- United States

- /

- Professional Services

- /

- NYSE:TRU

How Investors Are Reacting To TransUnion (TRU) Launching AI Credit Washing Detection Tool

Reviewed by Sasha Jovanovic

- TransUnion recently launched its industry-first Credit Washing Solution, harnessing advanced analytics and machine learning to help financial institutions detect improper suppression of legitimate credit data, an issue estimated to have erased US$10 billion in debt from U.S. credit reports in 2025 alone.

- This solution comes as atypical charge-off suppression is accelerating rapidly, with a very large increase in consumer-initiated cases over the past two years, presenting a new tool to address credit risk assessment and portfolio management challenges for lenders.

- We'll explore how the debut of this AI-driven fraud detection product further highlights TransUnion's positioning in analytics innovation and risk mitigation.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

TransUnion Investment Narrative Recap

To own a piece of TransUnion, you need to believe in both the persistent demand for advanced credit analytics and the company's ability to innovate ahead of emerging fraud techniques and regulatory shifts. The introduction of the AI-powered Credit Washing Solution could help position TransUnion as a leader in risk analytics, addressing one of the industry's most urgent short-term threats, though its immediate impact on earnings momentum appears limited compared to broader technology modernization efforts or changing competitive dynamics.

The most relevant company announcement to this news is TransUnion's recent dividend affirmation, as it underscores management’s commitment to ongoing shareholder returns even as the company invests in new product solutions. Investors may see this as a sign of financial strength and steady confidence, supporting the narrative that TransUnion remains focused on capital allocation while adapting to industry risks and evolving client needs.

However, against the promise of AI innovation, another risk investors should know is the growing sophistication and frequency of cyberattacks targeting data companies like TransUnion...

Read the full narrative on TransUnion (it's free!)

TransUnion's outlook anticipates $5.6 billion in revenue and $869.9 million in earnings by 2028. This is based on an expected 8.4% annual revenue growth rate and an increase in earnings of $477.9 million from the current $392.0 million.

Uncover how TransUnion's forecasts yield a $106.70 fair value, a 30% upside to its current price.

Exploring Other Perspectives

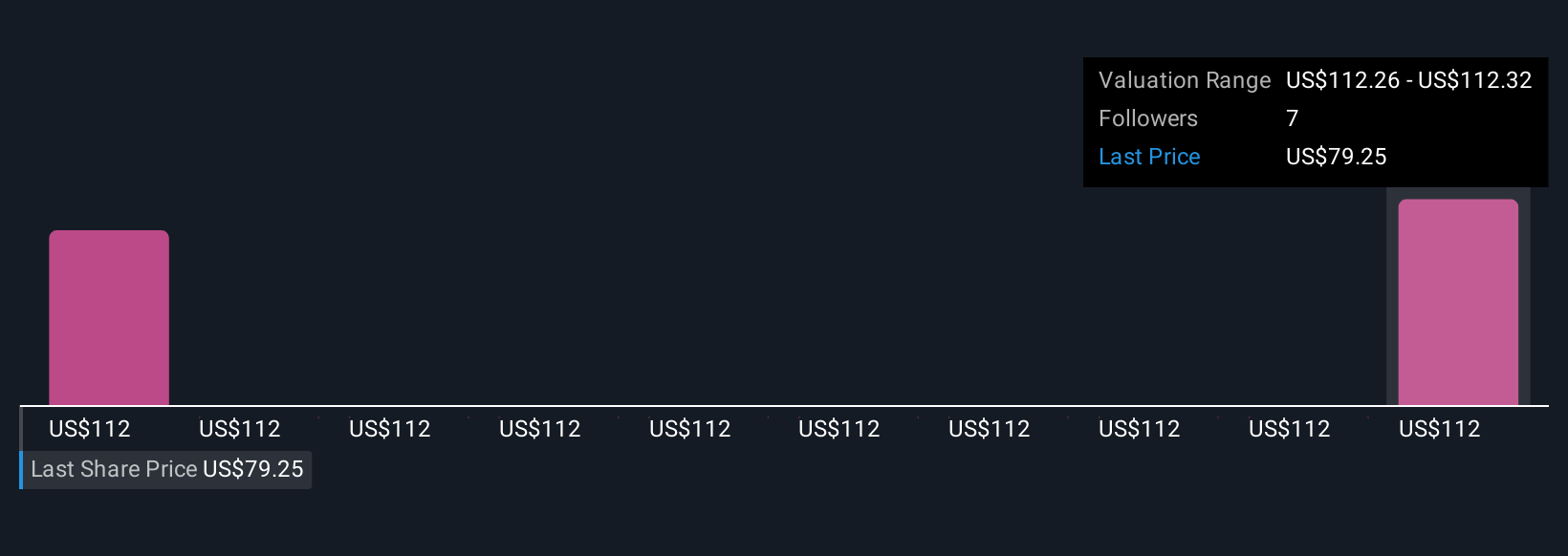

Simply Wall St Community members set fair value for TransUnion in the tight US$106.70 to US$107.56 range based on their own models and growth expectations. Amid this close consensus, many are weighing the impact of regulatory changes and shifting data privacy rules on future returns, explore diverse investor outlooks and factor these considerations into your research.

Explore 2 other fair value estimates on TransUnion - why the stock might be worth just $106.70!

Build Your Own TransUnion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TransUnion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransUnion's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives