- United States

- /

- Consumer Durables

- /

- NasdaqGS:GPRO

Those Who Purchased GoPro (NASDAQ:GPRO) Shares Three Years Ago Have A 51% Loss To Show For It

While it may not be enough for some shareholders, we think it is good to see the GoPro, Inc. (NASDAQ:GPRO) share price up 22% in a single quarter. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 51%. So it's good to see it climbing back up. After all, could be that the fall was overdone.

Check out our latest analysis for GoPro

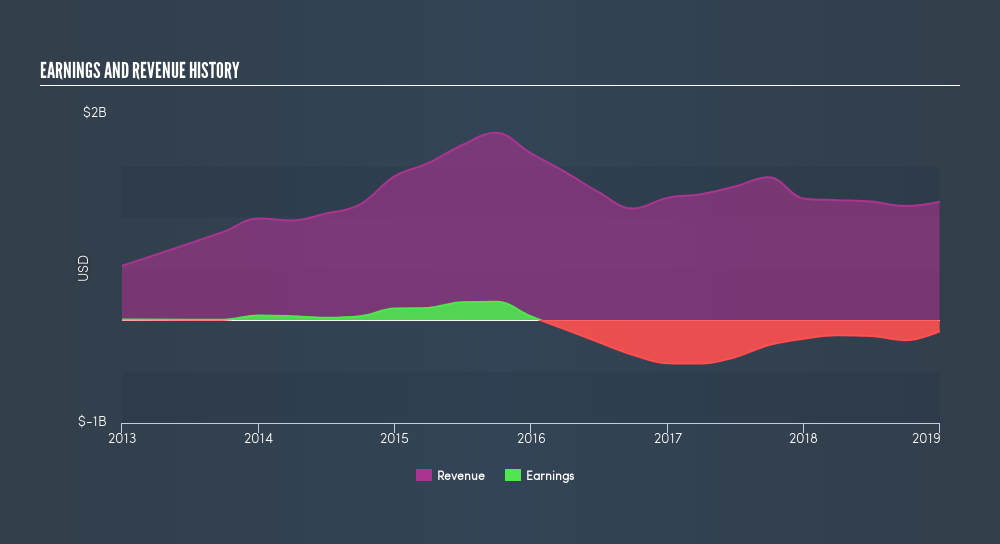

GoPro isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years GoPro saw its revenue shrink by 7.9% per year. That is not a good result. The share price decline of 21% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This freereport showing analyst forecasts should help you form a view on GoPro

A Different Perspective

Pleasingly, GoPro's total shareholder return last year was 6.6%. What is absolutely clear is that is far preferable to the dismal 21% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. If you would like to research GoPro in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: GoPro may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:GPRO

GoPro

Develops and sells cameras, mountable and wearable accessories, and subscription services and software in the Americas, Europe, the Middle East, Africa, the Asia and Pacific region, and internationally.

Undervalued with excellent balance sheet.