- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

Assessing TransMedics Group And Two Other Stocks That Might Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. market navigates a landscape marked by fluctuating indices and rising Treasury yields, investors are closely watching legislative developments that could impact economic conditions. Amidst this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.27 | $51.54 | 49% |

| Quaker Chemical (NYSE:KWR) | $107.26 | $210.06 | 48.9% |

| Super Group (SGHC) (NYSE:SGHC) | $8.44 | $16.54 | 49% |

| KBR (NYSE:KBR) | $55.33 | $108.40 | 49% |

| Horizon Bancorp (NasdaqGS:HBNC) | $15.69 | $30.68 | 48.9% |

| Insteel Industries (NYSE:IIIN) | $36.65 | $72.23 | 49.3% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.45 | $18.49 | 48.9% |

| Carvana (NYSE:CVNA) | $302.29 | $586.89 | 48.5% |

| Verra Mobility (NasdaqCM:VRRM) | $24.53 | $47.91 | 48.8% |

| Mobileye Global (NasdaqGS:MBLY) | $16.05 | $31.07 | 48.3% |

Here's a peek at a few of the choices from the screener.

TransMedics Group (NasdaqGM:TMDX)

Overview: TransMedics Group, Inc. is a commercial-stage medical technology company focused on transforming organ transplant therapy for end-stage organ failure patients globally, with a market cap of $4.13 billion.

Operations: The company's revenue is primarily derived from its Surgical & Medical Equipment segment, which generated $488.23 million.

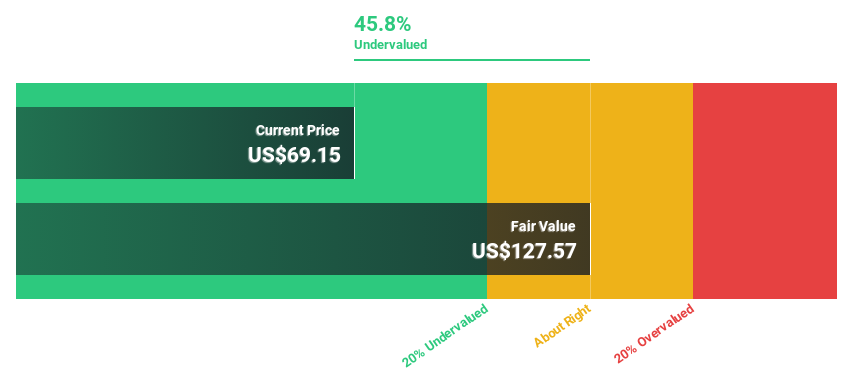

Estimated Discount To Fair Value: 47.9%

TransMedics Group is trading at US$124.71, significantly below its estimated fair value of US$239.19, suggesting it may be undervalued based on cash flows. Recent earnings showed strong growth with Q1 2025 revenue at US$143.54 million and net income of US$25.68 million, reflecting improved profitability. The company's revised full-year revenue guidance projects up to $585 million, indicating robust future growth potential despite debt concerns not fully covered by operating cash flow.

- The growth report we've compiled suggests that TransMedics Group's future prospects could be on the up.

- Click here to discover the nuances of TransMedics Group with our detailed financial health report.

Willdan Group (NasdaqGM:WLDN)

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States and has a market cap of $731.80 million.

Operations: The company's revenue is derived from two main segments: Energy, contributing $498.81 million, and Engineering & Consulting, accounting for $96.88 million.

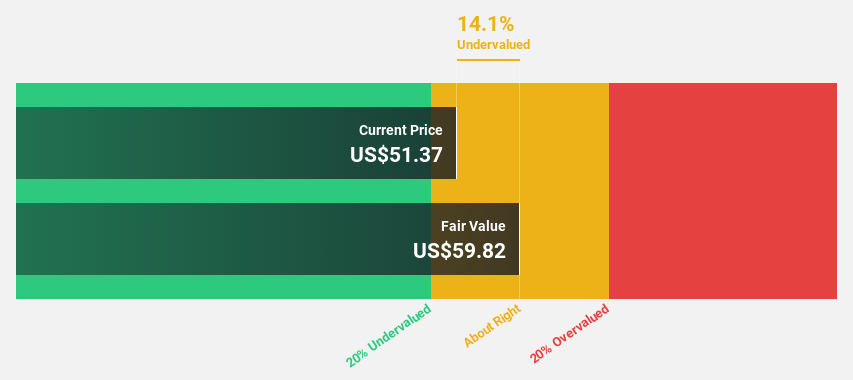

Estimated Discount To Fair Value: 14.9%

Willdan Group, trading at US$50.55, is undervalued based on cash flows with an estimated fair value of US$59.43. Earnings are expected to grow significantly at 23.4% annually, outpacing the broader US market. Recent Q1 2025 results showed a revenue increase to US$152.39 million and net income of US$4.69 million, reflecting ongoing profitability improvements amid strategic acquisitions and expanded credit facilities enhancing financial flexibility for future growth initiatives.

- Our comprehensive growth report raises the possibility that Willdan Group is poised for substantial financial growth.

- Dive into the specifics of Willdan Group here with our thorough financial health report.

Grindr (NYSE:GRND)

Overview: Grindr Inc. operates a social networking and dating application catering to the LGBTQ community globally, with a market cap of $4.66 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating $363.23 million.

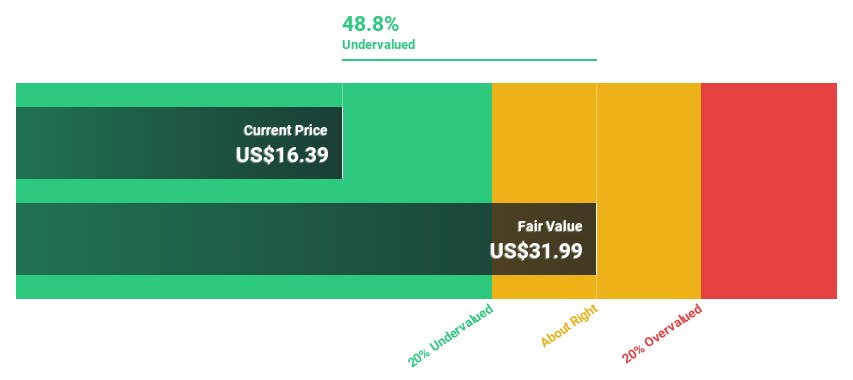

Estimated Discount To Fair Value: 31.4%

Grindr, trading at US$24.31, is significantly undervalued with a fair value estimate of US$35.45. The company reported Q1 2025 sales of US$93.94 million and net income of US$27.02 million, reversing a previous loss, alongside raised full-year revenue growth guidance to 26% or more. Despite insider selling and profitability expected within three years, Grindr's strategic expansions and share buyback program underscore its potential for enhanced cash flow valuation.

- According our earnings growth report, there's an indication that Grindr might be ready to expand.

- Take a closer look at Grindr's balance sheet health here in our report.

Make It Happen

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 168 more companies for you to explore.Click here to unveil our expertly curated list of 171 Undervalued US Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives