- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Crocs (NasdaqGS:CROX) Withdraws 2025 Guidance Despite Q1 Revenue Holding Steady at US$937 Million

Reviewed by Simply Wall St

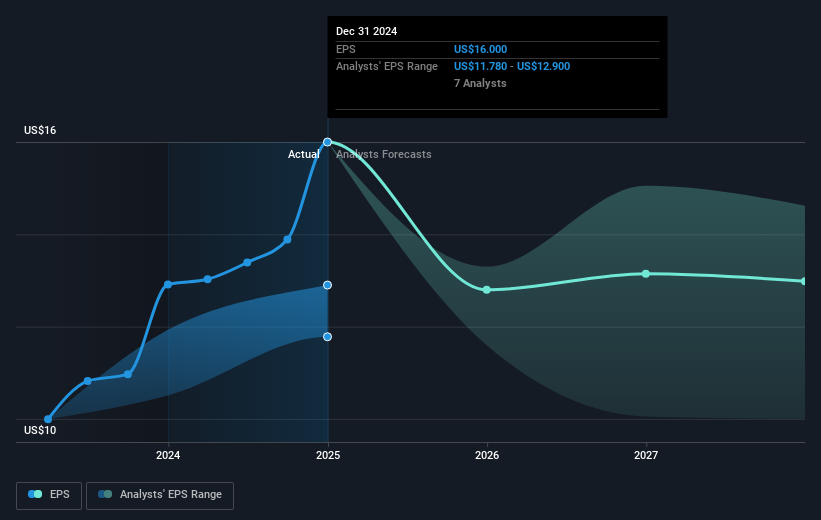

Crocs (NasdaqGS:CROX) recently navigated a turbulent landscape by withdrawing its full-year earnings guidance for 2025, attributing the move to uncertainties in global trade policies. Despite this, the company reported an increase in net income and earnings per share for the first quarter of 2025 compared to the same period last year. Over the last quarter, Crocs' stock price moved up by 5%, aligning with broader market trends that saw positive shifts following a U.S.-U.K. trade deal announcement. These corporate developments, alongside the broader bullish market momentum, likely sustained investor confidence in Crocs amid an otherwise volatile period.

Find companies with promising cash flow potential yet trading below their fair value.

The recent decision by Crocs to withdraw its earnings guidance for 2025 due to global trade policy uncertainties could potentially affect investor sentiment. This move raises questions about the company's future growth projections, particularly in light of its revenue of $4.10 billion and earnings of $950.07 million. Analysts' forecasts indicate a possible reduction in profit margins over the next three years, which could impact Crocs' ability to meet its revenue growth targets from international expansions and new product lines. Meanwhile, the share price increase of 5% over the last quarter, buoyed by the U.S.-U.K. trade deal, contrasts with Crocs' substantial five-year total return of 377.76%, highlighting the company's long-term performance.

Despite Crocs' recent short-term share price gain, the stock remains 21.63% below the consensus analyst price target of $121.55. The company's return on equity and profit growth rates have shown strong historical performance, yet recent results have underperformed the broader U.S. Luxury industry, which had a negative return of 17.1% over the past year. With analysts anticipating a decline in earnings to $712.0 million by 2028, Crocs' stock valuation appears attractive, trading at a lower price-to-earnings ratio relative to industry peers. However, concerns over tariff impacts and consumer shifts towards lower-priced products underscore challenges that may cloud future revenue and earnings potential.

Take a closer look at Crocs' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion