- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Could Croctober’s Global Push Reveal the Next Chapter in Crocs’ (CROX) Brand Strategy?

Reviewed by Sasha Jovanovic

- Crocs kicked off its annual Croctober celebration on October 8, 2025, featuring exclusive product launches such as the Classic Unfurgettable Leopard Knee High Boot and a month-long TikTok Shop livestream for fans globally.

- This month-long event is designed to strengthen fan engagement and bring global visibility to the brand through creative, community-focused product experiences.

- We'll review how this heightened fan engagement from Croctober could influence Crocs' investment narrative as international expansion becomes increasingly important.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Crocs Investment Narrative Recap

To own Crocs stock today, you need to believe that its growing international business and focus on brand engagement will outweigh short-term pressures from soft North American demand, inventory challenges at HEYDUDE, and recent market volatility. The Croctober celebration and new product launches are unlikely to materially shift the company's most important short-term catalyst, international sales growth, nor do they address the primary risk of consumer weakness and competitive threats in North America.

Among recent announcements, the Q3 earnings call scheduled for October 30 stands out as directly relevant. Given the current share price decline and heightened scrutiny from market participants, this report will play a key role in clarifying whether ongoing promotional efforts and product innovation can buffer the company against continued challenges in its legacy markets.

But investors should also keep in mind that, in contrast, ongoing trade tensions and tariff risks could escalate...

Read the full narrative on Crocs (it's free!)

Crocs' outlook anticipates $4.0 billion in revenue and $925.2 million in earnings by 2028. This forecast assumes a 1.0% annual decline in revenue and a $688.7 million increase in earnings from the current $236.5 million.

Uncover how Crocs' forecasts yield a $87.83 fair value, a 15% upside to its current price.

Exploring Other Perspectives

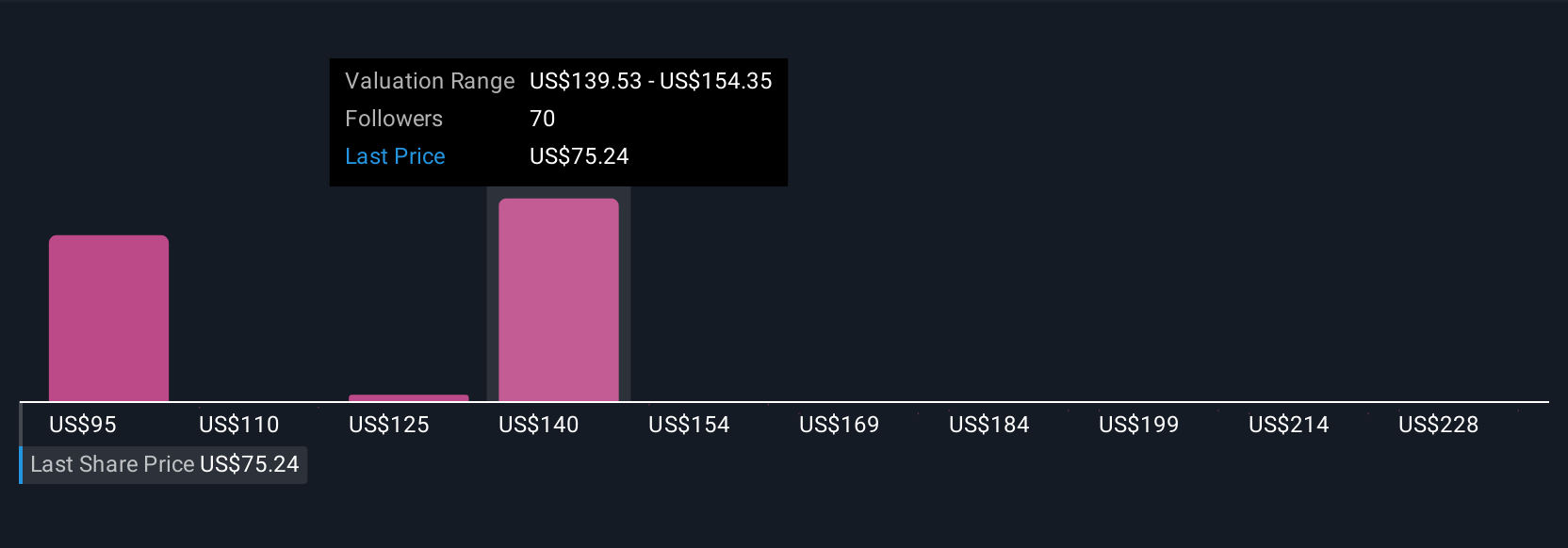

Twenty-one Simply Wall St Community members estimate Crocs’ fair value from US$86.17 up to US$201.93 per share. While international expansion remains a critical catalyst for growth, competitive challenges and regional risks mean opinions can differ sharply, explore these varying perspectives for a broader view.

Explore 21 other fair value estimates on Crocs - why the stock might be worth just $86.17!

Build Your Own Crocs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crocs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crocs' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives