- United States

- /

- Professional Services

- /

- NYSE:RHI

How Investors May Respond To Robert Half (RHI) Valuation Discount and Strong Earnings Outlook

Reviewed by Sasha Jovanovic

- Recently, it was reported that Robert Half Inc. is trading at a price-to-earnings ratio below the industry average, with earnings projected to grow by 42% over the next few years.

- This combination of perceived undervaluation and positive earnings expectations has generated fresh investor optimism around the company’s future prospects and fundamentals.

- Next, we'll examine how expectations for significant earnings growth could influence Robert Half's overall investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Robert Half Investment Narrative Recap

To be a shareholder in Robert Half right now, one needs to believe that the company can translate recent investor optimism, driven by expectations for strong earnings growth and an attractive valuation, into actual business recovery and improved fundamentals. However, earnings guidance remains cautious, and the near-term outlook is still shaped more by revenue headwinds and persistent margin pressure than by the positive headlines, so the recent news does not immediately change the main risk: sustained revenue weakness and operational cost challenges. Of the company's recent developments, the steady commitment to its dividend stands out the most. The August 2025 dividend announcement sends a signal of management’s confidence in Robert Half’s cash generation and longer-term prospects, but with revenues and profit margins still under pressure, this action’s significance will be closely watched as a catalyst, especially if earnings rebound meets projections. Yet, against earnings optimism, investors should not ignore how persistent revenue declines could...

Read the full narrative on Robert Half (it's free!)

Robert Half's narrative projects $5.9 billion revenue and $313.2 million earnings by 2028. This requires 1.9% yearly revenue growth and a $135.1 million earnings increase from $178.1 million today.

Uncover how Robert Half's forecasts yield a $43.67 fair value, a 28% upside to its current price.

Exploring Other Perspectives

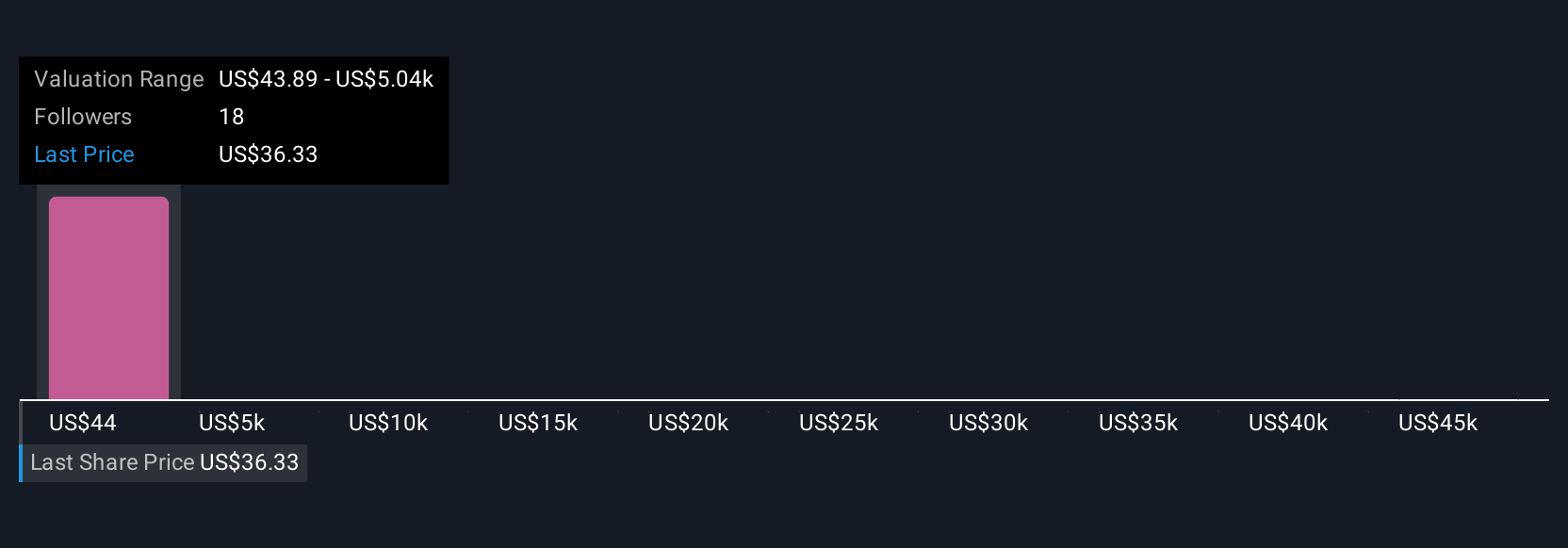

Five Simply Wall St Community fair value estimates for Robert Half range from as low as US$32 all the way to US$49,991.88. While opinions are wide ranging, keep in mind that many holders remain focused on whether Robert Half can reverse declining revenues and restore growth, a key challenge that divides outlooks and invites you to explore several alternative viewpoints.

Explore 5 other fair value estimates on Robert Half - why the stock might be a potential multi-bagger!

Build Your Own Robert Half Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robert Half research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Robert Half research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robert Half's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHI

Robert Half

Provides talent solutions and business consulting services in the United States and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives