- United States

- /

- Leisure

- /

- NasdaqGS:JAKK

3 Undiscovered Gems In The US Market To Enhance Your Portfolio

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 5.1% in the last week and rising 11% over the past year, with earnings projected to grow by 14% annually. In such a dynamic environment, identifying lesser-known stocks with strong fundamentals and growth potential can be an effective strategy for enhancing your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Solesence (NasdaqCM:SLSN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solesence, Inc. is a science-driven company that develops, manufactures, and sells an integrated family of technologies in the United States with a market capitalization of $273.40 million.

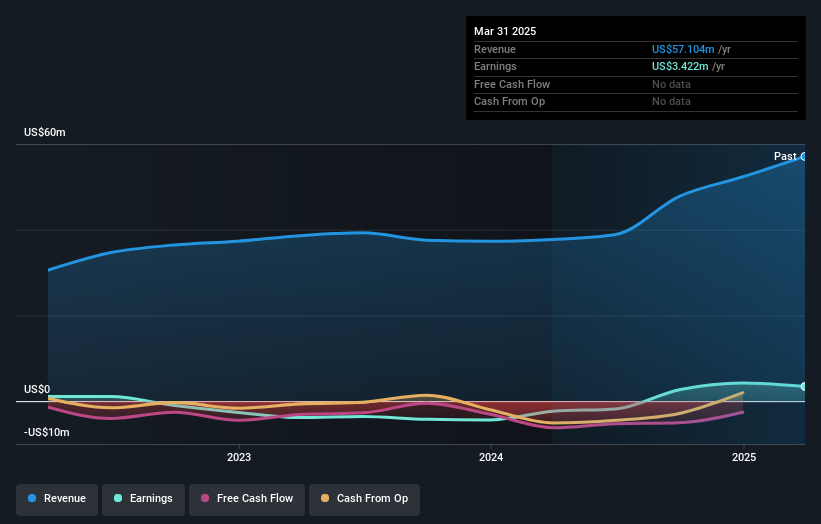

Operations: Solesence generates revenue primarily from its specialty chemicals segment, which accounts for $57.10 million.

Solesence, a nimble player in the beauty science sector, has recently transitioned to the NASDAQ Capital Market under the ticker SLSN. Over five years, its debt to equity ratio improved significantly from 236.2% to 82.4%, though it remains high at 70.4%. The company's EBIT covers interest payments 6.8 times over, indicating strong operational efficiency despite volatile share prices recently. In Q1 2025, Solesence reported revenue of US$14.63 million and net income of US$0.08 million; however, shareholders experienced dilution last year as part of its growth strategy in this competitive industry landscape.

- Navigate through the intricacies of Solesence with our comprehensive health report here.

Gain insights into Solesence's historical performance by reviewing our past performance report.

JAKKS Pacific (NasdaqGS:JAKK)

Simply Wall St Value Rating: ★★★★★★

Overview: JAKKS Pacific, Inc. is a global company involved in the design, production, marketing, sale, and distribution of toys and related products as well as consumer goods such as kids' furniture and costumes with a market capitalization of approximately $258.26 million.

Operations: JAKKS Pacific generates revenue primarily from two segments: Toys/Consumer Products, which contributes $594.55 million, and Costumes, with $119.67 million in revenue.

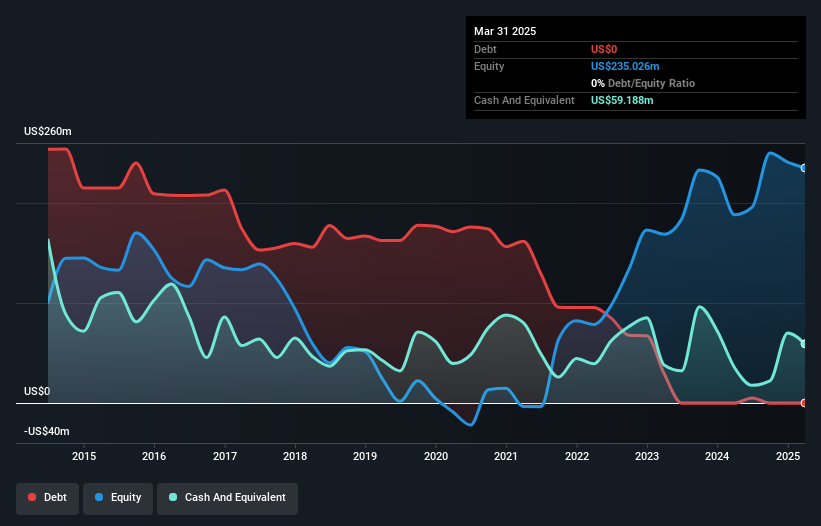

JAKKS Pacific, a nimble player in the toy industry, is making strategic moves to bolster its market presence. The company has no debt and trades at 18.7% below fair value estimates, offering potential upside from its current US$19.46 share price. Recent earnings show a 56.6% growth over the past year, outpacing the leisure industry's 5.5%. However, projected earnings are expected to dip by an average of 24.7% annually over the next three years. With new licensing deals and product innovations like their DC x Sonic crossover toys, JAKKS is poised for intriguing developments despite challenges ahead.

Northwest Pipe (NasdaqGS:NWPX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Northwest Pipe Company, along with its subsidiaries, manufactures and sells water-related infrastructure products in North America and Canada, with a market cap of $403.03 million.

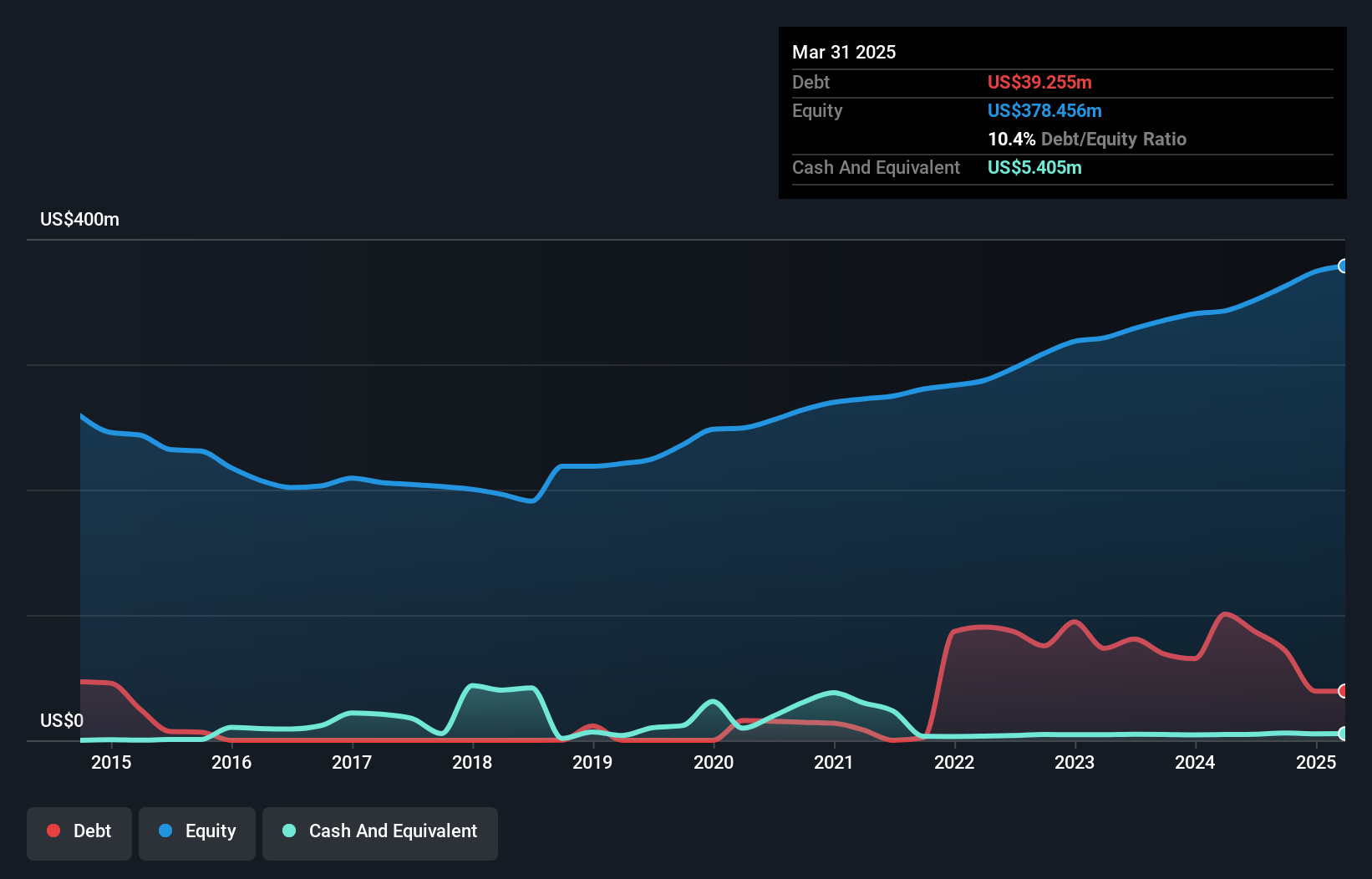

Operations: Northwest Pipe generates revenue primarily from two segments: Engineered Steel Pressure Pipe, contributing $336.38 million, and Precast Infrastructure and Engineered Systems, adding $159.06 million. The company's financial structure reveals a focus on these core areas, impacting its overall profitability metrics.

Northwest Pipe, a notable player in the infrastructure sector, is navigating a challenging landscape with strategic expansions and M&A opportunities. Their recent earnings report showed revenue of US$116 million for Q1 2025, up from US$113 million the previous year, though net income dipped to US$3.96 million from US$5.24 million. The company's debt management remains satisfactory with a net debt to equity ratio of 8.9%, while EBIT covers interest payments 9.4 times over—well above industry norms. Despite trading at 25.6% below fair value estimates, rising steel costs and tariffs could pressure margins moving forward.

Make It Happen

- Explore the 279 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade JAKKS Pacific, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JAKK

JAKKS Pacific

Designs, produces, markets, sells, and distributes toys and related products, consumer products, kids indoor and outdoor furniture, costumes, and sporting goods and home furnishings space products worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives