Stock Analysis

- United States

- /

- Luxury

- /

- NYSE:AS

Examining 3 US Growth Companies With Up To 20% Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market shows modest gains with major indexes like the Dow Jones and S&P 500 inching upward, investors are keenly watching the unfolding earnings season for clues about future market directions. In such a climate, examining growth companies with high insider ownership can offer valuable insights, as these firms often demonstrate alignment between management's interests and those of shareholders, potentially enhancing stability and confidence amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's review some notable picks from our screened stocks.

Amer Sports (NYSE:AS)

Simply Wall St Growth Rating: ★★★★☆☆

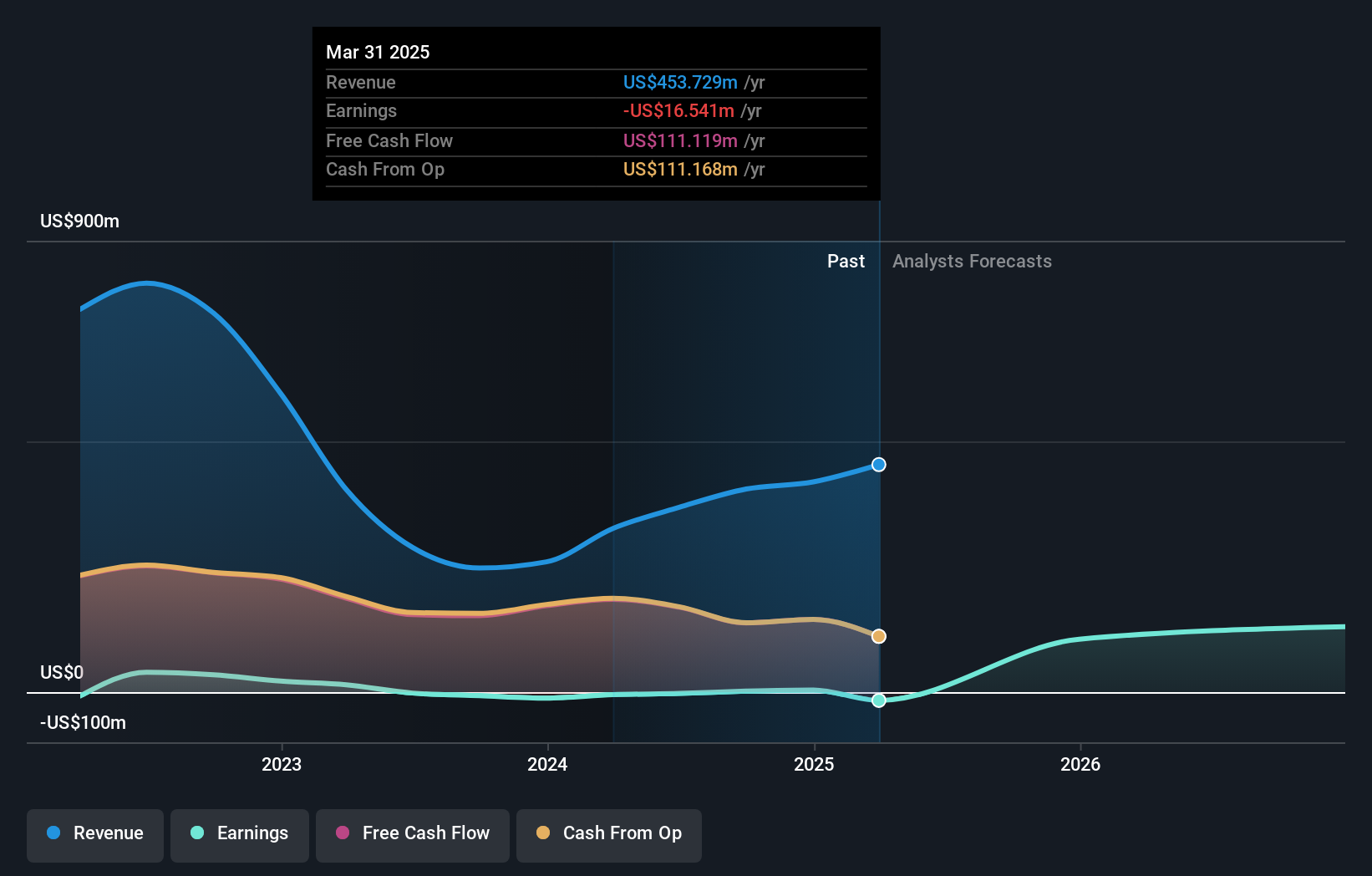

Overview: Amer Sports, Inc. is a global company that designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories across various regions with a market capitalization of $5.56 billion.

Operations: Amer Sports generates revenue through three primary segments: Technical Apparel ($1.75 billion), Outdoor Performance ($1.69 billion), and Ball & Racquet Sports ($1.06 billion).

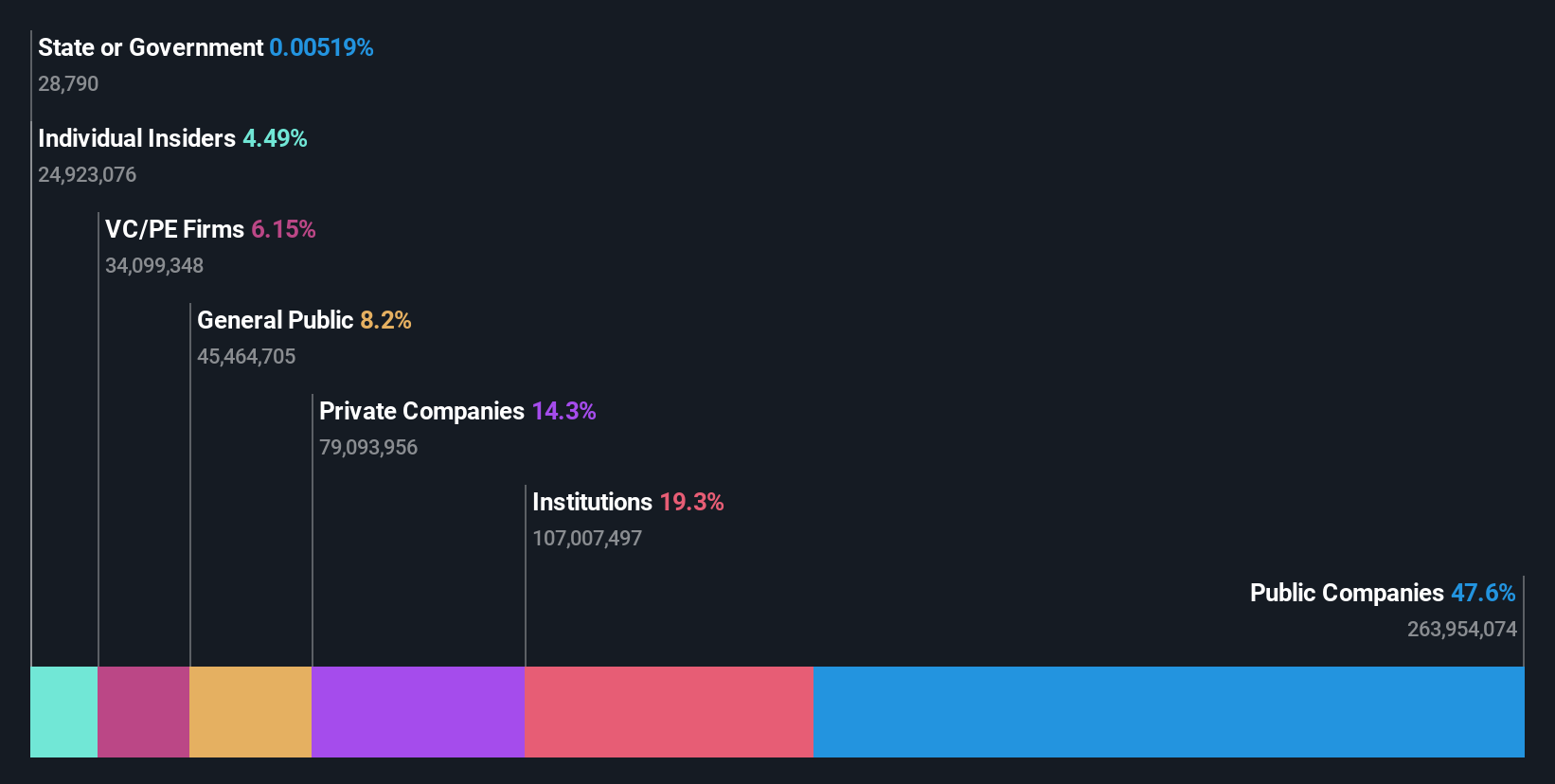

Insider Ownership: 20.6%

Amer Sports, recently added to multiple Russell indexes, indicates robust market recognition. Despite a challenging Q2 with an expected operating margin of 0.0% and negative EPS, Amer Sports forecasts mid-teens revenue growth for 2024 with improved year-end earnings projections, reflecting a recovery trajectory. Insider trading stability over the past three months complements this outlook, reinforcing its potential amidst forecasted above-market revenue growth and significant anticipated earnings improvement.

- Get an in-depth perspective on Amer Sports' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Amer Sports shares in the market.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bridge Investment Group Holdings Inc., operating in the United States, is a real estate investment management firm with a market capitalization of approximately $1.01 billion.

Operations: The firm generates its revenue primarily through its role as a fully integrated real estate investment manager, amounting to $326.32 million.

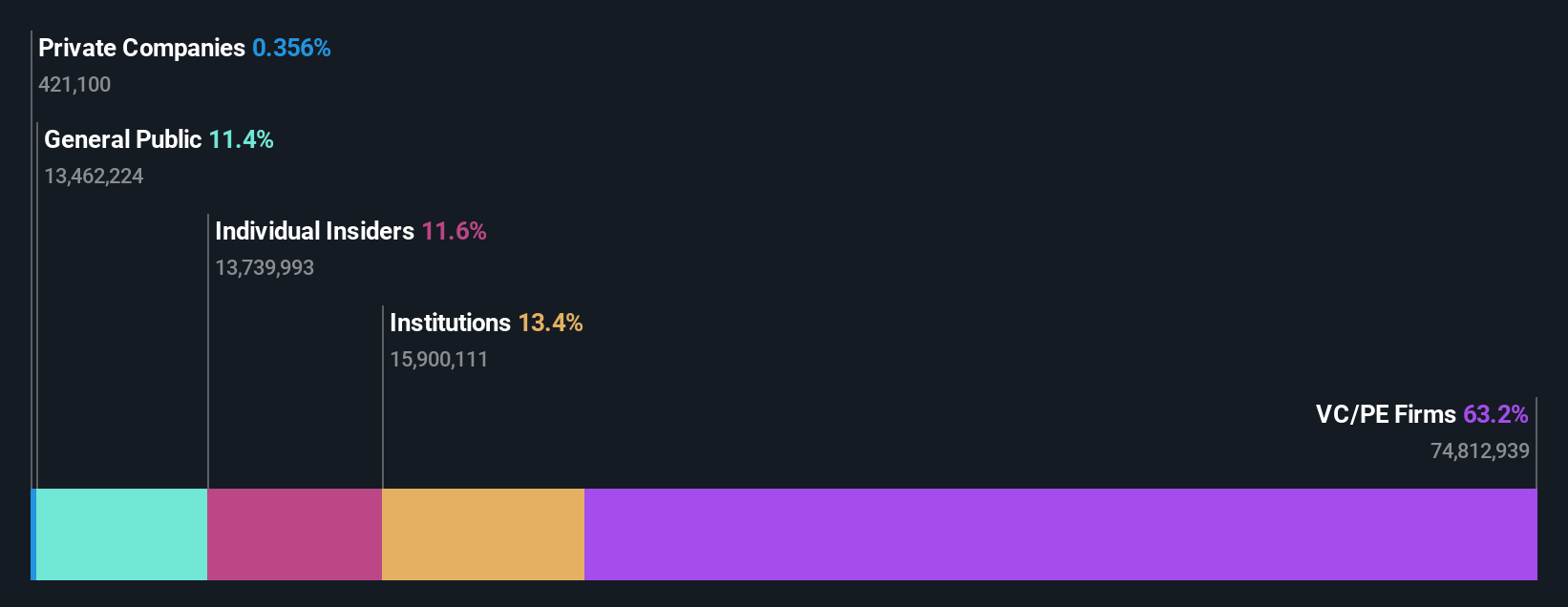

Insider Ownership: 11.6%

Bridge Investment Group Holdings is poised for substantial growth, with earnings expected to rise substantially and revenue projected to increase by 23.7% annually, outpacing the US market's 8.6%. Despite trading at a significant discount to its fair value and having high insider ownership, challenges include a high debt level and recent shareholder dilution. The firm's commitment to affordable housing was highlighted by a recent deal ensuring long-term affordability for hundreds of units, demonstrating strong community engagement and potential for sustainable impact.

- Navigate through the intricacies of Bridge Investment Group Holdings with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Bridge Investment Group Holdings shares in the market.

Mach Natural Resources (NYSE:MNR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mach Natural Resources LP is an independent upstream oil and gas company specializing in the acquisition, development, and production of oil and natural gas reserves in the Anadarko Basin region, with a market cap of approximately $1.86 billion.

Operations: The company generates revenue primarily through its exploration and production activities, totaling approximately $758.38 million.

Insider Ownership: 15.1%

Mach Natural Resources, despite its recent dividend decrease to US$0.75, shows robust growth potential with earnings forecasted to rise by 49.37% annually. Trading 65.1% below its estimated fair value and with analysts predicting a 36.2% price increase, the firm benefits from substantial insider purchases over the past three months, indicating strong internal confidence. However, it faces challenges like high debt levels and a significant drop in net income from US$91.69 million to US$41.7 million in Q1 2024 compared to the previous year.

- Delve into the full analysis future growth report here for a deeper understanding of Mach Natural Resources.

- Upon reviewing our latest valuation report, Mach Natural Resources' share price might be too pessimistic.

Taking Advantage

- Unlock our comprehensive list of 185 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Amer Sports is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, China, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.