- United States

- /

- Luxury

- /

- NYSE:DECK

Deckers Outdoor (DECK) Sees 11% Share Price Rise Over Last Week

Reviewed by Simply Wall St

Deckers Outdoor (DECK) experienced a substantial 11% rise in its share price over the last week. This increase comes after significant events, including the launch of UGG's Goldenstar and Goldencoast UGGbraid Clog collection and the company's removal from the Russell 1000 Growth-Defensive Index and the Russell 1000 Defensive Index. While UGG's new product introduction could have bolstered investor sentiment, the index removal might have tempered any overly optimistic outlooks. During the same period, the broader market increased by approximately 1%, buoyed by investor optimism regarding a U.S.-Japan trade deal and corporate earnings prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent 11% rise in Deckers Outdoor's share price might reflect positive investor sentiment buoyed by UGG's Goldenstar and Goldencoast UGGbraid Clog collection. This enthusiasm aligns with the company's strategy to expand the UGG and HOKA brands globally. However, the removal from the Russell 1000 indexes could temper longer-term bullish views. Over a five-year period, Deckers Outdoor has delivered a total return of 201.08%, highlighting effective execution on global expansion and direct-to-consumer strategies compared to the short-term market optimism that drove a broader market increase of 14.6% in the last year.

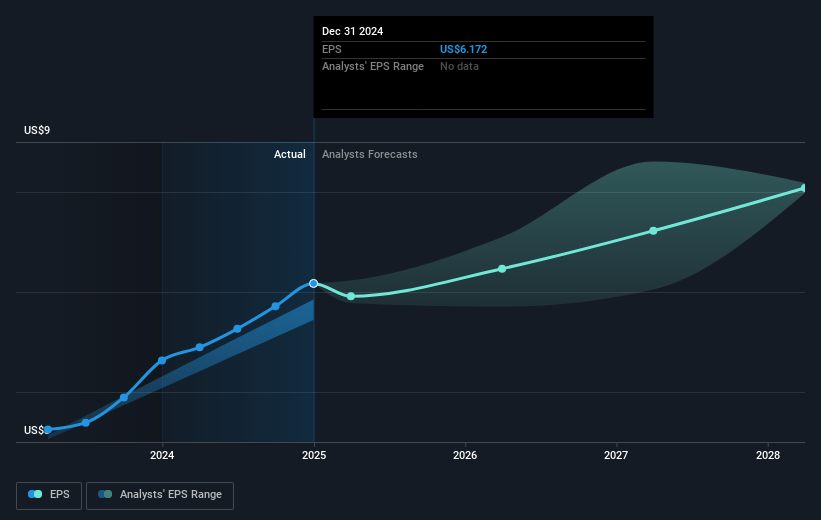

While Deckers underperformed the US Luxury industry and the broader market over the past year, the company's strong longer-term growth indicates resilience, with forecasted earnings growth. Analysts predict a decline in profit margins from 19.1% to 16.9% over the next three years. This forecast could be influenced by the recent news if UGG's product expansion successfully supports revenue, countering pressures from index removal and potential currency fluctuations.

The current share price of US$105.69 is at a discount to the consensus price target of US$122.04, indicating potential upside if Deckers meets or exceeds analyst expectations. Achieving the target likely depends on global expansion strategies and maintaining brand strength, with revenues needing to hit an estimated US$6.5 billion by 2028 to align with analyst projections. As always, it’s crucial to consider personal assumptions and expectations against the provided forecasts.

The valuation report we've compiled suggests that Deckers Outdoor's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives