- United States

- /

- Professional Services

- /

- NYSE:TRU

TransUnion (TRU) One-Off $139.6M Loss Challenges Bullish Community Narrative on Profitability

Reviewed by Simply Wall St

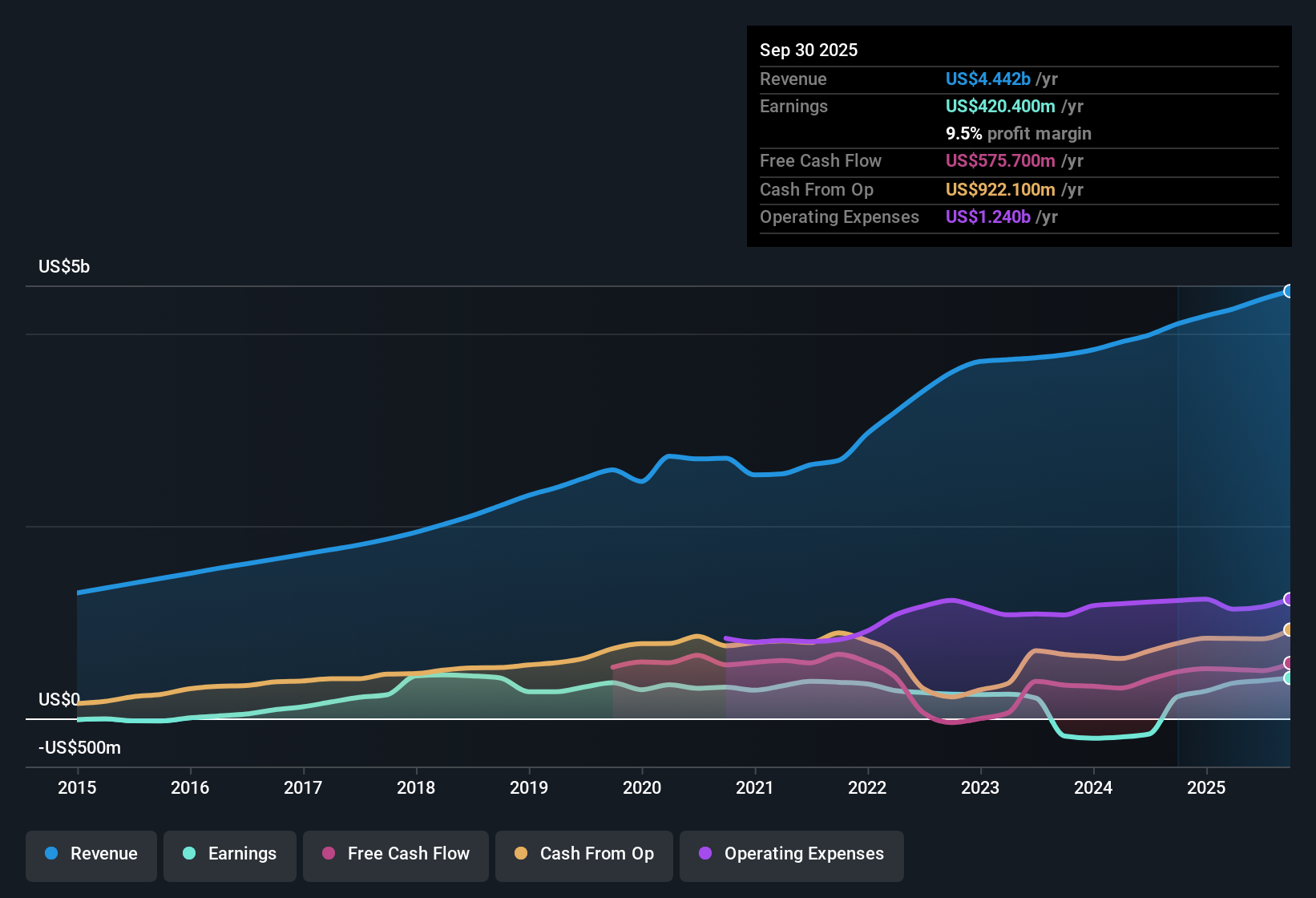

TransUnion (TRU) posted a one-off loss of $139.6 million in its latest twelve-month period through September 30, 2025, reflecting a significant hit to its bottom line. Over the past five years, earnings have declined by 18.3% per year, though the company has recently returned to profitability and is now forecast to deliver annual EPS growth of 19.9%, which is well above the US market average of 15.5%. Investors are weighing a positive swing in profit margins and a compelling growth outlook against valuation concerns and the lingering effects of recent non-recurring costs.

See our full analysis for TransUnion.Next, we’ll see how these headline results stack up against the established narratives, evaluating where the numbers confirm expectations and where the story takes a turn.

See what the community is saying about TransUnion

Profit Margins Jump to 9.0%

- TransUnion's profit margins have rebounded to 9.0%, and analysts see a further climb to 15.7% within three years as technology transformation costs phase out after 2025.

- According to the analysts' consensus narrative, ongoing investment in AI, cloud platforms, and high-margin analytics products is expected to push margins higher.

- Efficiency gains from the global OneTru rollout and cross-selling analytics such as TruIQ are strengthening profitability trends beyond core bureau services.

- Regulatory compliance and cyber exposure remain structural headwinds that could limit upside if they drive higher costs or operational risks above management's forecasts.

Forecast: EPS to Grow 19.9% Annually

- Projected annual earnings per share growth of 19.9% outpaces the US market average of 15.5%, with earnings expected to reach $869.9 million and EPS of $4.5 by September 2028, nearly doubling current levels.

- Analysts' consensus view highlights how technology-driven product expansion and demand for predictive compliance solutions are sustaining revenue growth.

- Expanding international operations, notably in India and Latin America, are seen as important drivers supporting this profit momentum.

- Integration of legacy systems and increased competition from fintech innovators could temper these gains if execution falters or pricing pressures intensify.

Valuation: 41.5x PE Above Peers, Shares Below DCF Fair Value

- The current PE ratio of 41.5x significantly exceeds the Professional Services industry average of 26.1x and its peer group average of 25.9x. TransUnion trades at $83.48 per share, a discount to its DCF fair value of $108.13 and the official analyst target of $107.50.

- Analysts' consensus narrative notes a conflicting setup, where the premium multiple reflects optimism for margin expansion and earnings durability.

- Questions persist about earnings quality and the impact of the recent $139.6 million one-off loss.

- It remains crucial for investors to judge if future growth can justify the valuation gap or if shares are merely riding sector momentum.

If you want the complete breakdown of risks and opportunities behind the consensus perspective, see what’s driving both the bull and bear debates in our full analysis.

📊 Read the full TransUnion Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TransUnion on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a new angle? Share your outlook and shape your own take on TransUnion in just a few minutes: Do it your way

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite TransUnion’s strong growth outlook, its elevated valuation and questions about earnings quality highlight the risks that come with paying a premium for uncertain profit trends.

To sidestep those valuation clouds, consider these 876 undervalued stocks based on cash flows where you’ll discover stocks that analysts rate as genuinely undervalued based on future cash flows and sustainable upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives