- United States

- /

- Professional Services

- /

- NYSE:FVRR

Fiverr International Ltd. (NYSE:FVRR) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Fiverr International Ltd. (NYSE:FVRR) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

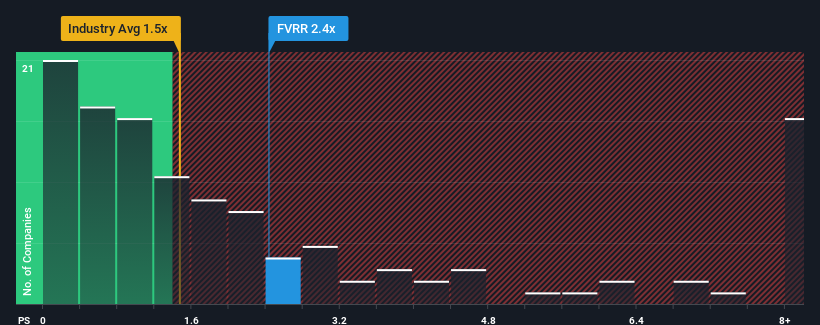

In spite of the heavy fall in price, when almost half of the companies in the United States' Professional Services industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Fiverr International as a stock probably not worth researching with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Fiverr International

What Does Fiverr International's P/S Mean For Shareholders?

There hasn't been much to differentiate Fiverr International's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Fiverr International will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Fiverr International?

Fiverr International's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.1%. The latest three year period has also seen an excellent 91% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the eleven analysts following the company. With the industry only predicted to deliver 7.1% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Fiverr International's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Fiverr International's P/S Mean For Investors?

Despite the recent share price weakness, Fiverr International's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Fiverr International shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Fiverr International you should know about.

If these risks are making you reconsider your opinion on Fiverr International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FVRR

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives