- United States

- /

- Commercial Services

- /

- NYSE:ROL

Is Rollins (ROL) Still Undervalued After Recent Gains? A Fresh Look at the Stock’s Valuation

Reviewed by Kshitija Bhandaru

See our latest analysis for Rollins.

Rollins has quietly racked up a year-to-date share price return of 21.68%, outpacing many of its peers, and the 1-year total shareholder return sits at a solid 15.38%. While the past week saw a dip, the longer-term momentum remains positive and reflects continued confidence in the company’s outlook.

If you’re on the hunt for the next breakout, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with steady gains and an optimistic outlook, is Rollins still trading at an attractive entry point? Or has the recent surge already anticipated much of the company’s future growth potential?

Most Popular Narrative: 6% Undervalued

With Rollins trading at $56.02, the most widely followed narrative comes in with a fair value of $59.67 per share. This places the current price just below where consensus sees the stock's prospects heading, spotlighting optimism for continued momentum.

Strategic acquisitions and multi-brand approach enhance revenue growth, earnings, and competitive advantage throughout economic fluctuations. Investing in sales, marketing, and operational efficiency drives organic and commercial division growth, boosting margins and recurring revenue.

Want to see what makes this target stand out? The narrative centers on relentless acquisitions, ambitious margin expansion, and a revenue outlook that would surprise even long-time investors. The numbers behind this valuation are not what you would expect. Find out how bold the projections really are.

Result: Fair Value of $59.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, market uncertainty and rising costs could temper Rollins’s growth. These factors may serve as potential catalysts for a shift in the current optimistic outlook.

Find out about the key risks to this Rollins narrative.

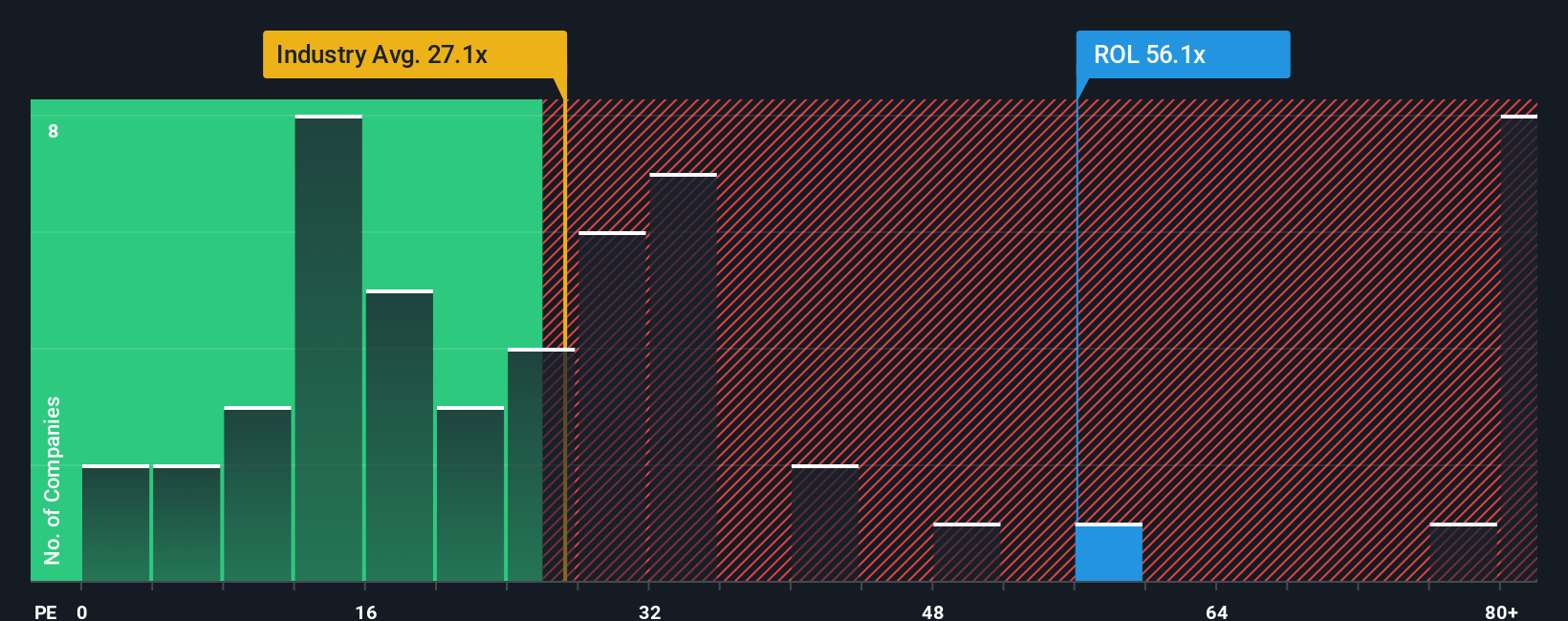

Another View: Price to Earnings Tells a Different Story

While analyst models point to Rollins trading slightly below fair value, looking at the market-based valuation offers a reality check. The company’s price-to-earnings ratio is 55.5x, which is far higher than the industry average of 27.4x, the peer average of 40.2x, and its fair ratio of 29.5x. This sizable gap suggests investors are paying a premium, leaving less room for upside if expectations shift. Could the current optimism be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rollins Narrative

If you want to dig deeper or believe there’s another angle to consider, you can build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Looking for More Investment Ideas?

Don’t settle for the obvious; some of the most rewarding opportunities fly under the radar. Make sure you check these out before your next move:

- Capture truly undervalued opportunities by checking out these 870 undervalued stocks based on cash flows and find compelling stocks the market hasn’t fully recognized yet.

- Boost your income with stable payouts through these 18 dividend stocks with yields > 3%, featuring companies offering impressive yields above 3%.

- Ride the AI wave by starting your search with these 24 AI penny stocks, where innovative companies are pioneering tomorrow’s technologies right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives