- United States

- /

- Luxury

- /

- NYSE:BIRK

Should Investors Reexamine Birkenstock After Its 25% Fall in 2025?

Reviewed by Bailey Pemberton

Are you wondering whether to give Birkenstock Holding’s stock a home in your portfolio, cut your losses, or double down? You’re not the only one. The past year has been a bit of a roller coaster for Birkenstock, with the stock falling 3.4% in the last week and losing 25.5% of its value since the start of the year. While that may spook some investors, others see it as a potential bargain, especially since much of the market’s big-picture news, such as shifts in consumer spending and recent momentum in the fashion retailer space, has started to turn cautiously optimistic.

That brings us to what really matters: how the market values Birkenstock Holding right now. On our 6-point undervaluation scorecard, Birkenstock nails 5 out of 6 checks, giving it a very strong value score of 5. This tells us that, at least by classic valuation measures, there’s a lot going for this familiar name. But of course, numbers are only part of the story. Next, we will dig into the approaches experts use to judge a stock’s valuation. Later, we will reveal a perspective that goes even deeper than the standard metrics.

Why Birkenstock Holding is lagging behind its peers

Approach 1: Birkenstock Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's terms. This approach helps investors gauge what a business is truly worth, based on expected profitability rather than simply the current market price.

For Birkenstock Holding, the latest reported Free Cash Flow sits at €266.2 million. Analysts have estimated that this figure will continue to grow over the coming years, reaching roughly €510.3 million by the fiscal year ending September 2027. While detailed analyst forecasts run out after 2027, independent research suggests that Birkenstock's Free Cash Flow could approach €801.2 million by 2035, with growth slowly moderating over the next decade.

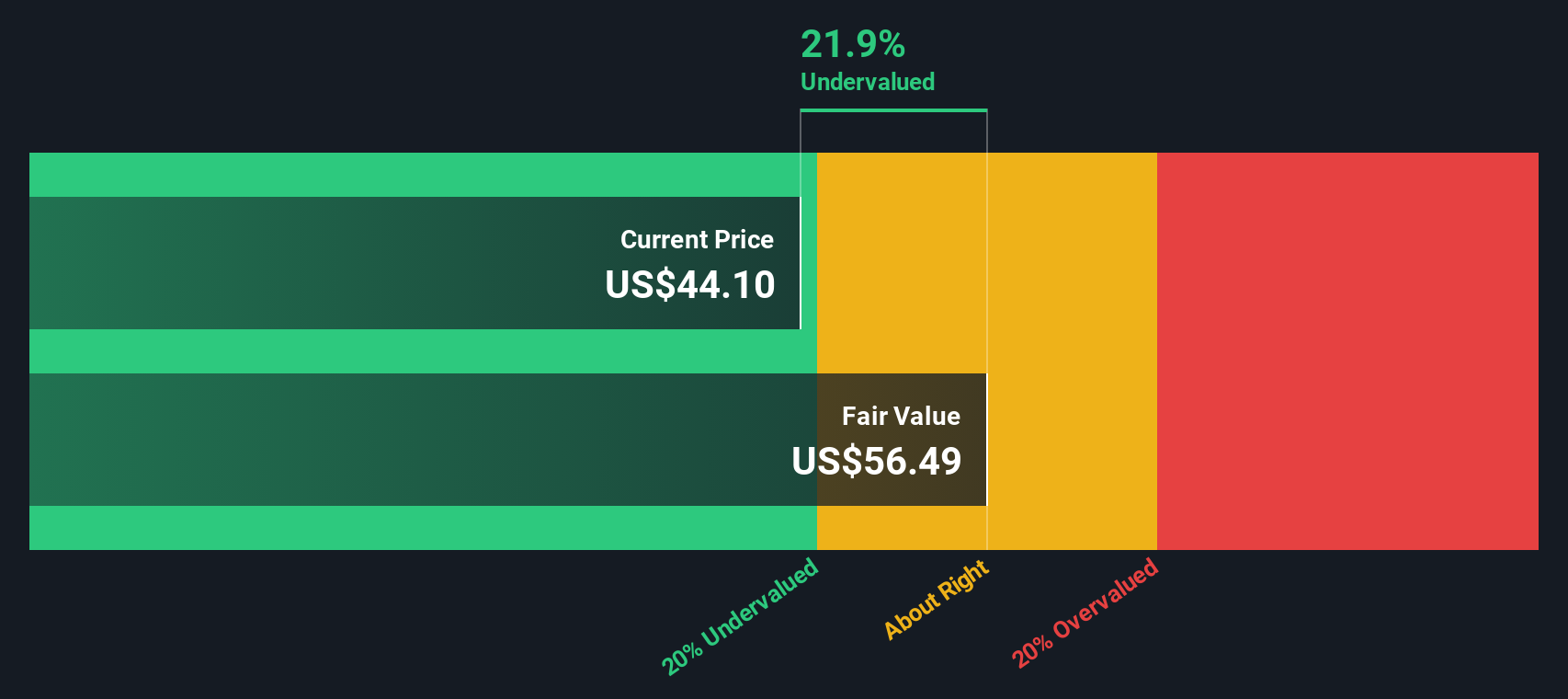

Bringing all these projected cash flows into today's values, the DCF analysis calculates an intrinsic value for Birkenstock Holding of €56.48 per share. This is about 24.5% higher than the current market price, signaling a notable margin of safety for long-term investors. In short, the DCF model suggests Birkenstock's shares are trading well below what the underlying business is really worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Birkenstock Holding is undervalued by 24.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Birkenstock Holding Price vs Earnings

The Price-to-Earnings (PE) ratio is a key valuation metric for profitable companies like Birkenstock Holding, as it helps investors compare how much they are paying for each dollar of earnings generated. The PE ratio is especially relevant for established businesses that are already delivering consistent profits because it reflects both market optimism and company fundamentals.

Growth expectations and perceived risk play a major role in what qualifies as a “normal” or “fair” PE ratio. Generally, companies with higher expected earnings growth, stronger profitability, or less business risk can justify trading at a higher PE multiple. Those facing headwinds or uncertainties tend to warrant lower valuations.

Currently, Birkenstock Holding trades at a PE ratio of 22x. This places it just above the Luxury industry average of 20x and meaningfully below the peer group average of 35x. However, simply benchmarking against industry or peers can be misleading, as it ignores Birkenstock’s unique growth profile, business quality, risk factors, and market size.

This is where the Simply Wall St “Fair Ratio” comes in. The Fair Ratio for Birkenstock is 22x, calculated using proprietary methods that factor in not only growth and profitability, but also risk, margin, and size. Because it considers all these variables together, it provides a more accurate yardstick for fair valuation than simple peer or sector comparisons.

Comparing Birkenstock’s current PE ratio (22x) to its Fair Ratio (22x), the stock appears to be trading at close to its fair value on this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Birkenstock Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company. It connects what you believe about Birkenstock Holding’s business, industry trends, and prospects to a set of numbers, like future revenues, earnings, and what you think the shares should be worth. Narratives make these assumptions explicit and link your investment thesis directly to a living financial forecast, resulting in a Fair Value that you can easily compare to the current market price.

On Simply Wall St’s platform, millions of investors now use Narratives through the Community page to communicate their conviction and see how their view stacks up to others. Narratives are simple to create and, because they update whenever big news or earnings hit, you are never left behind as the story changes.

For Birkenstock Holding, one investor might write a Narrative expecting rapid expansion in Asia, strong margin gains, and set a Fair Value as high as $80.82, based on bullish growth and premiumization assumptions. Another might emphasize wholesale channel risks and margin pressures, arriving at a much lower Fair Value, as conservative as $57.16. With Narratives, you can customize your approach, stay agile as new information emerges, and invest with conviction that fits your own perspective.

Do you think there's more to the story for Birkenstock Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birkenstock Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIRK

Birkenstock Holding

Engages in the manufacture and sale of footwear products.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives