- United States

- /

- Professional Services

- /

- NYSE:DNB

Dun & Bradstreet Holdings (NYSE:DNB) Has Affirmed Its Dividend Of $0.05

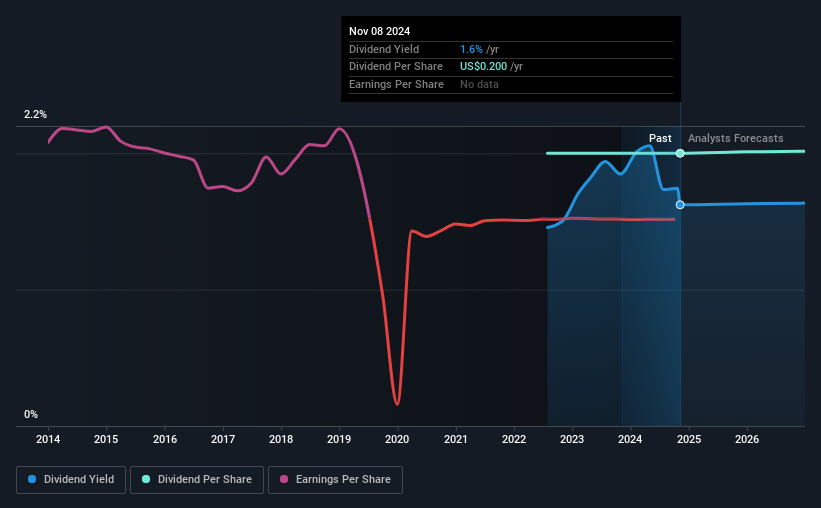

Dun & Bradstreet Holdings, Inc. (NYSE:DNB) has announced that it will pay a dividend of $0.05 per share on the 19th of December. This means the dividend yield will be fairly typical at 1.6%.

Check out our latest analysis for Dun & Bradstreet Holdings

Dun & Bradstreet Holdings' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Dun & Bradstreet Holdings' Could Struggle to Maintain Dividend Payments In The Future

Dun & Bradstreet Holdings' Future Dividends May Potentially Be At Risk

We aren't too impressed by dividend yields unless they can be sustained over time. Dun & Bradstreet Holdings is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

EPS is forecast to rise very quickly over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio could reach 111%, which is unsustainable.

Dun & Bradstreet Holdings Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The payments haven't really changed that much since 2 years ago. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Dun & Bradstreet Holdings has impressed us by growing EPS at 90% per year over the past five years. While the company hasn't yet recorded a profit, the growth rates are healthy. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

Our Thoughts On Dun & Bradstreet Holdings' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Dun & Bradstreet Holdings (of which 1 can't be ignored!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNB

Dun & Bradstreet Holdings

Provides business to business data and analytics in North America and internationally.

Undervalued with moderate growth potential.