- United States

- /

- Professional Services

- /

- NYSE:PL

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the United States stock market experiences a boost from the Santa Claus Rally, with major indices like the Nasdaq Composite and S&P 500 showing gains, investors are turning their attention to various opportunities. Penny stocks, a term that may seem outdated but remains relevant, often refer to smaller or newer companies offering potential growth at an affordable price point. In this article, we explore several penny stocks that stand out for their financial strength and potential value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.21 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $103.25M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8849 | $6.43M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2399 | $8.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $86.14M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.33 | $43.89M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.855 | $49.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.27 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8502 | $76.47M | ★★★★★☆ |

Click here to see the full list of 739 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Grab Holdings (NasdaqGS:GRAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering various services in countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam; it has a market cap of approximately $19.89 billion.

Operations: Grab Holdings Limited has not reported specific revenue segments.

Market Cap: $19.89B

Grab Holdings Limited, despite being unprofitable, maintains a robust financial position with short-term assets of $6.5 billion surpassing both its long-term liabilities ($321 million) and short-term liabilities ($2.4 billion). The company has sufficient cash runway for over three years due to positive free cash flow growth. Recent activities include a share buyback program, repurchasing 1.45% of shares for $189.4 million, and an upward revision in revenue guidance for 2024 to $2.76-$2.78 billion, reflecting solid operational momentum despite shareholder dilution and management's relatively new tenure averaging 2 years.

- Unlock comprehensive insights into our analysis of Grab Holdings stock in this financial health report.

- Examine Grab Holdings' earnings growth report to understand how analysts expect it to perform.

Energy Vault Holdings (NYSE:NRGV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Energy Vault Holdings, Inc. develops and sells energy storage solutions with a market cap of $305.76 million.

Operations: The company generates revenue from its Electric Equipment segment, amounting to $130.96 million.

Market Cap: $305.76M

Energy Vault Holdings, Inc. faces challenges with declining revenue, reporting US$1.2 million for Q3 2024 compared to US$172.21 million a year prior, and ongoing unprofitability with increased losses over five years. Despite these hurdles, the company has formed a strategic partnership with RackScale Data Centers to deploy its high-density B-Nest™ energy storage systems, potentially accelerating data center power solutions amidst grid constraints. While Energy Vault's cash runway is limited to six months based on free cash flow estimates, recent capital raising efforts may provide some financial relief as it navigates volatility and shareholder dilution concerns.

- Get an in-depth perspective on Energy Vault Holdings' performance by reading our balance sheet health report here.

- Understand Energy Vault Holdings' earnings outlook by examining our growth report.

Planet Labs PBC (NYSE:PL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planet Labs PBC designs, constructs, and launches satellite constellations to provide high cadence geospatial data via an online platform globally, with a market cap of approximately $1.23 billion.

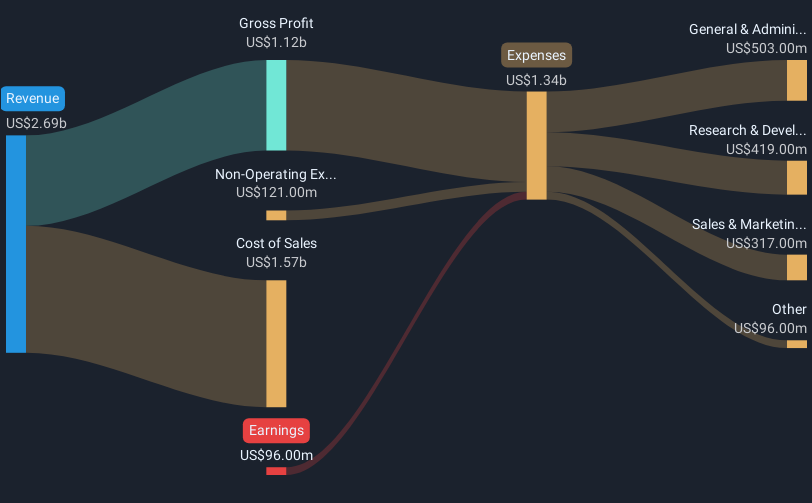

Operations: The company's revenue is primarily generated from its data processing segment, totaling $241.65 million.

Market Cap: $1.23B

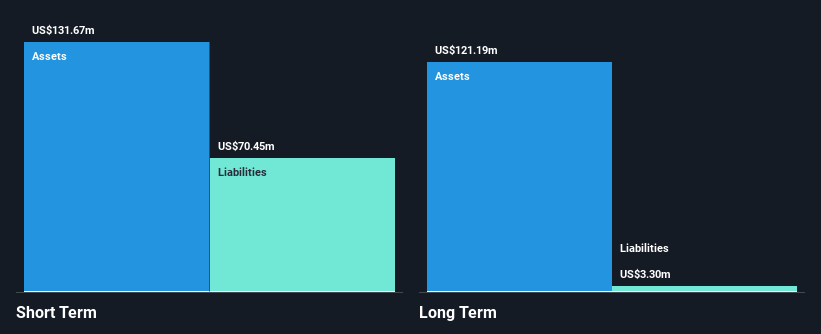

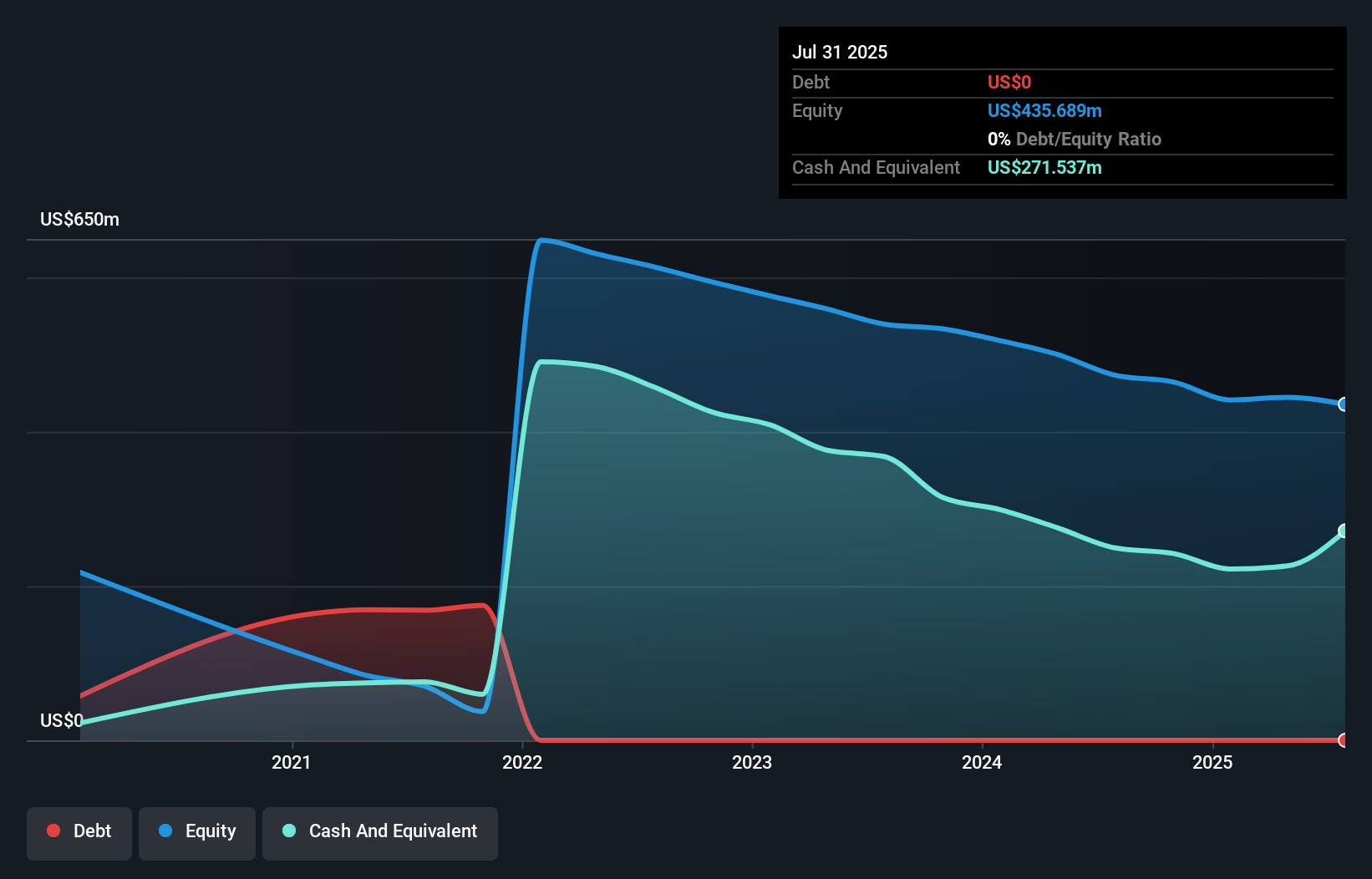

Planet Labs PBC, a satellite data provider, reported third-quarter sales of US$61.27 million, up from US$55.38 million the previous year, while reducing its net loss to US$20.08 million from US$38 million. Despite being unprofitable and experiencing shareholder dilution with a 3.2% increase in shares outstanding over the past year, Planet Labs maintains a strong cash position with short-term assets of US$301.6 million exceeding liabilities and no debt on its balance sheet. Recent product advancements include high-resolution Pelican-2 satellites equipped with AI technology for rapid data processing and expanded contracts like one with Colombia's National Police for illicit crop monitoring using satellite imagery.

- Click to explore a detailed breakdown of our findings in Planet Labs PBC's financial health report.

- Explore Planet Labs PBC's analyst forecasts in our growth report.

Next Steps

- Embark on your investment journey to our 739 US Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Planet Labs PBC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives