- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

October 2024 US Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by rising Treasury yields and fluctuating indices, investors are keeping a close eye on potential opportunities. For those exploring beyond established giants, penny stocks—despite their somewhat antiquated name—remain an intriguing segment for investment consideration. These stocks often represent smaller or newer companies that can offer growth potential at lower price points, especially when backed by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.786075 | $5.8M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $517.9M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.21 | $8.33M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.75 | $114.35M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.96 | $3.11M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $98.03M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Navitas Semiconductor (NasdaqGM:NVTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Navitas Semiconductor Corporation designs, develops, and markets gallium nitride power integrated circuits and related technologies for power conversion and charging, with a market cap of approximately $469.65 million.

Operations: The company generates revenue primarily from its semiconductors segment, totaling $91.68 million.

Market Cap: $469.65M

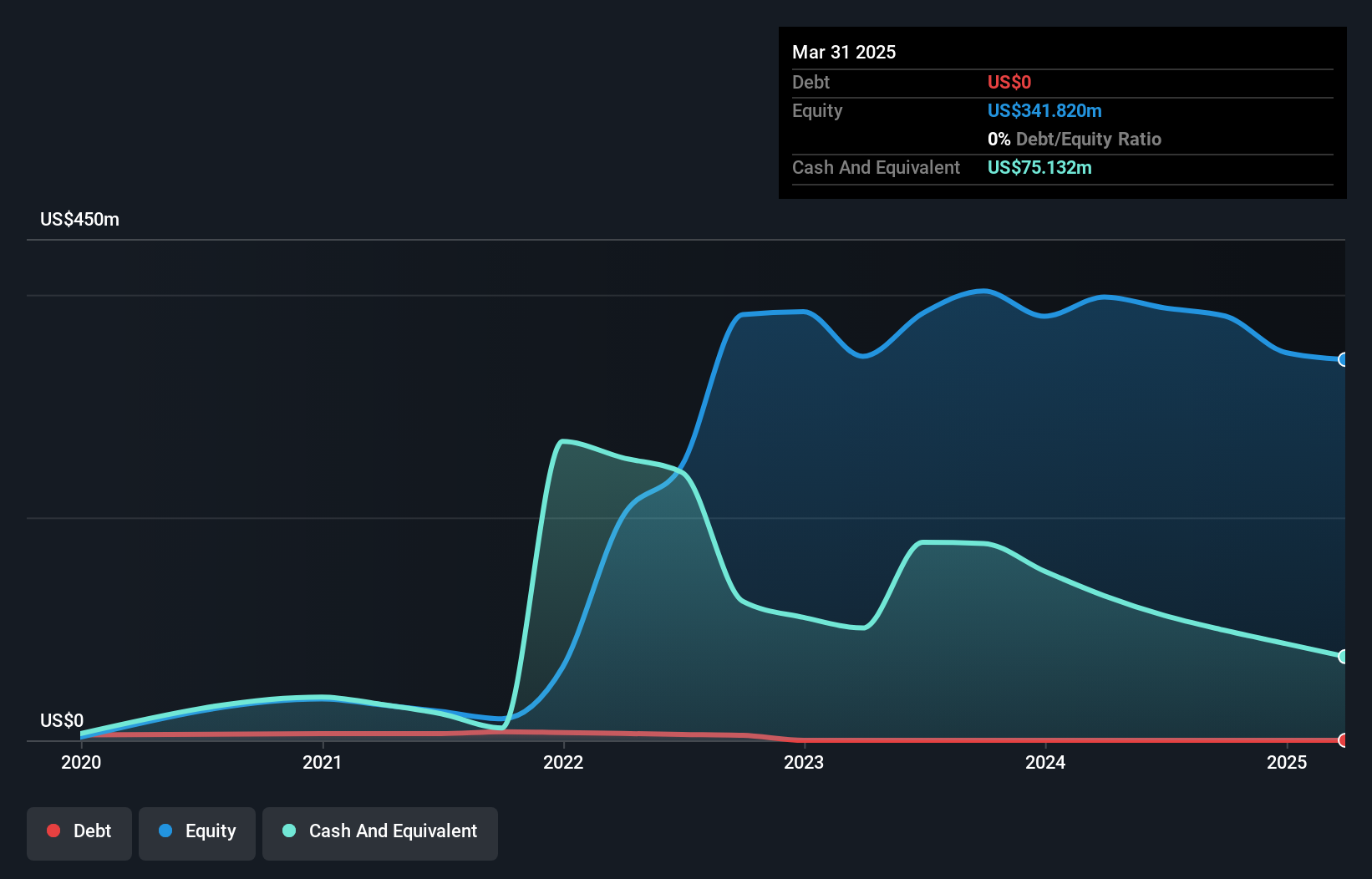

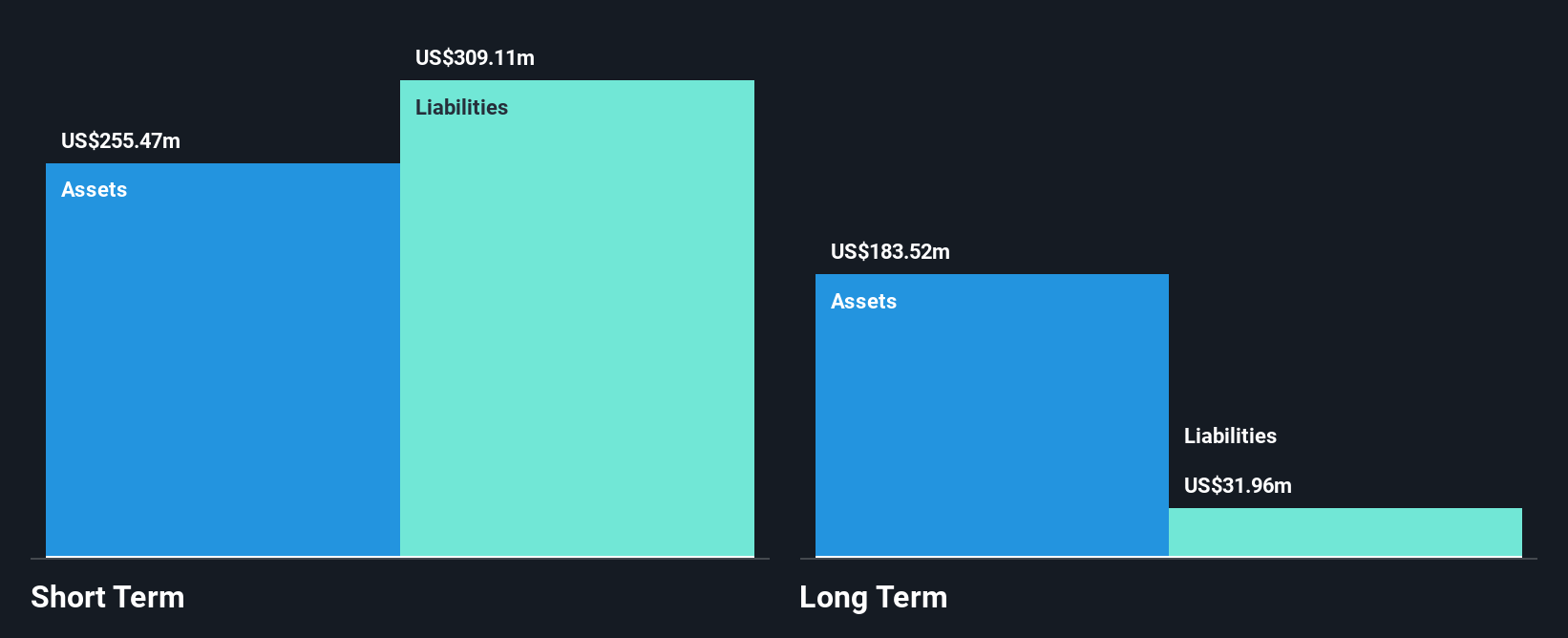

Navitas Semiconductor, with a market cap of approximately US$469.65 million, has been actively expanding its product offerings in the semiconductor sector. Recent announcements include the GaNSlim™ and GaNSafe families, targeting high-power applications like AI data centers and EV charging. Despite generating US$91.68 million in revenue primarily from its semiconductor segment, Navitas remains unprofitable with a negative return on equity of -13.16%. The company has no debt and sufficient cash runway for over two years but faces challenges with significant insider selling and shareholder dilution over the past year while earnings are forecasted to decline by 7.8% annually for the next three years.

- Get an in-depth perspective on Navitas Semiconductor's performance by reading our balance sheet health report here.

- Gain insights into Navitas Semiconductor's outlook and expected performance with our report on the company's earnings estimates.

GoPro (NasdaqGS:GPRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GoPro, Inc. develops and sells cameras, mountable and wearable accessories, along with subscription services and software globally, with a market cap of approximately $2 billion.

Operations: The company generates revenue from its Photographic Equipment & Supplies segment, totaling $931.41 million.

Market Cap: $200.08M

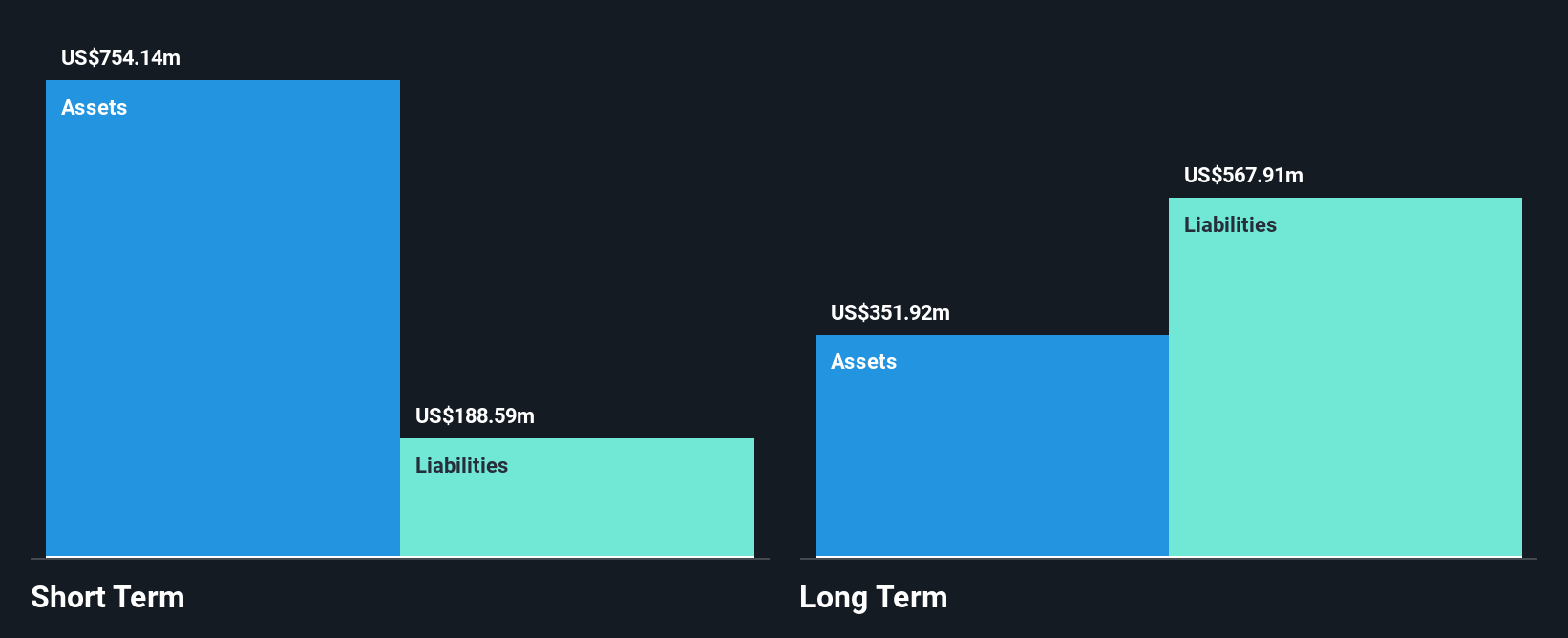

GoPro, Inc., with a market cap of approximately US$2 billion, continues to innovate with new product launches like the HERO13 Black and HERO cameras. Despite generating US$931.41 million in revenue from its Photographic Equipment & Supplies segment, GoPro remains unprofitable, facing increased losses over the past five years. The company trades at a significant discount to its estimated fair value and has reduced its debt-to-equity ratio from 73.1% to 50.3% over five years. While GoPro's management team is experienced, profitability challenges persist without forecasts for positive earnings in the near term.

- Unlock comprehensive insights into our analysis of GoPro stock in this financial health report.

- Gain insights into GoPro's future direction by reviewing our growth report.

Planet Labs PBC (NYSE:PL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planet Labs PBC designs, constructs, and launches satellite constellations to provide high cadence geospatial data via an online platform globally, with a market cap of approximately $669.13 million.

Operations: The company's revenue primarily comes from its Data Processing segment, totaling $235.76 million.

Market Cap: $669.13M

Planet Labs PBC, with a market cap of US$669.13 million, is leveraging its satellite technology to secure significant contracts like those with American Crystal Sugar and the German Space Agency. Despite generating US$235.76 million in revenue primarily from its Data Processing segment, the company remains unprofitable and has experienced shareholder dilution. Recent initiatives such as Project Centinela and partnerships for biodiversity monitoring position Planet Labs strategically in the geospatial data sector. The company's cash runway appears sufficient for over three years, although profitability is not anticipated soon according to current forecasts.

- Click here to discover the nuances of Planet Labs PBC with our detailed analytical financial health report.

- Examine Planet Labs PBC's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Investigate our full lineup of 755 US Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets gallium nitride power integrated circuits, silicon carbide, associated high-speed silicon system controllers, and digital isolators used in power conversion and charging.

Flawless balance sheet moderate.