- United States

- /

- Consumer Durables

- /

- NasdaqGS:CVCO

Cavco Industries (CVCO): Exploring Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Cavco Industries (CVCO) has shown an interesting mix of returns lately, with shares ticking down nearly 2% over the past day and around 8% lower over the past month. The past 3 months remain in positive territory.

See our latest analysis for Cavco Industries.

After a period of strong momentum earlier this year, Cavco Industries has cooled off recently, with a 7.8% drop in share price over the past month. Even so, when you zoom out, the company’s 1-year total shareholder return of nearly 18%, along with its robust 3-year and 5-year gains, point to durable value creation for patient investors.

If the recent pullback has you curious about what else is gaining traction, now is a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

The real question for investors is whether Cavco Industries is now undervalued after its recent decline, or if the current price already reflects expectations for its future growth. Is there a genuine buying opportunity, or has the market already priced in all the upside?

Most Popular Narrative: 9.2% Undervalued

Against Cavco Industries’ last close at $497.78, the most closely watched narrative pegs its fair value well above that price. This sets up a fascinating disconnect between what the market is paying today and what’s projected based on the company’s longer-term growth levers.

Public policy initiatives at the federal level are increasingly recognizing manufactured housing as a vital component of the nation's affordable housing solution. Recent bills could unlock broader zoning acceptance and regulatory changes (e.g., chassis removal), potentially expanding Cavco's addressable market and supporting long-term revenue and earnings growth.

Ever wondered what assumptions drive that fair value call? You might be surprised by the financial forecasts and bold margin expansion baked into the outlook. Don’t miss seeing what’s really powering the narrative around Cavco’s share price.

Result: Fair Value of $548.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as potential tariff increases on imported components and persistent regional demand weakness could still challenge Cavco Industries’ growth narrative in the future.

Find out about the key risks to this Cavco Industries narrative.

Another View: Earnings Multiple Raises a Red Flag

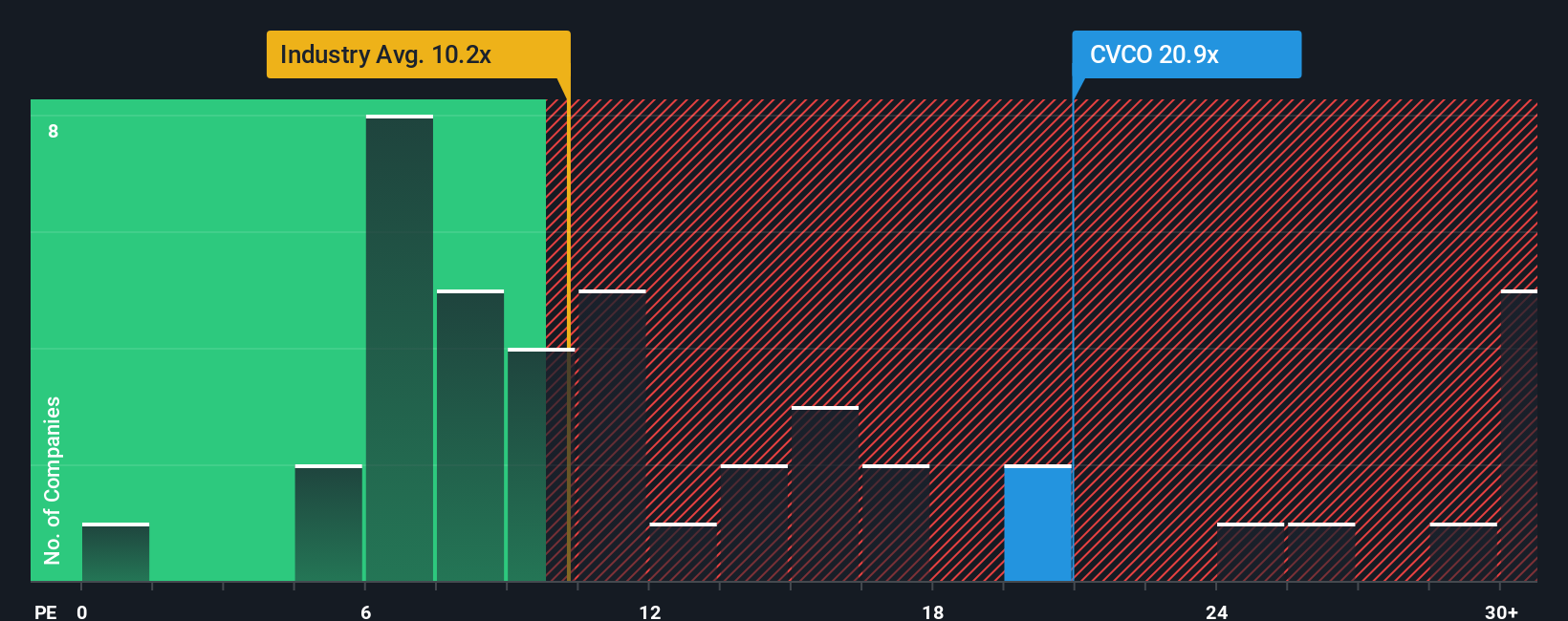

Taking a different approach, the current price-to-earnings ratio stands out at 20.9x, which is nearly double the industry average of 10.7x and also above its peer group’s average of 9.5x. Even compared to a fair ratio estimate of 16.2x, Cavco appears richly valued. That signals more optimism baked in than the broader sector. Will the share price grow into these expectations or does this set up a valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cavco Industries Narrative

If you see things differently or want to test your own ideas, you can quickly build an independent view using the same data in just minutes. Do it your way

A great starting point for your Cavco Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to broaden your portfolio and get ahead of the curve? Tap into fresh opportunities with these powerful, targeted stock ideas and never miss a momentum shift.

- Start building wealth by targeting steady income streams. Check out these 19 dividend stocks with yields > 3% yielding over 3% for stronger, more consistent returns.

- Accelerate your exposure to future-changing tech by backing innovation. Explore these 24 AI penny stocks featuring businesses at the forefront of artificial intelligence breakthroughs.

- Capitalize on undervalued gems with growth potential before the crowd. Browse these 898 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVCO

Cavco Industries

Designs, produces, and retails factory-built homes primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives