- United States

- /

- Professional Services

- /

- NYSE:NSP

Reassessing Insperity (NSP) Valuation After Stadium Capital Stake and New UnitedHealthcare Contract

Reviewed by Simply Wall St

Insperity (NSP) just drew fresh attention as Stadium Capital Management built a sizable new stake, right as the company locked in a multi year UnitedHealthcare contract designed to tame large claim healthcare costs.

See our latest analysis for Insperity.

Even with today’s pop, reflected in a 1 day share price return of 3.87 percent, Insperity’s 1 year total shareholder return of negative 55.08 percent and 3 year total shareholder return of negative 66.62 percent show that the stock is still trying to rebuild confidence rather than riding strong momentum.

If this kind of reset story has you rethinking your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership for other potentially interesting setups.

With the stock still trading well below its recent highs but analysts seeing upside to their price targets, is Insperity now quietly undervalued, or is the market already baking in a healthier earnings path ahead?

Most Popular Narrative Narrative: 20.1% Undervalued

With Insperity last closing at 35.97 dollars against a most popular narrative fair value of about 45 dollars, the storyline leans toward a recovery gap that still needs closing.

The upcoming launch of Insperity HRScale, a joint solution with Workday, targets a broader and more lucrative mid market segment, leveraging both advanced HR technology and comprehensive services; this is expected to drive higher revenue growth and improved operating leverage as premium pricing and larger average client size become possible.

Curious how modest revenue growth, rising margins and a lower future earnings multiple can still justify a higher value than today’s price? The full narrative breaks down the specific growth runway, profitability reset and valuation math behind that 45 dollar target, and explains why the timing of the earnings inflection really matters.

Result: Fair Value of $45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn healthcare cost inflation and execution risk around the Workday partnership could easily delay or derail the margin recovery that this narrative leans on.

Find out about the key risks to this Insperity narrative.

Another Take on Valuation

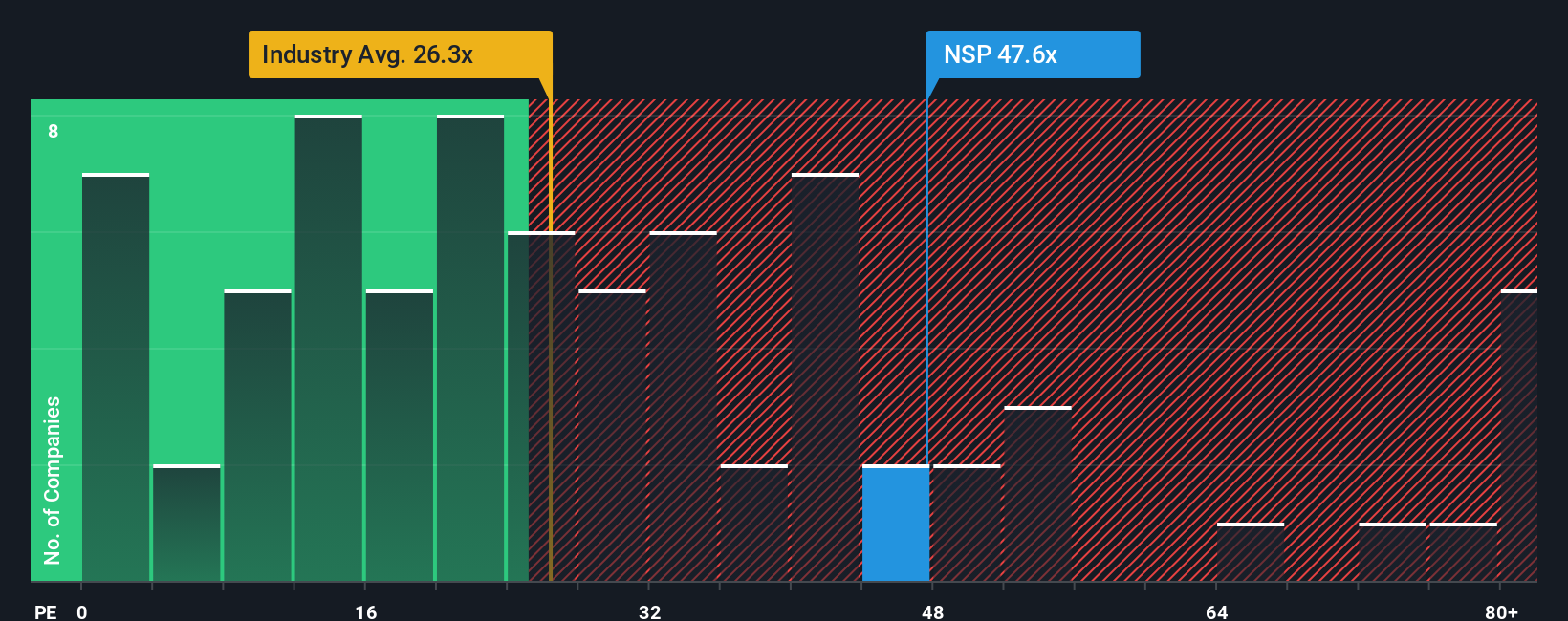

There is a catch to that 20.1 percent undervalued story. Insperity screens as expensive on earnings today, trading on a price to earnings ratio of about 79.8 times versus an industry average near 24 times and a fair ratio of roughly 63.7 times based on our analysis.

If the market ultimately drifts back toward that lower fair ratio instead of the narrative fair value, today’s discount could prove smaller than it looks on paper, or even flip into downside. Are investors being paid enough for that risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insperity Narrative

If this framing does not quite match your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Insperity, you could overlook sharper opportunities. Use the Simply Wall Street Screener to pinpoint compelling stocks that better fit your strategy today.

- Capture powerful long term compounding by scanning for income opportunities in these 14 dividend stocks with yields > 3% that may strengthen your portfolio’s yield and resilience.

- Capitalize on market mispricing with these 919 undervalued stocks based on cash flows that could offer stronger upside potential relative to their current share prices.

- Ride structural growth trends in digital assets through these 81 cryptocurrency and blockchain stocks that are building real businesses around blockchain and cryptocurrency infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026