- United States

- /

- Luxury

- /

- NasdaqGS:FOSL

We Think Fossil Group (NASDAQ:FOSL) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Fossil Group, Inc. (NASDAQ:FOSL) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Fossil Group

How Much Debt Does Fossil Group Carry?

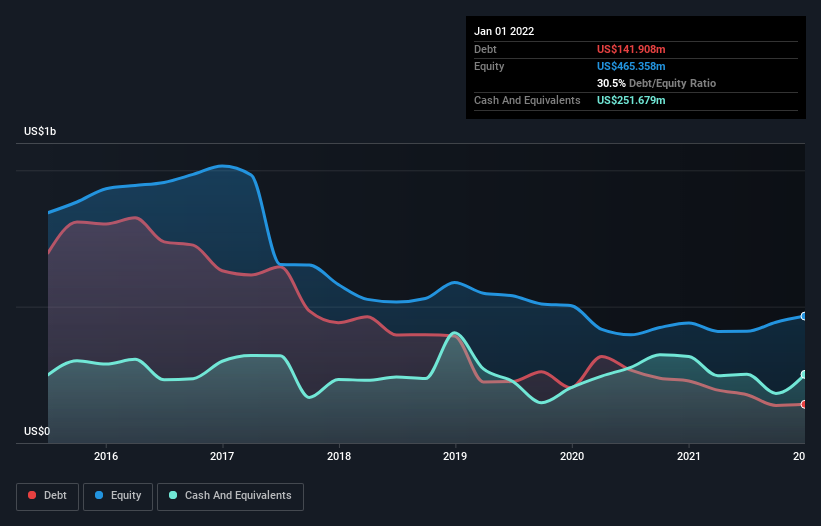

The image below, which you can click on for greater detail, shows that Fossil Group had debt of US$141.9m at the end of January 2022, a reduction from US$227.4m over a year. But it also has US$251.7m in cash to offset that, meaning it has US$109.8m net cash.

How Healthy Is Fossil Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Fossil Group had liabilities of US$535.6m due within 12 months and liabilities of US$367.7m due beyond that. Offsetting these obligations, it had cash of US$251.7m as well as receivables valued at US$318.2m due within 12 months. So its liabilities total US$333.5m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of US$487.0m, so it does suggest shareholders should keep an eye on Fossil Group's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, Fossil Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

Notably, Fossil Group made a loss at the EBIT level, last year, but improved that to positive EBIT of US$124m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is Fossil Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Fossil Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent year, Fossil Group recorded free cash flow of 37% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

Although Fossil Group's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$109.8m. So while Fossil Group does not have a great balance sheet, it's certainly not too bad. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Fossil Group , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FOSL

Fossil Group

Designs, develops, markets, and distributes consumer fashion accessories in the United States, Europe, Asia, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026