- United States

- /

- Commercial Services

- /

- NYSE:ROL

Rollins (NYSE:ROL) CFO Kenneth Krause To Assume Principal Accounting Officer Role As Traci Hornfeck Resigns

Reviewed by Simply Wall St

Rollins (NYSE:ROL) experienced a 7.47% price increase last month amid a significant month for the company. The departure of Chief Accounting Officer Traci Hornfeck and the CFO Kenneth D. Krause stepping into her role suggested stability in financial management, which may have reassured investors during this transition. Additionally, Rollins's successful pricing of $500 million in Senior Notes reflected investor confidence in the company's financial strategy, even as broader markets were volatile with the Nasdaq and S&P 500 indices seeing declines of 4% and 3%, respectively. Rollins's ongoing M&A activities, as highlighted by the CEO, may have further driven optimism about future growth prospects. The easing inflation reported towards month's end also bolstered overall market sentiment, aiding stock prices. Despite the broader market declines, Rollins managed to achieve a positive pricing outcome amidst these developments.

Unlock comprehensive insights into our analysis of Rollins stock here.

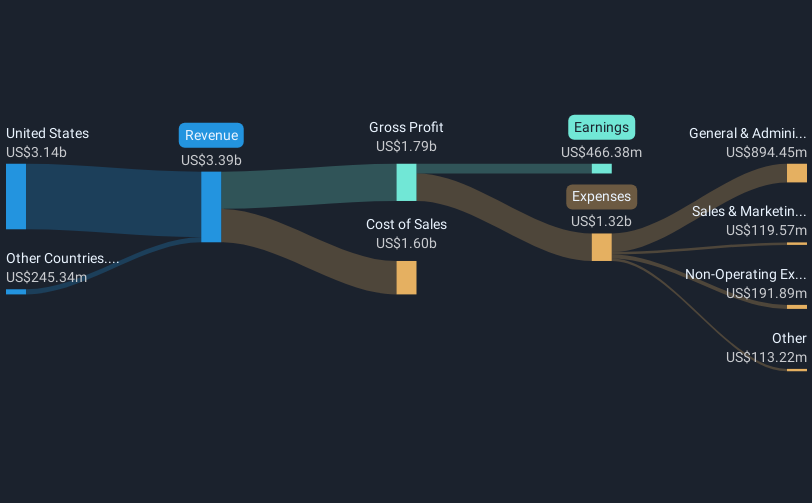

Rollins has delivered a total shareholder return of 110.06% over the past five years, significantly outperforming the US Commercial Services industry over the same timeframe. This performance can be attributed to several pivotal developments. Earnings growth, averaging 15.2% annually, provided a solid foundation for share appreciation. Executive leadership changes, such as Gary W. Rollins transitioning to Executive Chairman Emeritus in late 2024, have been carefully managed, ensuring stability. The company’s regular dividend increases, including a 10% rise announced in early 2025, have also contributed positively to total returns.

Moreover, Rollins's active pursuit of acquisitions has strengthened its growth trajectory. The announcement of a strong M&A pipeline in February 2025 reflects ongoing strategic expansion efforts. Finally, Rollins's financial strategy was backed by successfully pricing $500 million in Senior Notes in February 2025, providing flexibility for debt management and corporate initiatives. Collectively, these factors have bolstered investor confidence, resulting in robust long-term returns.

- See whether Rollins' current market price aligns with its intrinsic value in our detailed report

- Explore the potential challenges for Rollins in our thorough risk analysis report.

- Invested in Rollins? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with adequate balance sheet.