- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Should Hasbro's (HAS) Headquarters Move to Boston Shift Investor Perspectives on Future Growth?

Reviewed by Simply Wall St

- Hasbro announced in the past week that it will relocate its headquarters from Pawtucket, Rhode Island to Boston’s Seaport District by the end of 2026, moving at least 700 full-time jobs to Massachusetts and receiving up to US$14 million in tax incentives.

- This headquarters move highlights the competition among cities for major employers and signals potential changes in Hasbro's operational footprint and regional workforce engagement.

- We'll examine how Hasbro's choice to move its headquarters and workforce to Boston may alter its investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hasbro Investment Narrative Recap

To invest in Hasbro, you need to believe that its strong brands and recurring digital licensing revenues will outweigh pressures from a challenged traditional toy and game segment. The recent headquarters relocation to Boston is unlikely to materially affect Hasbro’s biggest short-term catalyst, growing digital and licensing income, or its most significant near-term risk, which remains a reliance on blockbuster franchises like Magic: The Gathering to drive both solid sales and margins.

Among Hasbro’s many recent announcements, its expanded collaborations with Disney for the PLAY-DOH brand stand out as highly relevant. These licensing partnerships underscore how Hasbro continues to unlock new revenue streams with established IP and reinforce digital and merchandising catalysts, counterbalancing cyclical headwinds in its core consumer products division.

Yet unlike new product launches, franchise concentration risk can impact results when expectations are highest and investors should be aware of...

Read the full narrative on Hasbro (it's free!)

Hasbro's narrative projects $4.9 billion revenue and $773.5 million earnings by 2028. This requires 4.7% yearly revenue growth and a $1,341.8 million earnings increase from the current earnings of -$568.3 million.

Uncover how Hasbro's forecasts yield a $89.17 fair value, a 19% upside to its current price.

Exploring Other Perspectives

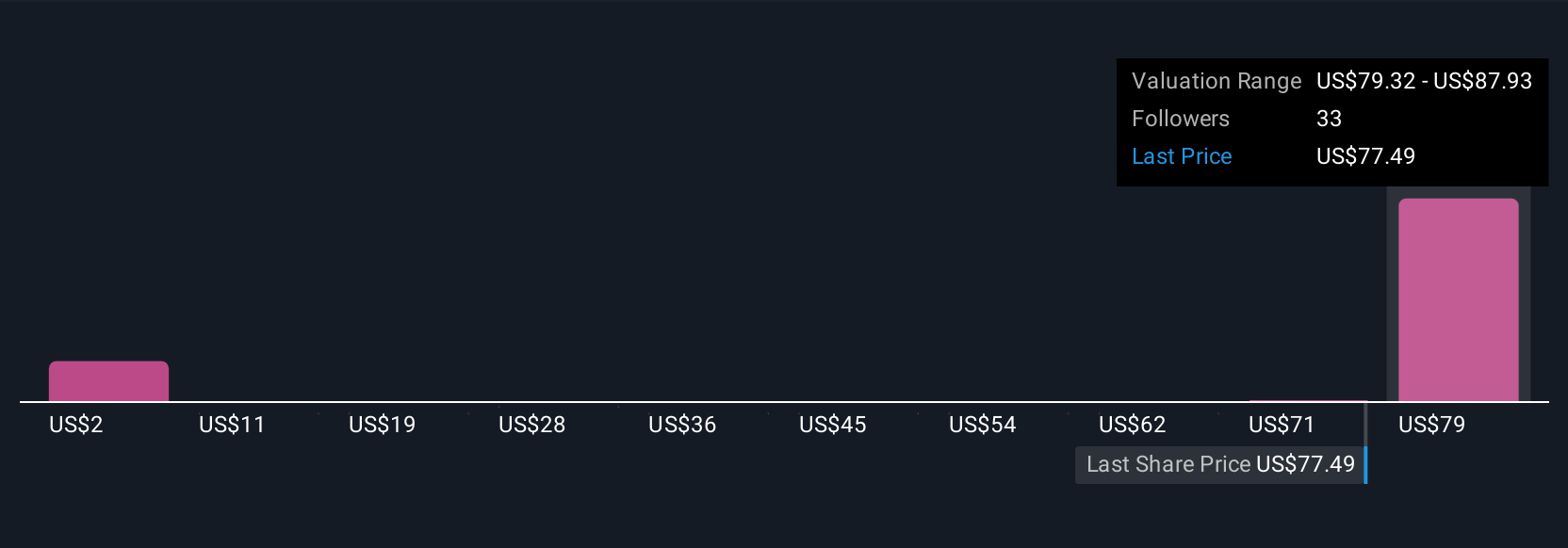

Six Community members on Simply Wall St estimate Hasbro’s fair value anywhere from US$1.90 up to US$89.17 per share. While opinions are wide ranging, the risk of overexposure to key franchises continues to shape sentiment and could sway outcomes depending on future consumer appetite.

Explore 6 other fair value estimates on Hasbro - why the stock might be worth less than half the current price!

Build Your Own Hasbro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hasbro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hasbro's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives