- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Does Hasbro’s (HAS) Walmart-Exclusive Toy Relaunch Reveal a Fresh Approach to Brand Revitalization?

Reviewed by Simply Wall St

- Just Play, in collaboration with Hasbro, recently relaunched the iconic EASY-BAKE and PLAYSKOOL toy brands, introducing refreshed, modernized versions now available exclusively at Walmart in the US with updated features and a contemporary look.

- This exclusive partnership targets both nostalgia-driven consumers and new parents, aiming to revitalize classic toy lines and expand Hasbro's reach within key retail channels.

- We'll explore how the exclusive Walmart relaunch of these flagship brands aligns with Hasbro's focus on franchise expansion and brand reinvention.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Hasbro Investment Narrative Recap

For shareholders, the key investment belief is that Hasbro can successfully leverage its iconic brands and partnerships to expand beyond its core franchises, offsetting pressure from its traditional toy and game business. The exclusive Walmart relaunch of EASY-BAKE and PLAYSKOOL is a positive step in brand reinvention, but by itself is unlikely to materially impact Hasbro’s most important current catalyst: digital and licensing-led growth. The primary concern remains ongoing weakness and volatility in traditional consumer products, which may continue to weigh on profitability and predictability in the short term.

One recent announcement closely related to this news is Hasbro’s launch of Nano-mals, aiming to blend technology with interactive play. While the EASY-BAKE and PLAYSKOOL relaunches speak to driving engagement among nostalgic and new audiences at retail, Nano-mals highlights Hasbro’s push into tech-enabled toys, an area that could support growth if successfully executed alongside renewed classics.

But even as Hasbro works to refresh beloved brands, investors should keep a close eye on its persistent reliance on...

Read the full narrative on Hasbro (it's free!)

Hasbro's narrative projects $4.9 billion revenue and $773.5 million earnings by 2028. This requires 4.7% yearly revenue growth and a $1.34 billion increase in earnings from the current level of -$568.3 million.

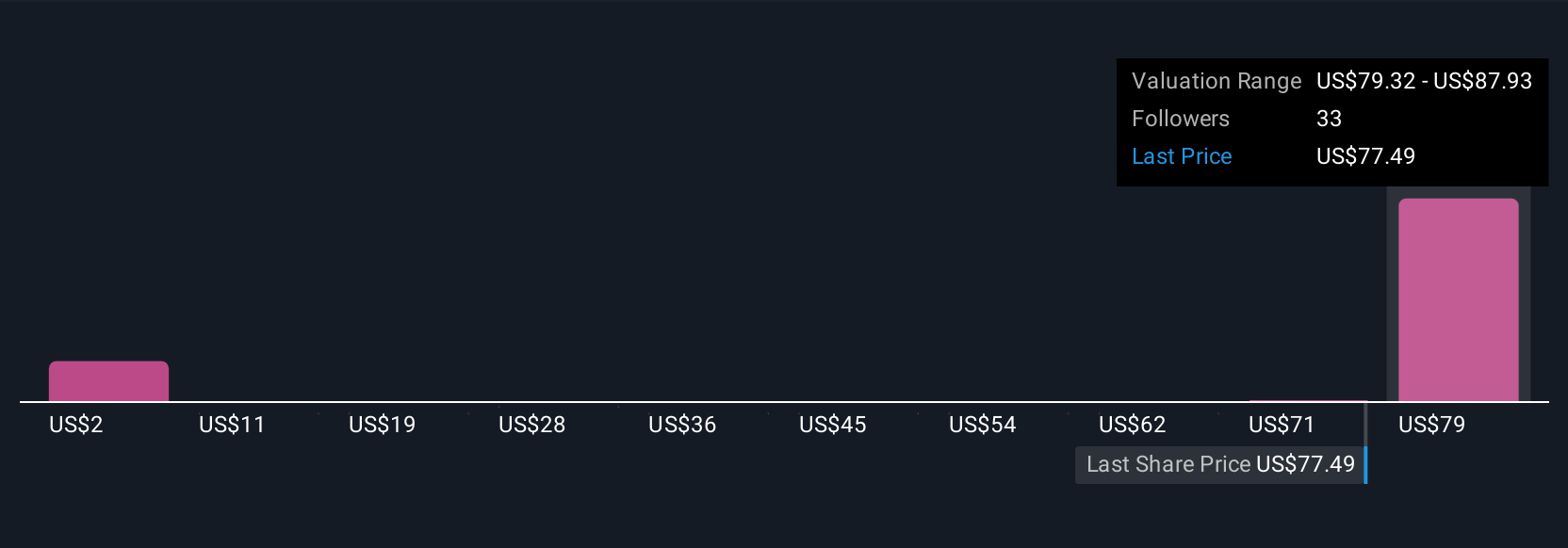

Uncover how Hasbro's forecasts yield a $88.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Hasbro ranging from US$1.90 to US$88.33, across six different perspectives. As you consider these varying views, remember that ongoing franchise concentration risk can affect both revenue growth and overall business predictability.

Explore 6 other fair value estimates on Hasbro - why the stock might be worth as much as 11% more than the current price!

Build Your Own Hasbro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hasbro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hasbro's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives