- United States

- /

- Luxury

- /

- NYSE:DECK

Deckers Outdoor (NYSE:DECK) Expands Share Buyback Plan To US$4,550 Million Amid Strong Earnings

Reviewed by Simply Wall St

Deckers Outdoor (NYSE:DECK) experienced an 18% share price increase over the past month, coinciding with a series of significant corporate events. The company announced a robust equity buyback plan expansion by $2.25 billion, enhancing shareholder value perception. This announcement, along with a strong fourth-quarter earnings report showing increases in both income and earnings per share, likely buoyed investor confidence. However, the broader market faced pressures from ongoing trade tensions driven by President Trump's tariff threats. Despite these market challenges, Deckers' measures, including the launch of new Hoka footwear, supported a favorable share performance during this period.

We've identified 1 possible red flag for Deckers Outdoor that you should be aware of.

The recent events surrounding Deckers Outdoor could significantly influence the company's ongoing narrative. The expansion of the equity buyback plan is likely to bolster investor confidence and enhance perceived shareholder value. Given the robust fourth-quarter performance, these developments may positively affect revenue and earnings forecasts by reinforcing the company's financial health. Additionally, the launch of new Hoka footwear aligns with their strategy of global expansion for the UGG and HOKA brands, which could further increase sales, especially in APAC and European markets.

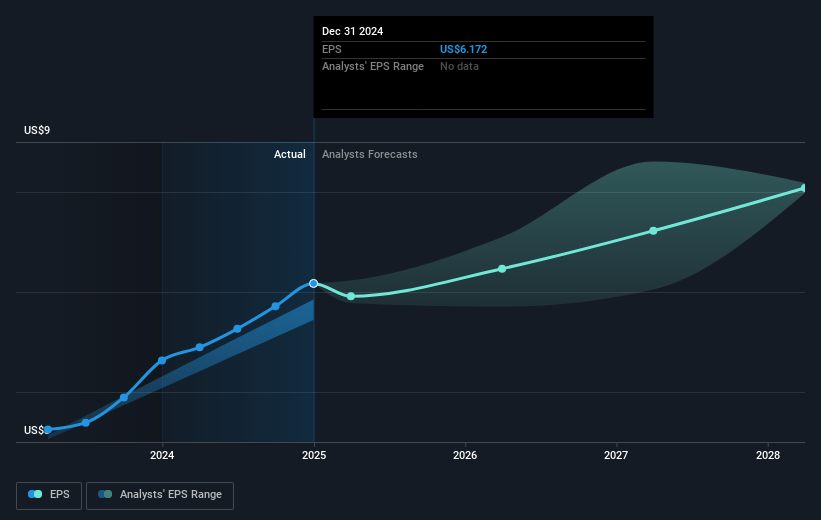

For longer-term context, Deckers' shares have experienced a very large total return of over 300% over the past five years. Despite this substantial growth, the company underperformed the US Luxury industry in the past year, which saw a significant decline of 7.4%. This discrepancy highlights the difference between short-term volatility and long-term performance strength when evaluating Deckers Outdoor's market position. As for revenue and earnings, analysts project annual revenue growth of 9.5%, though profit margins might compress to 16.9% over the next three years.

The current share price, standing at US$117.07, is notably below the consensus analyst price target of US$168.56, representing a potential upward movement. However, achieving this target would mean the company would need to sustain substantial financial momentum, as reflected by the required future PE ratio and earnings projections. Investors are encouraged to assess these targets with their own research and market expectations in mind.

Our valuation report here indicates Deckers Outdoor may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives