- United States

- /

- Commercial Services

- /

- NYSE:PBI

What the Pitney Bowes Share Surge Means After Recent Restructuring News

Reviewed by Bailey Pemberton

If you have been watching Pitney Bowes lately, you are probably wondering what to make of its rollercoaster stock chart. Is now the moment to buy, or should you stay on the sidelines? The fact is, this is a company whose shares have caught a wave of renewed interest, and investors are kicking the tires to see if there is more room to run or if the brakes are about to hit. Over just the past year, Pitney Bowes has soared 65.1%, and if you zoom out a little more, the stock has posted a staggering 375.9% gain over three years. Sure, the last month has been bumpy with a -9.4% return, but even some turbulence cannot take away from such a strong long-term story.

Why all the excitement now? Much of it can be traced to shifting market sentiment across logistics and shipping technology, with investors reassessing which companies are set to benefit most from global supply chain transformations. Pitney Bowes has managed to stay on the right side of these trends, which helps explain not just its recent surge but also the perception of lowered long-term risk. Still, it is not just momentum that makes Pitney Bowes interesting. By our numbers, the company scores a 5 out of 6 on key undervaluation checks. This means analysts believe it is undervalued in five major ways. That is no small feat.

Next, we will break down the specific valuation approaches behind this score, but stick around because there is an even sharper lens through which to judge the real value, and we will get to that by the end of the article.

Approach 1: Pitney Bowes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those amounts back to their present value. This approach allows investors to assess what a stock should be worth today, based on the future free cash a company is expected to generate.

For Pitney Bowes, analysts calculate a last twelve months free cash flow (FCF) of $173.97 million. Looking forward, projections suggest significant growth, with FCF expected to reach $364.76 million by 2026. Beyond that, analyst and model-based estimates predict FCF increasing steadily over the next decade, approaching $914.53 million by 2035. These forecasts underline an optimistic trajectory, reflecting both analyst inputs for the next few years and extrapolated values thereafter.

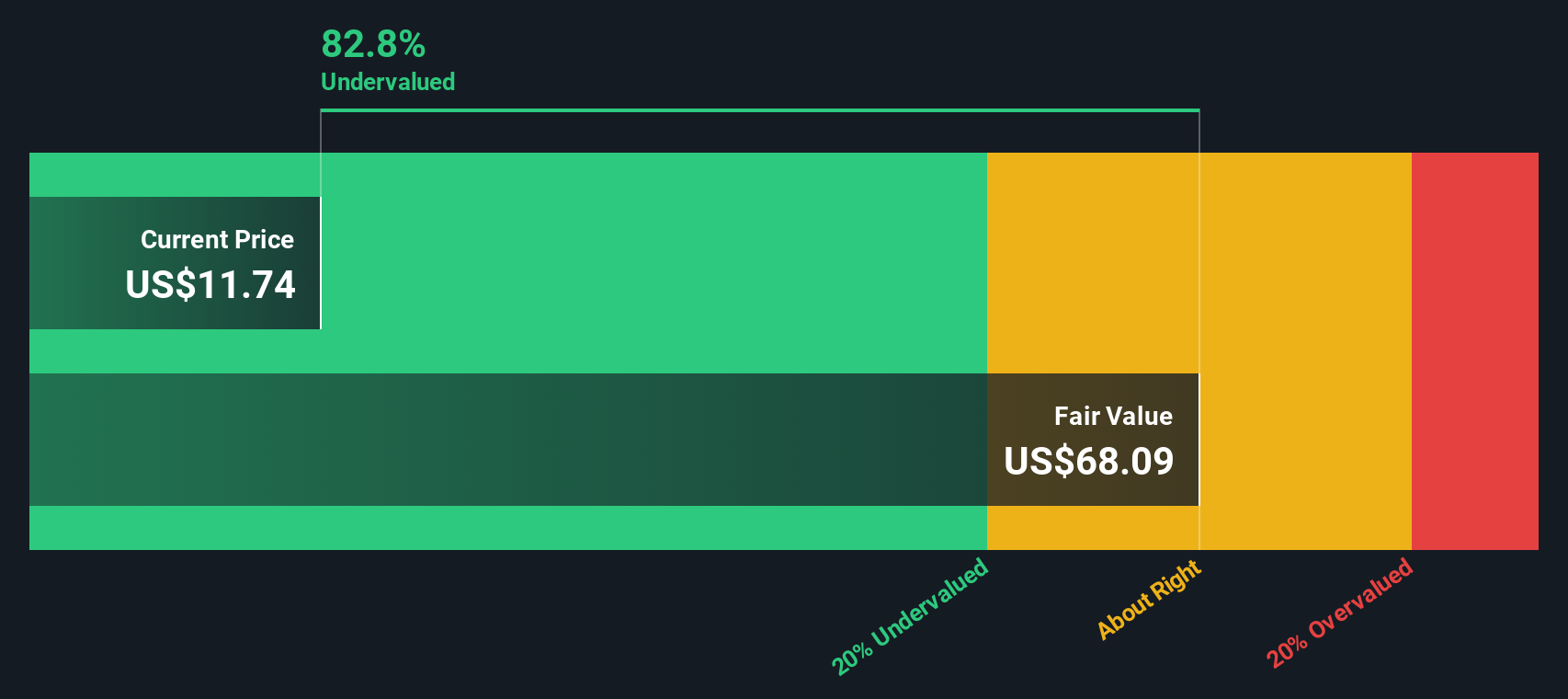

The DCF analysis applies a two-stage Free Cash Flow to Equity model. This model balances early higher growth with more stable long-term expansion. Using these forecasts, the DCF establishes an intrinsic fair value of $65.25 per share for Pitney Bowes. In comparison, the current trading price reflects an 83% discount versus the calculated fair value, signaling the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pitney Bowes is undervalued by 83.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pitney Bowes Price vs Earnings

The price-to-earnings (PE) ratio is a widely respected metric for evaluating profitable companies like Pitney Bowes because it connects a company's current share price to its earnings per share. For businesses generating consistent profits, the PE ratio serves as a quick gauge of how much investors are willing to pay for each dollar of earnings. This offers insight into market expectations for future growth and underlying risk.

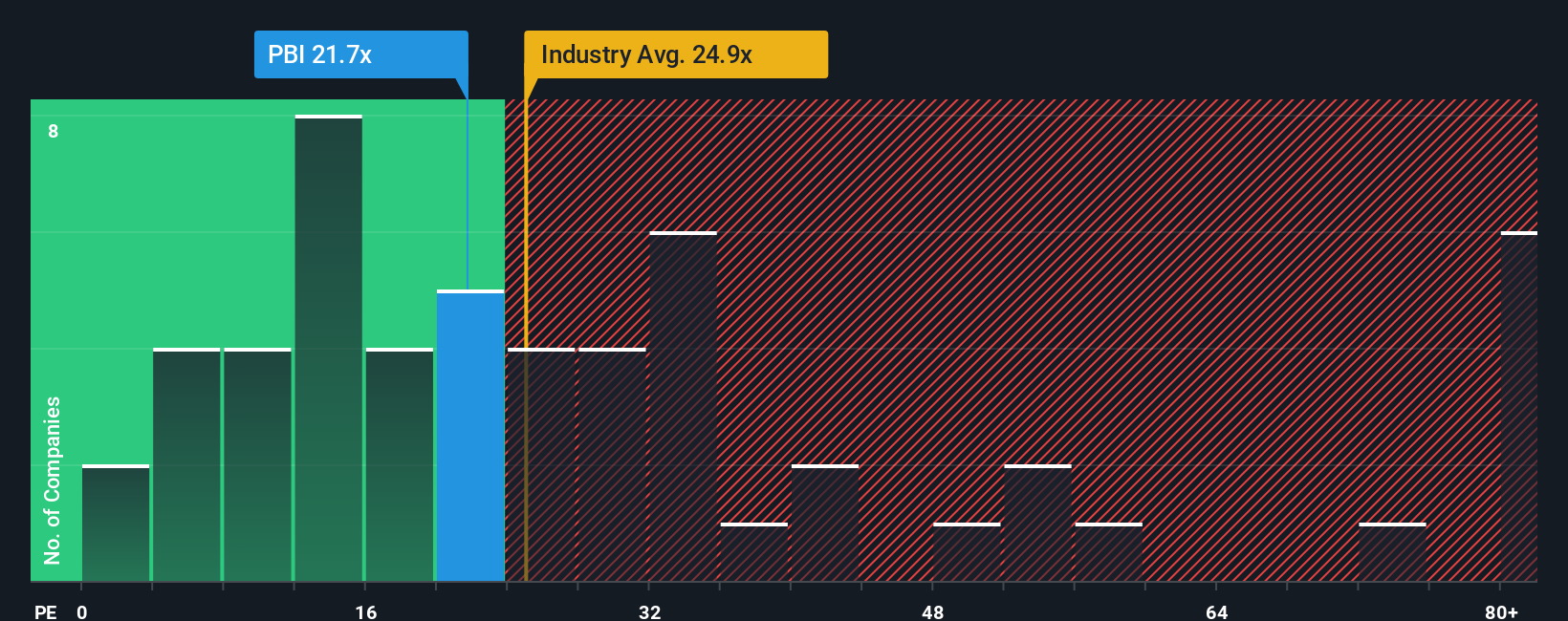

When setting a "normal" or "fair" PE ratio, several factors come into play. Higher earnings growth typically justifies a higher multiple since investors are willing to pay up for future prospects. Conversely, added risk or lower profitability tends to lower the fair value multiple. In the case of Pitney Bowes, the current PE sits at 13.1x, which is below both the industry average of 29.8x and the average among its peers at 15.2x. At first glance, this suggests that the market may be underestimating the company's earnings potential relative to competitors.

To go beyond surface-level comparisons, Simply Wall St uses a proprietary “Fair Ratio.” This fair PE ratio is custom-built for each company and reflects not just its sector but also its unique combination of growth rate, profit margin, market cap, and risk profile. This method avoids the pitfalls of one-size-fits-all benchmarking and offers a sharper, more context-aware valuation anchor. For Pitney Bowes, the Fair Ratio is calculated at 29.8x, far above its current multiple of 13.1x. This implies that, even after accounting for its specific risk factors and growth outlook, the shares are trading at a notable discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pitney Bowes Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your own story or perspective on a company, connecting what you believe about its future, such as revenue growth, profit margins, and industry shifts, with the financial forecasts and fair value you assign to its shares. Instead of just relying on numbers, Narratives let you link Pitney Bowes’ business trajectory with your expectations, making investment decisions much more personal and relevant.

Narratives are easy to use and available right now on Simply Wall St’s Community page, where millions of investors compare their views and see how new facts and figures update their outlooks in real time. By building a Narrative, you can quickly see how your assumptions stack up against the market price, helping you decide whether now is the time to buy, hold, or sell. Narratives keep evolving as new results or news comes out, so your investment case is always up to date.

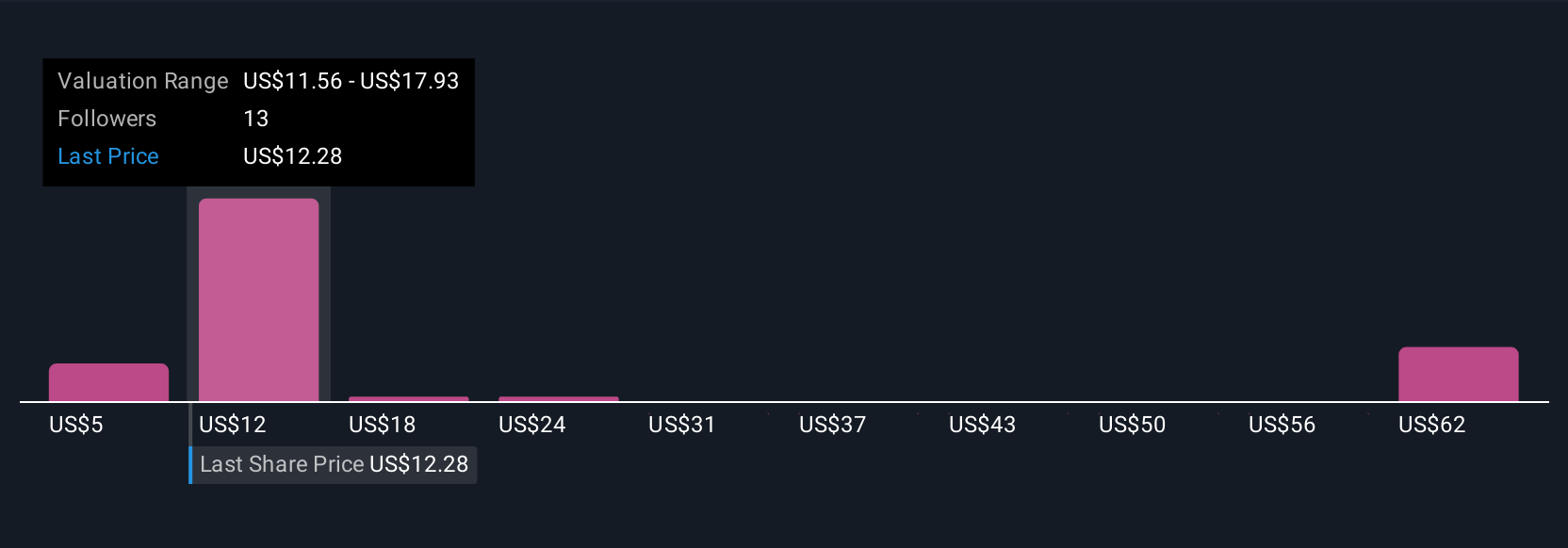

For example, one Pitney Bowes Narrative sees the company’s SaaS shipping and digital transformation driving strong profits and fair value up to $17.00 per share; meanwhile, a more cautious view highlights digital mail disruption and heavy debt, leading to a much lower fair value. With Narratives, you pick the story you think is most likely, and then decide with confidence what action to take.

Do you think there's more to the story for Pitney Bowes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBI

Pitney Bowes

Operates as a technology-driven company that provides SaaS shipping solutions, mailing innovation, and financial services to small businesses, large enterprises, and government entities around the world.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026