- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Evaluating Valuation as New Community Launches Spark Investor Debate

Reviewed by Kshitija Bhandaru

Century Communities (NYSE:CCS) just broke ground on several new residential communities across the US, with a major launch in Houston and new sales openings in California and Washington. These moves underline the company’s strategy to drive steady expansion, even as the entire sector navigates some challenging headlines.

See our latest analysis for Century Communities.

Century Communities’ string of new development launches comes at a challenging time for homebuilders, with recent political pressure adding to the sector’s volatility. The latest 1-year total shareholder return of -39% shows the stock has been under heavy pressure. While it is off nearly 21% year-to-date, long-term holders will note a three-year total return of 43%, which highlights past resilience even as short-term momentum is fading.

If you’re open to finding opportunities beyond homebuilders, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With the stock down sharply this year despite fresh developments and growth projects, should investors see Century Communities as an undervalued play on US housing, or is the market already pricing in all future upside?

Most Popular Narrative: 3% Undervalued

With analysts’ consensus fair value at $59.50 and the last close at $57.73, these figures sit nearly level. However, the narrative supports a modestly higher upside if major headwinds play out as expected in the underlying assumptions.

Ongoing elevated mortgage rates and affordability constraints are dampening homebuyer demand, forcing Century Communities to increase sales incentives and accept lower average selling prices. This is already putting downward pressure on gross margins and is expected to weigh further on both revenues and earnings in the coming quarters.

Want to know what the narrative is betting on? Discover how falling profit margins, slowing sales, and pivotal financial milestones are woven into this fair value call. The real surprise lies in the future profitability assumptions—do they hold up? Explore the numbers that unlock this outlook.

Result: Fair Value of $59.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent US housing undersupply and Century’s growing community footprint could support sales and challenge the view that margins will continue to shrink.

Find out about the key risks to this Century Communities narrative.

Another View: What Do Multiples Say?

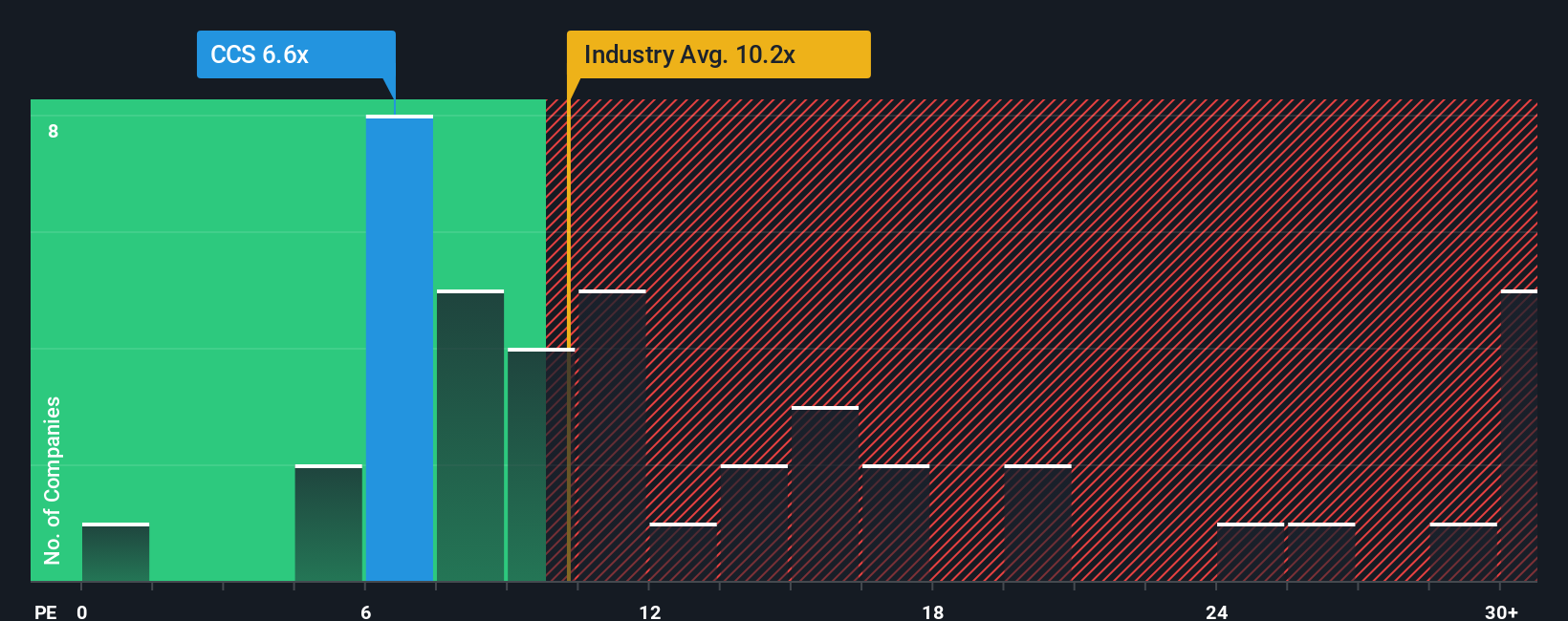

Looking at Century Communities through the lens of standard valuation ratios offers a different perspective. The company’s price-to-earnings ratio is 6.6x, which is lower than both the industry average at 10.2x and its peer group at 7.3x, and it also trails its own fair ratio of 9x. This discount suggests the market is cautious. Does this hint at hidden risks, or present an opportunity for patient investors as market conditions evolve?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Communities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Communities Narrative

If you see things differently or prefer to dig into the numbers on your own, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to uncover opportunities you might be overlooking. Use the Simply Wall Street Screener to make smarter moves and stay ahead of the curve.

- Tap into potential high-yield returns by checking out these 19 dividend stocks with yields > 3%, where you can see which companies offer dividends above 3%.

- Catch the momentum in tech innovation when you review these 24 AI penny stocks, highlighting which AI-driven businesses are reshaping the market.

- Capitalize on mispriced opportunities by targeting these 892 undervalued stocks based on cash flows, focusing on undervalued stocks based on cash flows that could become your next winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives