- United States

- /

- Capital Markets

- /

- NYSEAM:CET

JAKKS Pacific And Two Other Leading Dividend Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust 15% increase over the past 12 months. In this context of steady growth and positive earnings expectations, identifying strong dividend stocks like JAKKS Pacific and two others can offer investors potential income stability alongside capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.63% | ★★★★★☆ |

| Universal (UVV) | 6.02% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.71% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.11% | ★★★★★★ |

| Ennis (EBF) | 5.63% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.10% | ★★★★★☆ |

| Dillard's (DDS) | 5.63% | ★★★★★★ |

| Credicorp (BAP) | 4.84% | ★★★★★☆ |

| CompX International (CIX) | 4.85% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.91% | ★★★★★★ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

JAKKS Pacific (JAKK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAKKS Pacific, Inc. is a company that designs, produces, markets, sells, and distributes toys and related products globally, with a market cap of approximately $219.47 million.

Operations: JAKKS Pacific, Inc. generates its revenue primarily through two segments: Toys/Consumer Products, which account for $594.55 million, and Costumes, contributing $119.67 million.

Dividend Yield: 5.1%

JAKKS Pacific recently declared a quarterly dividend of US$0.25 per share, with a low payout ratio of 6%, indicating strong coverage by earnings. The company's cash payout ratio stands at 28.6%, further supporting dividend sustainability. Despite being added to the Russell 2000 Value-Defensive Index, future earnings are projected to decline by an average of 26.8% annually over the next three years, raising concerns about long-term dividend stability and growth potential for investors seeking consistent income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of JAKKS Pacific.

- The valuation report we've compiled suggests that JAKKS Pacific's current price could be quite moderate.

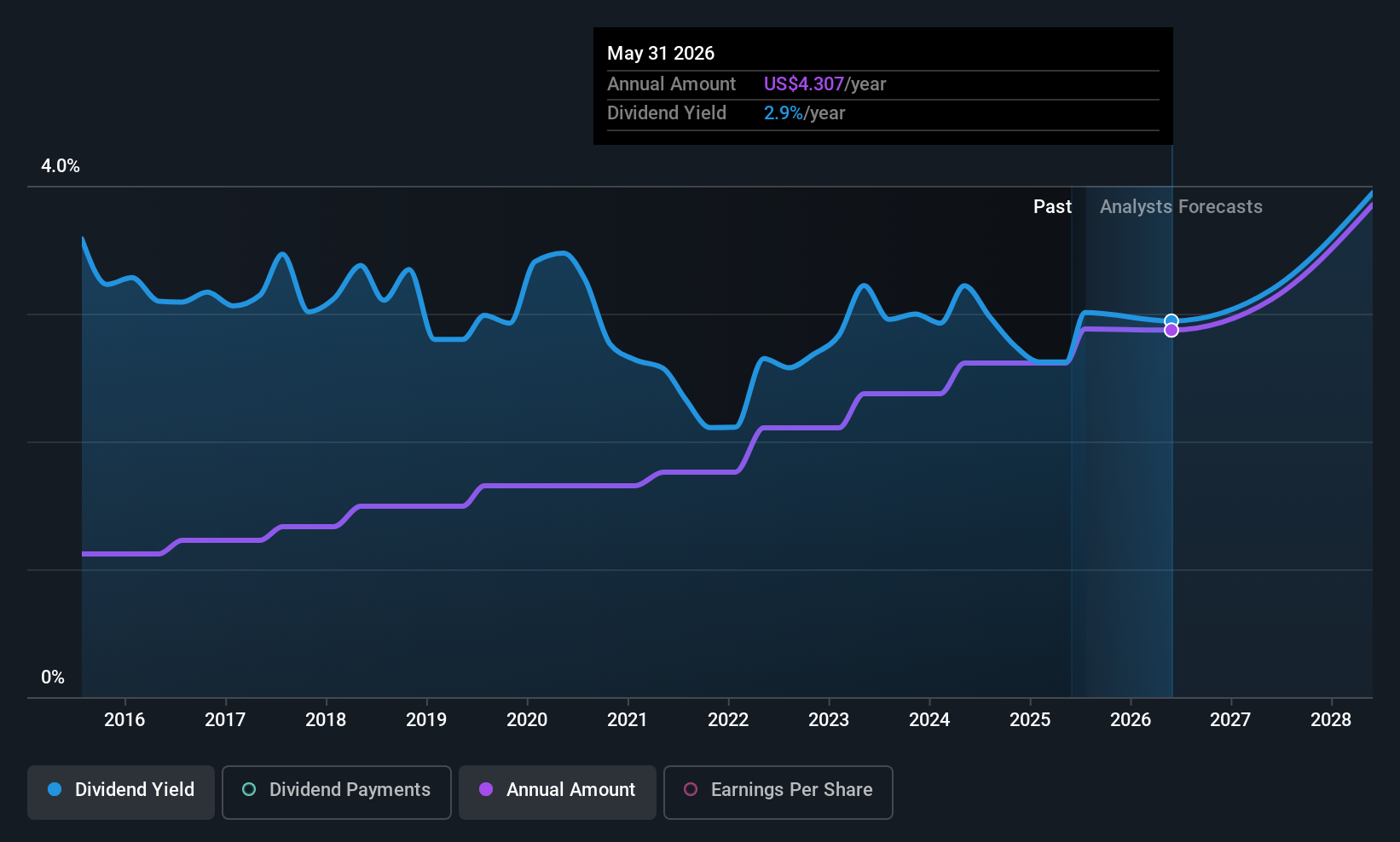

Paychex (PAYX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paychex, Inc. offers human capital management solutions including payroll, employee benefits, HR, and insurance services for small to medium-sized businesses in the United States, Europe, and India with a market cap of $51.68 billion.

Operations: Paychex, Inc.'s revenue from its Staffing & Outsourcing Services segment amounts to $5.57 billion.

Dividend Yield: 3%

Paychex offers a quarterly dividend of US$1.08 per share, recently increased by 10%. While dividends have been stable and growing over the past decade, their sustainability is questioned due to high payout ratios—87.4% of earnings and 91.1% of cash flows. Despite trading close to fair value and recent revenue growth, net income has declined year-over-year, raising concerns about future dividend coverage amidst executive changes and strategic partnerships like the one with SoFi.

- Get an in-depth perspective on Paychex's performance by reading our dividend report here.

- Our expertly prepared valuation report Paychex implies its share price may be too high.

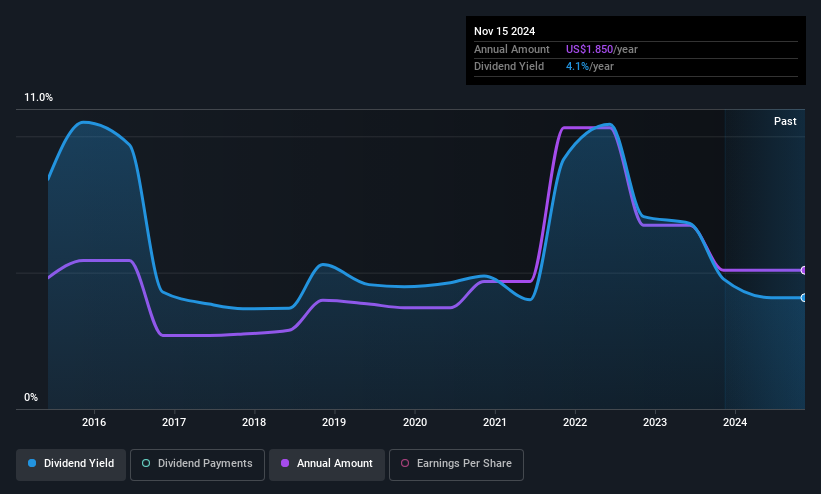

Central Securities (CET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of $1.40 billion.

Operations: Central Securities Corp. generates its revenue primarily from the Financial Services - Closed End Funds segment, amounting to $23.70 million.

Dividend Yield: 4.6%

Central Securities' dividend yield of 4.65% ranks in the top 25% of US dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 174.7%. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings growth of 28.8% supports a low payout ratio of 22.6%, but large one-off items affect financial results. A recent $0.25 per share dividend includes taxable components as ordinary income and long-term capital gain.

- Click to explore a detailed breakdown of our findings in Central Securities' dividend report.

- Our valuation report unveils the possibility Central Securities' shares may be trading at a discount.

Make It Happen

- Investigate our full lineup of 142 Top US Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CET

Central Securities

Central Securities Corp. is a publicly owned investment manager.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives