- United States

- /

- Media

- /

- NasdaqGS:SCHL

US Dividend Stocks To Boost Your Income

Reviewed by Simply Wall St

In the current U.S. market landscape, investors are navigating steady stocks after a significant AI-driven selloff, with attention now shifting to earnings reports and Federal Reserve meetings. Amidst these fluctuations, dividend stocks can offer a reliable income stream, providing stability and potential growth as investors assess economic conditions and interest rates.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.12% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Polaris (NYSE:PII) | 4.67% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.45% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 5.10% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.65% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.78% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

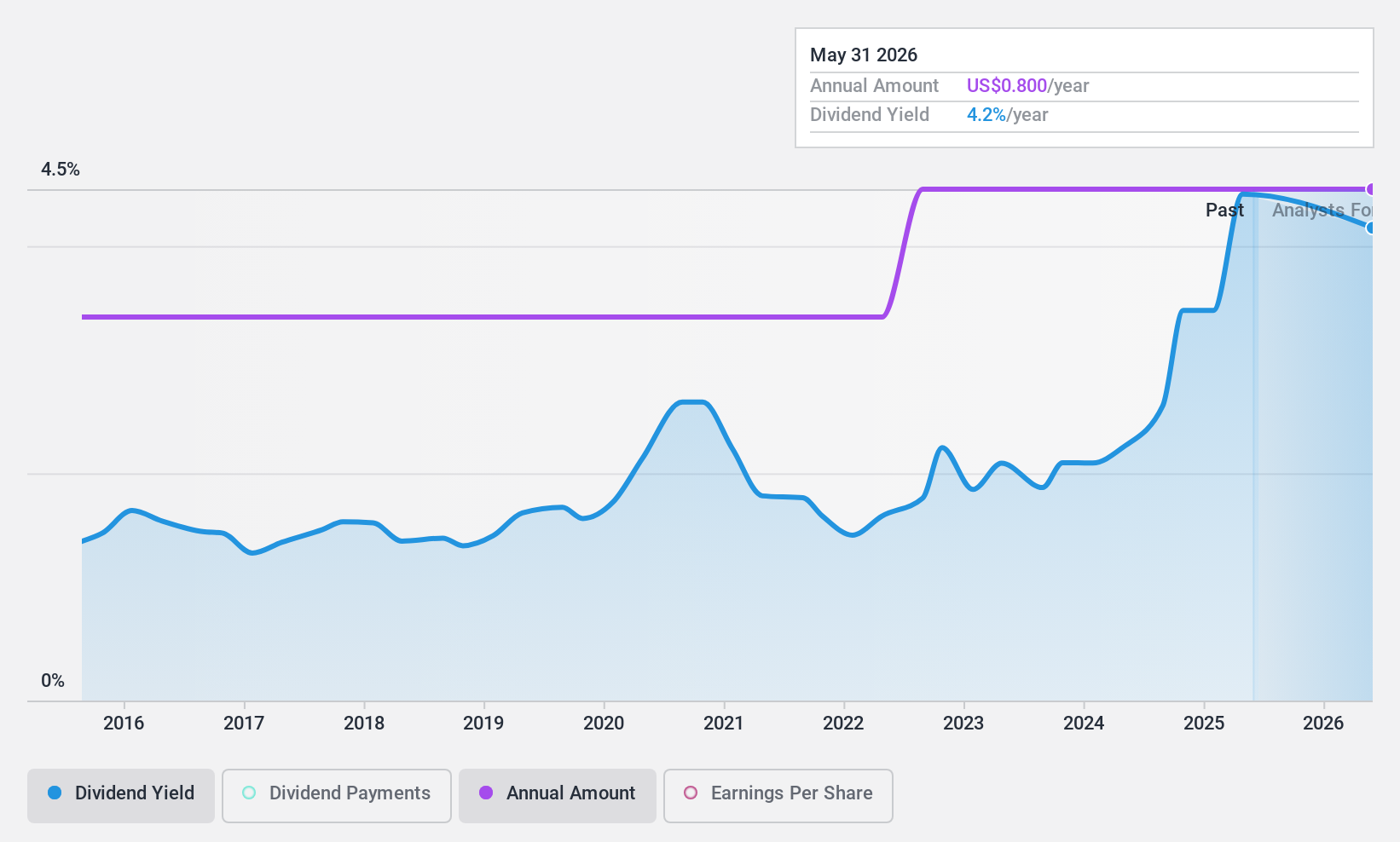

Scholastic (NasdaqGS:SCHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scholastic Corporation publishes and distributes children's books globally, with a market cap of approximately $574.39 million.

Operations: Scholastic Corporation's revenue is primarily derived from Children's Book Publishing and Distribution ($932.80 million), Education Solutions ($331.10 million), and International operations ($273.40 million).

Dividend Yield: 3.9%

Scholastic's dividend payments have been stable and reliable over the past decade, with a low cash payout ratio of 43.1%, indicating coverage by cash flows despite unprofitability. However, its current dividend yield of 3.93% is below the top tier in the US market, and dividends are not covered by earnings. Recent financial performance shows decreased sales and net income, while a shelf registration for $12.42 million was filed to support an ESOP-related offering.

- Click here and access our complete dividend analysis report to understand the dynamics of Scholastic.

- The valuation report we've compiled suggests that Scholastic's current price could be quite moderate.

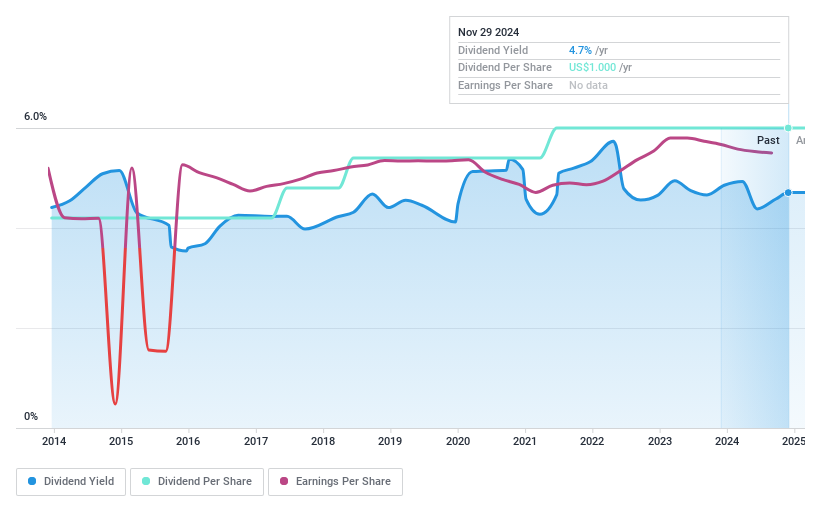

Ennis (NYSE:EBF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ennis, Inc. manufactures and sells business forms and other business products in the United States, with a market cap of approximately $539.76 million.

Operations: Ennis, Inc. generates revenue primarily through its Print segment, which accounts for $399.35 million.

Dividend Yield: 4.8%

Ennis offers a stable dividend yield of 4.78%, placing it in the top 25% of US dividend payers. With a payout ratio of 62.9% and cash payout ratio at 40.8%, dividends are well-covered by earnings and cash flows, respectively, ensuring sustainability. Over the past decade, dividends have been reliable with consistent growth and stability. Recent financials show slight declines in sales but steady net income growth, supporting ongoing dividend payments amidst share buyback activities totaling $40.41 million.

- Unlock comprehensive insights into our analysis of Ennis stock in this dividend report.

- Our valuation report unveils the possibility Ennis' shares may be trading at a discount.

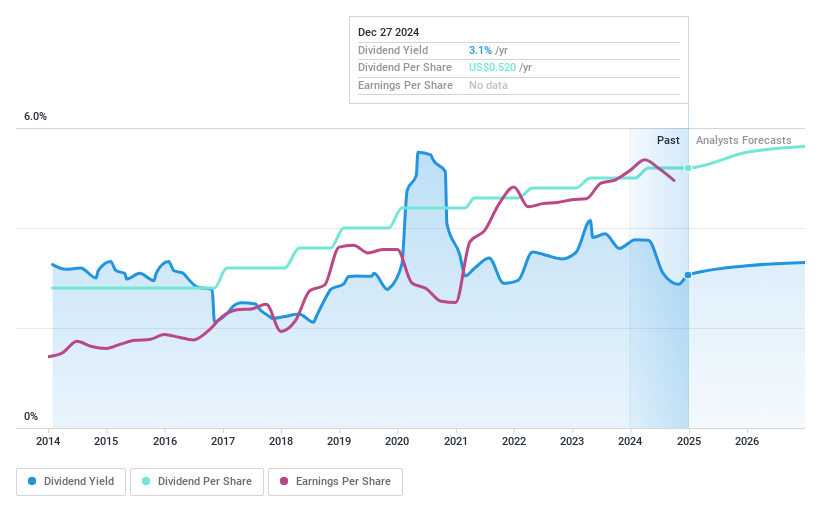

First Commonwealth Financial (NYSE:FCF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Commonwealth Financial Corporation is a financial holding company offering consumer and commercial banking services in the United States, with a market cap of approximately $1.67 billion.

Operations: First Commonwealth Financial Corporation generates revenue of $456.47 million from its banking services segment.

Dividend Yield: 3.1%

First Commonwealth Financial offers a reliable dividend yield of 3.1%, though it falls short of the top 25% in the US market. The company's payout ratio is modest at 34.7%, indicating dividends are well-covered by earnings, with stability over the past decade and consistent growth. Recent financials show a decline in net income but ongoing share repurchases totaling $35.36 million reflect management's confidence in its value proposition amidst strategic executive changes and upcoming earnings announcements.

- Navigate through the intricacies of First Commonwealth Financial with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of First Commonwealth Financial shares in the market.

Make It Happen

- Reveal the 135 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SCHL

Scholastic

Scholastic Corporation publishes and distributes children’s books worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives