- United States

- /

- Consumer Durables

- /

- NasdaqGS:PRPL

Investors in Purple Innovation (NASDAQ:PRPL) from five years ago are still down 88%, even after 29% gain this past week

It's nice to see the Purple Innovation, Inc. (NASDAQ:PRPL) share price up 29% in a week. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 88% lower after that period. So we don't gain too much confidence from the recent recovery. The important question is if the business itself justifies a higher share price in the long term. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

On a more encouraging note the company has added US$20m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Purple Innovation isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Purple Innovation reduced its trailing twelve month revenue by 2.9% for each year. While far from catastrophic that is not good. The share price fall of 14% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

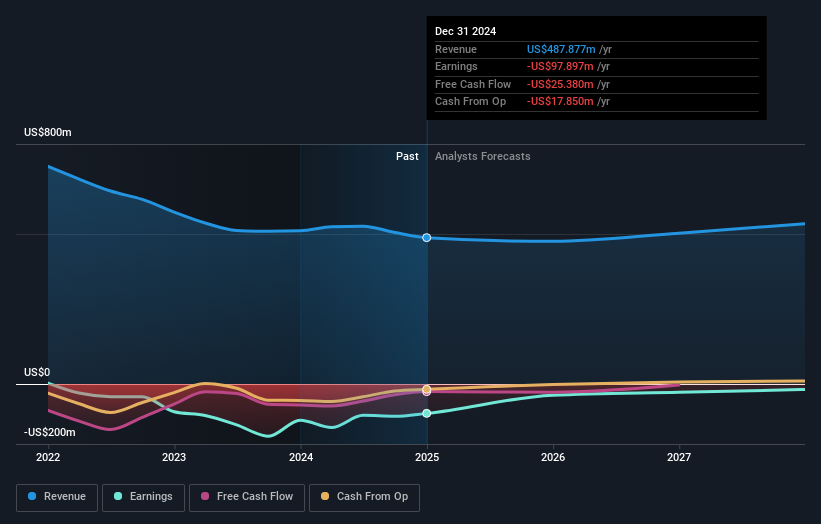

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Purple Innovation in this interactive graph of future profit estimates.

A Different Perspective

Investors in Purple Innovation had a tough year, with a total loss of 48%, against a market gain of about 9.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Purple Innovation better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Purple Innovation you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Purple Innovation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRPL

Purple Innovation

Designs, manufactures, and sells sleep and other products in the United States and internationally.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives