- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

3 US Stocks Trading Below Estimated Value In November 2024

Reviewed by Simply Wall St

As the U.S. stock market continues to climb towards record highs, investors are keenly observing opportunities that may be trading below their estimated value. In this environment of rising indices, identifying undervalued stocks can offer potential for growth as these assets might have been overlooked amid the broader market rally.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.45 | $99.93 | 49.5% |

| UMB Financial (NasdaqGS:UMBF) | $125.00 | $243.19 | 48.6% |

| Business First Bancshares (NasdaqGS:BFST) | $28.38 | $54.91 | 48.3% |

| West Bancorporation (NasdaqGS:WTBA) | $24.28 | $46.85 | 48.2% |

| Five Star Bancorp (NasdaqGS:FSBC) | $33.39 | $63.91 | 47.8% |

| Pinterest (NYSE:PINS) | $30.02 | $59.51 | 49.6% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $115.19 | $219.35 | 47.5% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.35 | $30.27 | 49.3% |

| Nutanix (NasdaqGS:NTNX) | $73.18 | $143.80 | 49.1% |

| Snap (NYSE:SNAP) | $11.42 | $22.72 | 49.7% |

Here's a peek at a few of the choices from the screener.

Teradyne (NasdaqGS:TER)

Overview: Teradyne, Inc. designs, develops, manufactures, and sells automated test systems and robotics products worldwide with a market cap of approximately $17.62 billion.

Operations: The company's revenue segments include Semiconductor Test at $1.93 billion, Robotics at $395.19 million, System Test at $295.53 million, and Wireless Test at $118.27 million.

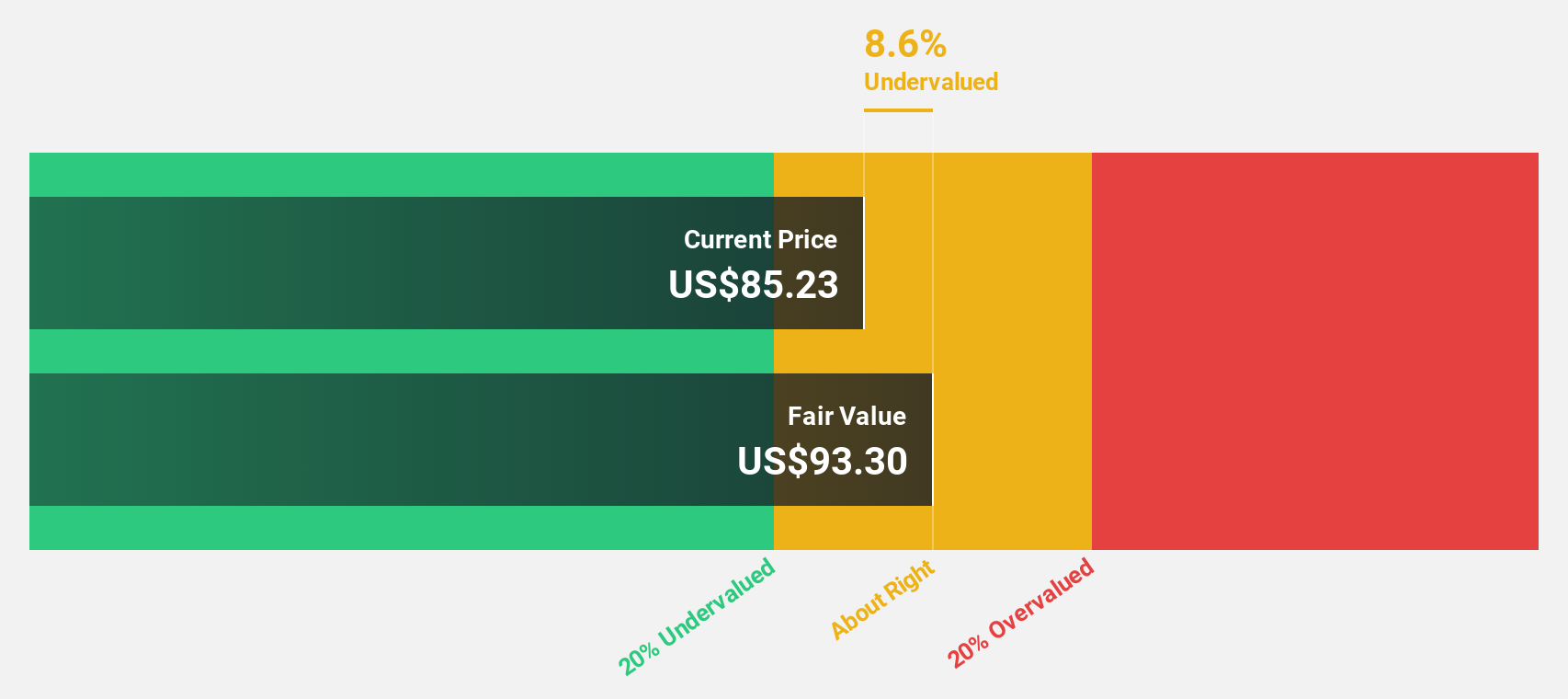

Estimated Discount To Fair Value: 12.6%

Teradyne's stock is currently trading at US$108.21, below its estimated fair value of US$123.88, indicating potential undervaluation based on cash flows. The company forecasts significant earnings growth of 21.7% annually, surpassing the U.S. market average, although revenue growth is slower at 14.8%. Recent financial results show improved net income and earnings per share compared to last year, while an expanded buyback plan enhances shareholder value through increased equity repurchases.

- Insights from our recent growth report point to a promising forecast for Teradyne's business outlook.

- Unlock comprehensive insights into our analysis of Teradyne stock in this financial health report.

Dynatrace (NYSE:DT)

Overview: Dynatrace, Inc. offers a security platform for multicloud environments across various global regions and has a market cap of approximately $16.55 billion.

Operations: The company generates revenue of $1.56 billion from its Internet Software & Services segment.

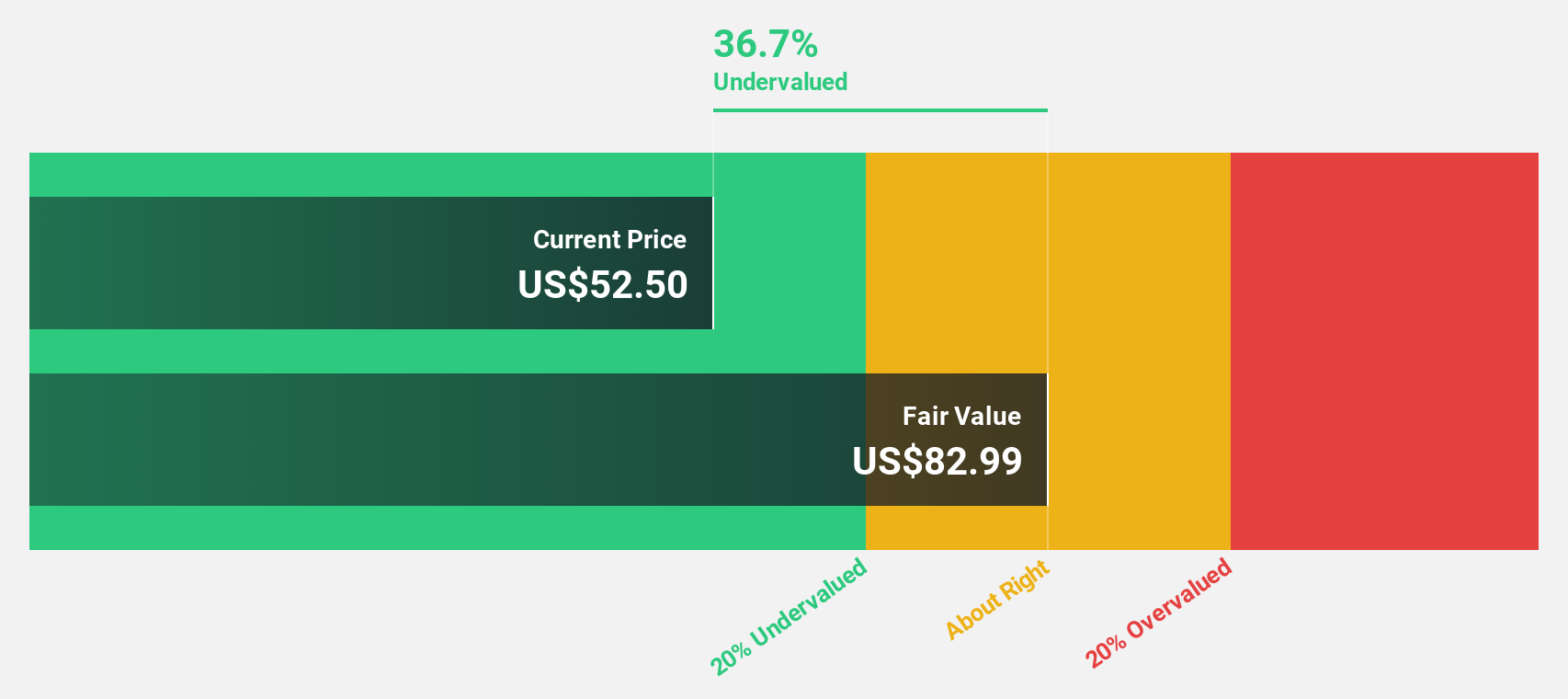

Estimated Discount To Fair Value: 33.8%

Dynatrace is trading at US$55.46, significantly below its estimated fair value of US$83.76, suggesting it may be undervalued based on cash flows. The company expects robust earnings growth of 21.7% annually, outpacing the U.S. market average, with revenue projected to grow 13.5% per year. Recent financial reports reveal increased net income and earnings per share year-over-year, while ongoing share repurchases further enhance shareholder value through equity consolidation efforts.

- The growth report we've compiled suggests that Dynatrace's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Dynatrace's balance sheet health report.

KBR (NYSE:KBR)

Overview: KBR, Inc. offers scientific, technology, and engineering solutions to both government and commercial clients globally, with a market cap of approximately $8.23 billion.

Operations: The company generates revenue through its Government Solutions segment, which accounts for $5.60 billion, and its Sustainable Technology Solutions segment, contributing $1.75 billion.

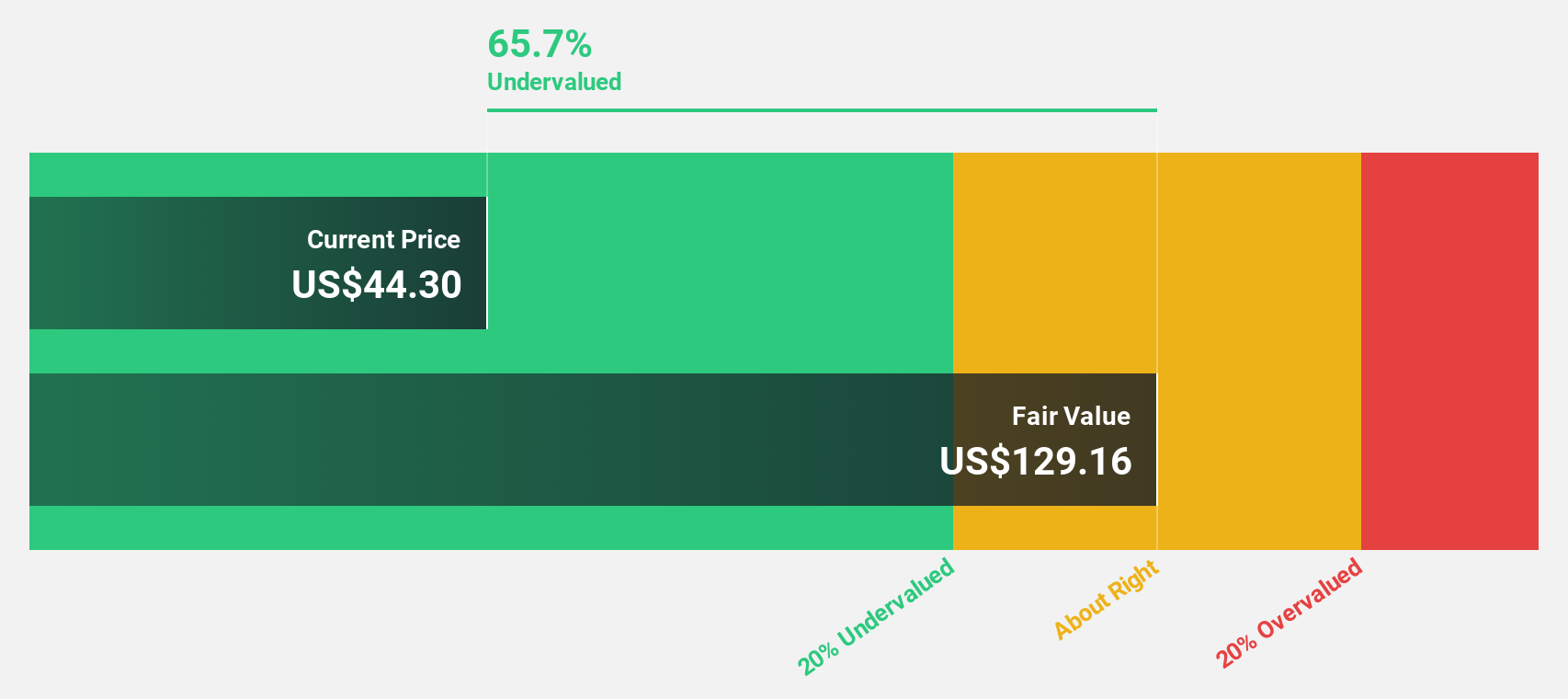

Estimated Discount To Fair Value: 31.3%

KBR trades at US$61.76, below its estimated fair value of US$89.84, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 22.9% annually, surpassing the U.S. market average growth rate. Recent agreements for major projects in Angola and Oman bolster its revenue prospects, despite a lowered earnings guidance for 2024. KBR's ongoing share buybacks enhance equity consolidation amidst strong financial performance improvements this year.

- In light of our recent growth report, it seems possible that KBR's financial performance will exceed current levels.

- Navigate through the intricacies of KBR with our comprehensive financial health report here.

Key Takeaways

- Explore the 186 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products worldwide.

Flawless balance sheet with high growth potential.