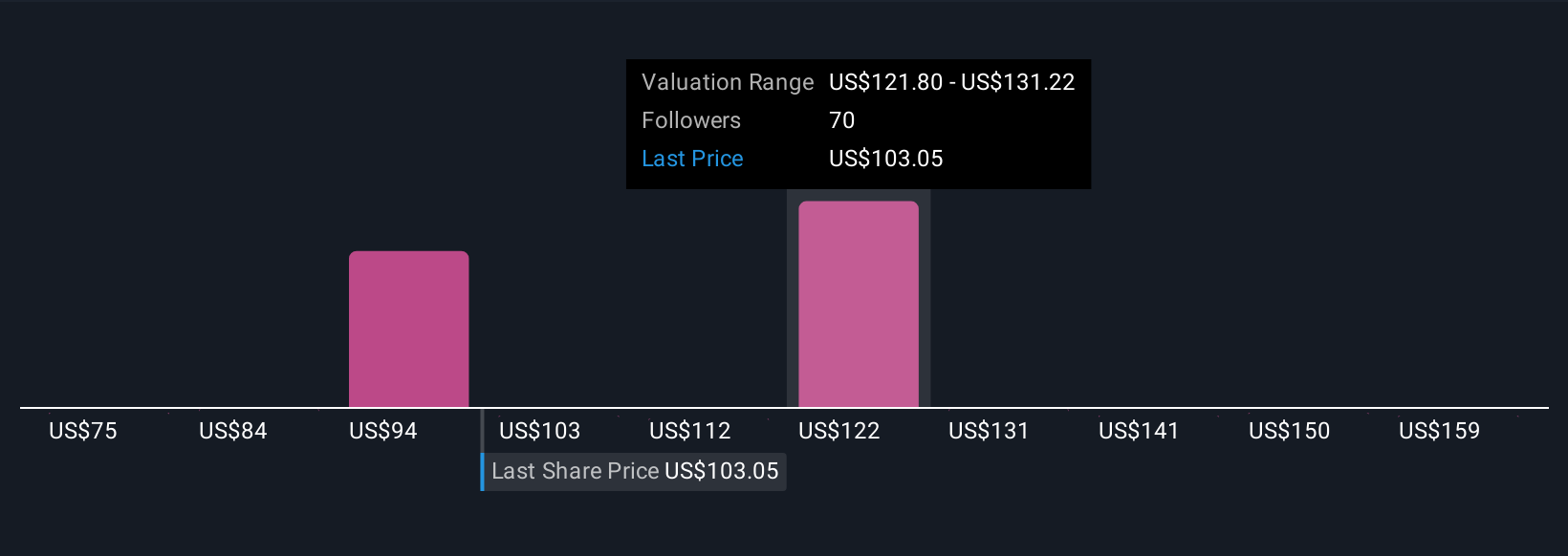

For Deckers Outdoor, some investors see global expansion of UGG and HOKA driving fair values as high as $158.00, while others, concerned about brand risks and margin pressures, set their fair value as low as $97.00. This highlights how Narratives make it easy to express and test your outlook against real-world shifts.

Do you think there's more to the story for Deckers Outdoor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives