- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Hasbro (HAS) Valuation Check After New Dungeons & Dragons and EXODUS Digital Gaming Push

Reviewed by Simply Wall St

Hasbro (HAS) just leaned further into digital gaming, with Wizards of the Coast unveiling WARLOCK: DUNGEONS & DRAGONS and a fresh EXODUS trailer. These moves refocus the story on its higher growth, IP driven businesses.

See our latest analysis for Hasbro.

Investors seem to be warming to this pivot, with a roughly 44% year to date share price return and a 3 year total shareholder return above 60%, suggesting momentum is rebuilding around Hasbro’s IP heavy strategy.

If these gaming moves have you rethinking where growth could show up next, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar opportunities.

But with the stock already up sharply this year and trading only modestly below analyst targets, is Hasbro still flying under the radar for value focused investors, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 10.9% Undervalued

With Hasbro closing at $81.55 versus a narrative fair value near $91.54, the current setup reflects meaningful upside if the digital pivot delivers.

Rapidly growing cross platform digital gaming and licensing revenue, exemplified by Wizards of the Coast (notably Magic: The Gathering's 23%+ YoY growth and MONOPOLY GO!), is expanding Hasbro's addressable market and recurring high margin earnings streams, positioning the company to capitalize on the global rise of digital entertainment, which should drive outsized revenue and operating profit growth.

Curious how a traditional toy maker ends up priced like a scalable entertainment platform? The narrative leans on aggressive profit recovery and richer margins. Want to see the exact earnings path and valuation multiple that aim to justify this gap?

Result: Fair Value of $91.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on Magic and execution risk in the expanding video game slate could quickly undermine the optimistic growth and margin recovery narrative.

Find out about the key risks to this Hasbro narrative.

Another Lens on Value

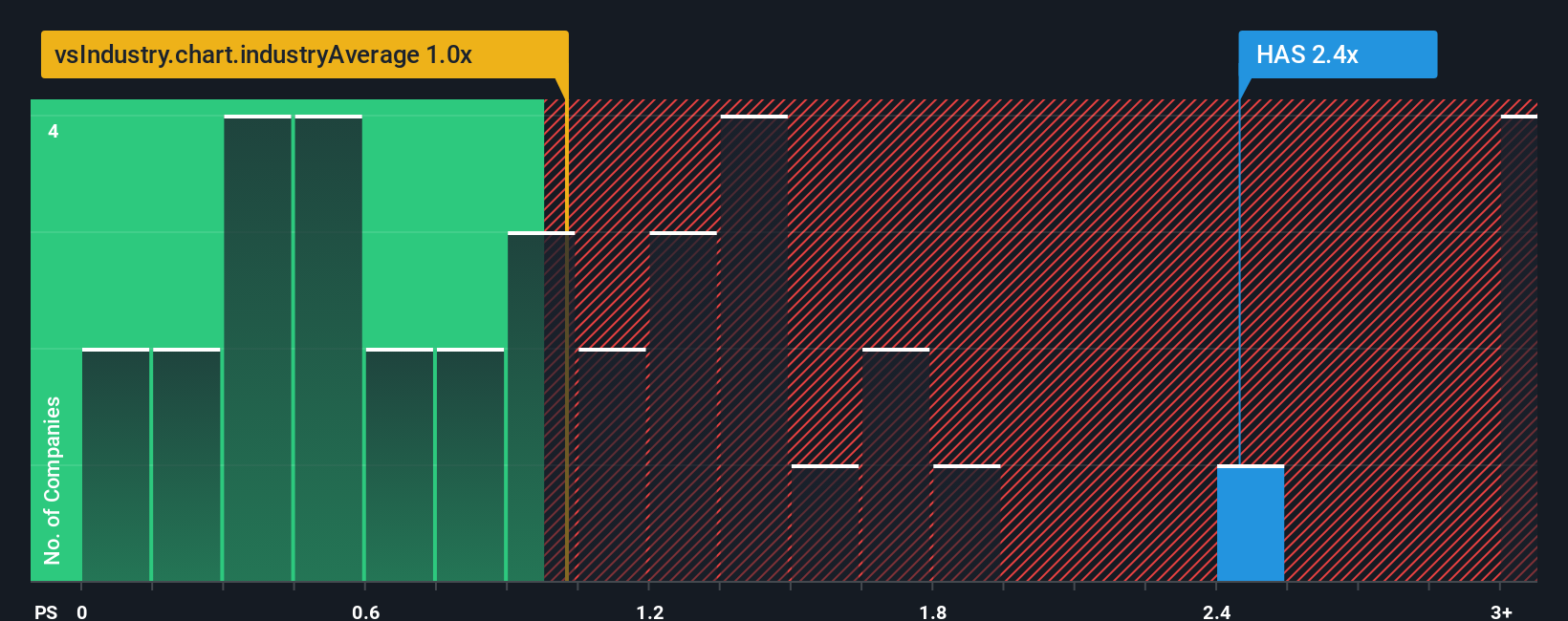

Not everyone sees Hasbro as a bargain. On a price to sales basis the stock trades at 2.6 times, far richer than the US Leisure sector at 1 time and peers around 1.2 times. It is also still above a 2.2 times fair ratio, which raises the risk that sentiment cools before earnings catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hasbro Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build your personalized view in under three minutes using Do it your way.

A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winners by using the Simply Wall Street Screener to pinpoint high conviction opportunities other investors may be overlooking.

- Capture compounding potential by targeting quality names trading below intrinsic value with these 903 undervalued stocks based on cash flows tailored to long term builders.

- Focus on businesses involved in breakthrough algorithms, chips, and computing power through these 27 quantum computing stocks.

- Identify payers offering attractive yields with these 13 dividend stocks with yields > 3% that may support your portfolio through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)