- United States

- /

- Professional Services

- /

- NYSE:PAYC

Is Paycom Offering Value After a 28.4% Slide Amid Cloud Payroll Rerating?

Reviewed by Bailey Pemberton

- If you are looking at Paycom Software and wondering whether the recent share price still reflects its true potential, you are not alone. This stock has quietly become a lightning rod for value focused investors.

- Despite a modest 0.5% gain over the last week, the stock is still down 0.6% over 30 days and a steep 28.4% over the past year, with longer term returns of 45.4% and 61.4% in the red over three and five years, which naturally raises the question of whether sentiment has overshot the fundamentals.

- Much of the recent attention on Paycom has centered on how fast growing software names are being repriced as investors reassess what they are willing to pay for future cash flows in a higher rate world. At the same time, ongoing adoption of cloud based payroll and human capital management platforms has kept Paycom in the conversation as a business with durable demand, even if the share price has been volatile.

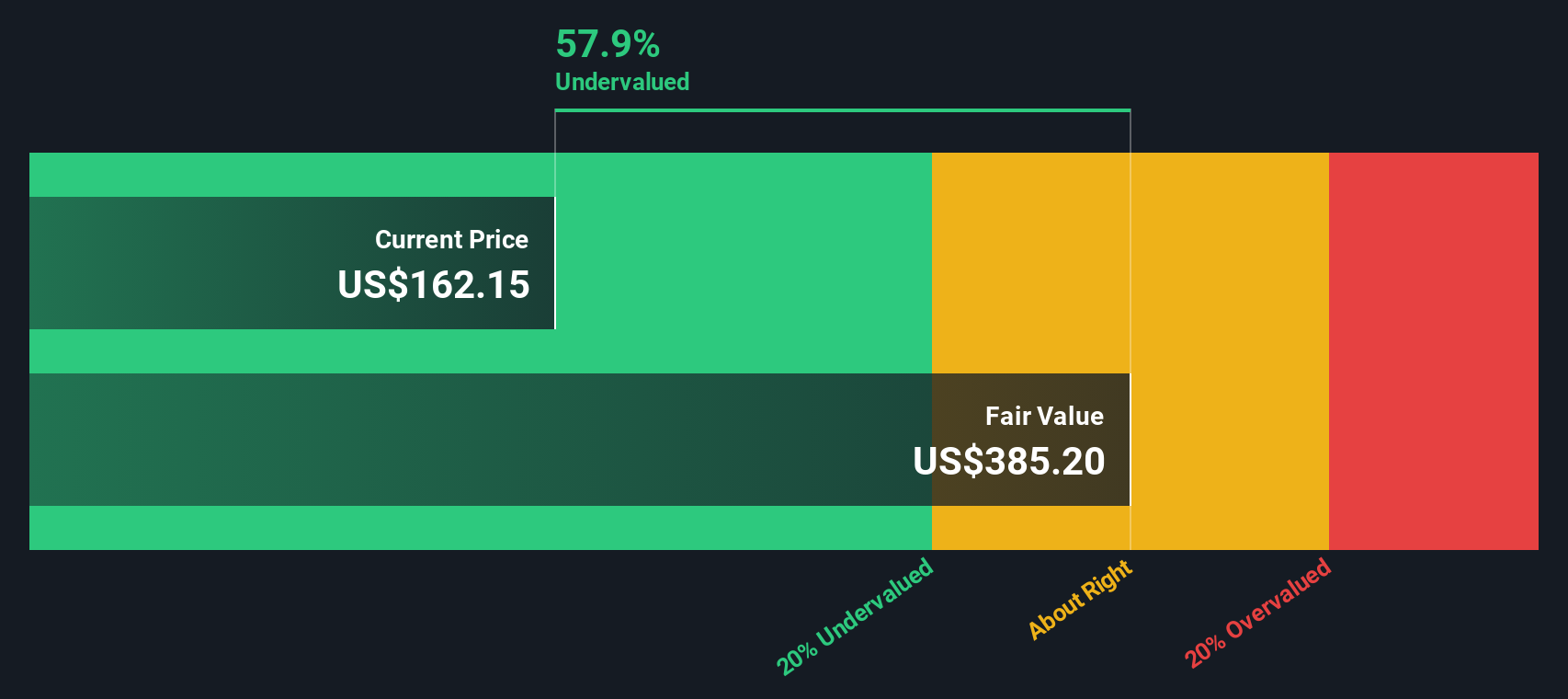

- On our framework, Paycom currently scores a 6/6 valuation check, suggesting it screens as undervalued across all six metrics. In the sections that follow, we will walk through the main valuation approaches behind that score, before finishing with an even more intuitive way to think about what the market is really pricing in.

Find out why Paycom Software's -28.4% return over the last year is lagging behind its peers.

Approach 1: Paycom Software Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those cash flows back to a single present value figure.

For Paycom Software, the latest twelve month Free Cash Flow stands at about $409.8 million. Analysts and internal estimates suggest this could rise steadily over the coming decade, with projected Free Cash Flow of around $1.13 billion by 2035, based on a two stage Free Cash Flow to Equity model. Early years draw on analyst forecasts, while later years are extrapolated from those trends by Simply Wall St.

When all projected cash flows are discounted back, the model arrives at an intrinsic value of roughly $375.73 per share. Compared with the current market price, this implies the stock is about 55.7% undervalued, suggesting investors may be pricing in a much weaker future than the cash flow outlook supports.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Paycom Software is undervalued by 55.7%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Paycom Software Price vs Earnings

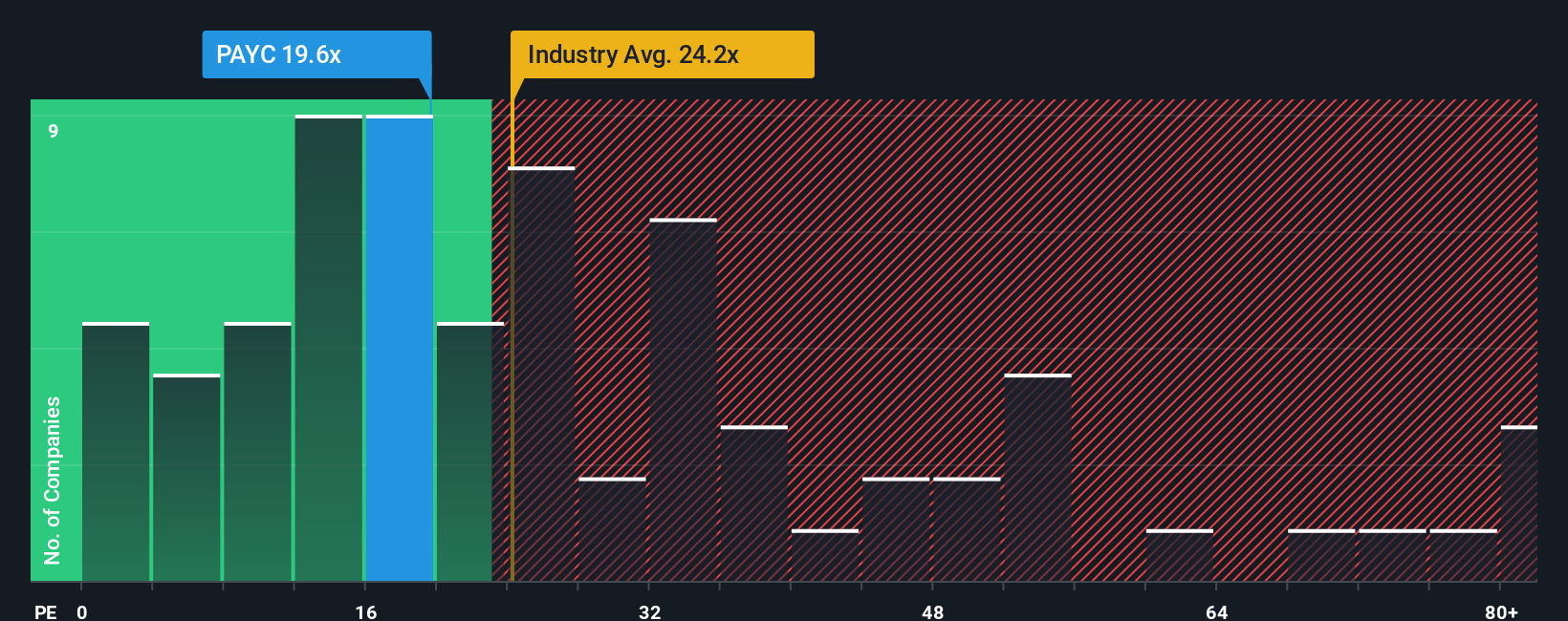

For profitable companies like Paycom, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or greater uncertainty should translate into a lower, more cautious multiple.

Paycom currently trades on a PE of about 20.2x. That sits below both the Professional Services industry average of roughly 25.0x and the peer group average of around 22.1x, suggesting the market is applying a discount to Paycom relative to comparable businesses. However, simple comparisons like these do not fully capture differences in growth profiles, margins, or risk.

To address this, Simply Wall St calculates a proprietary Fair Ratio. This estimates the PE multiple a company should trade on after accounting for its earnings growth outlook, profitability, industry, market cap, and specific risk factors. This makes it a more nuanced benchmark than a straight peer or sector average. For Paycom, the Fair Ratio comes out at about 24.9x, meaning the shares are trading below where they might reasonably sit given those fundamentals, which points to undervaluation on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Paycom Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, story driven frameworks that let you spell out your view of a company, connect that story to a financial forecast for revenue, earnings, and margins, and then turn it into a Fair Value that you can easily compare with today’s share price. On Simply Wall St’s Community page, millions of investors use Narratives to record their assumptions, see how those assumptions translate into future cash flows and valuation, and then decide whether a stock like Paycom Software looks worth buying, holding, or selling. Because Narratives are updated dynamically when new information arrives, such as earnings results, product news, or changes in the macro backdrop, your Fair Value view evolves with the facts rather than staying frozen. For Paycom, one investor might build a bullish Narrative that assumes faster AI driven growth and results in a Fair Value closer to $310 per share. Another investor could take a more cautious stance that focuses on softer employment trends and arrives nearer $208, and the platform helps you see exactly which assumptions drive that difference.

Do you think there's more to the story for Paycom Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)