- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

Verisk Analytics (VRSK): Exploring Valuation as AI-Powered XactAI Launch and Leadership Change Shape Strategy

Reviewed by Kshitija Bhandaru

Verisk Analytics (VRSK) has made two strategic moves: the launch of XactAI, an artificial intelligence-powered suite to streamline property claims, and the appointment of Saurabh Khemka as president of Underwriting Solutions. Both moves signal the company's ongoing focus on digital innovation and leadership stability.

See our latest analysis for Verisk Analytics.

Verisk’s recent AI rollout and executive transition have kept investor attention on its digital transformation story, but the 1-year total shareholder return of -0.06% shows that momentum has stalled compared to peers. At the same time, steady revenue and net income growth signal potential as strategic moves mature.

If you’re looking to discover companies where insider leadership helps fuel expansion, now’s the time to explore fast growing stocks with high insider ownership.

With the company trading below its average analyst price target, yet having already posted substantial gains over the past three years, investors face a dilemma. Is Verisk undervalued at current levels, or has the market already priced in the next wave of digital-driven growth?

Most Popular Narrative: 19% Undervalued

Verisk Analytics currently trades at $249.04, while the most closely followed narrative calculates a fair value of $307.31. This apparent gap has drawn attention on whether the market is underestimating the impact of Verisk’s current initiatives.

Verisk Analytics is focusing on expanding its go-to-market strategy to drive revenue growth by applying successful sales models to more business units in 2025, which could lead to increased sales and customer acquisition. This focus will likely enhance revenue.

What’s behind the bold price target? The narrative hinges on transformative expansion strategies and ambitious profit margin projections. These factors present numbers that could surprise even seasoned followers. Ready to see the assumptions driving this valuation?

Result: Fair Value of $307.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation and unpredictable weather events could disrupt Verisk’s revenue momentum. These factors may challenge even the most optimistic growth projections.

Find out about the key risks to this Verisk Analytics narrative.

Another View: Market Multiples Raise Questions

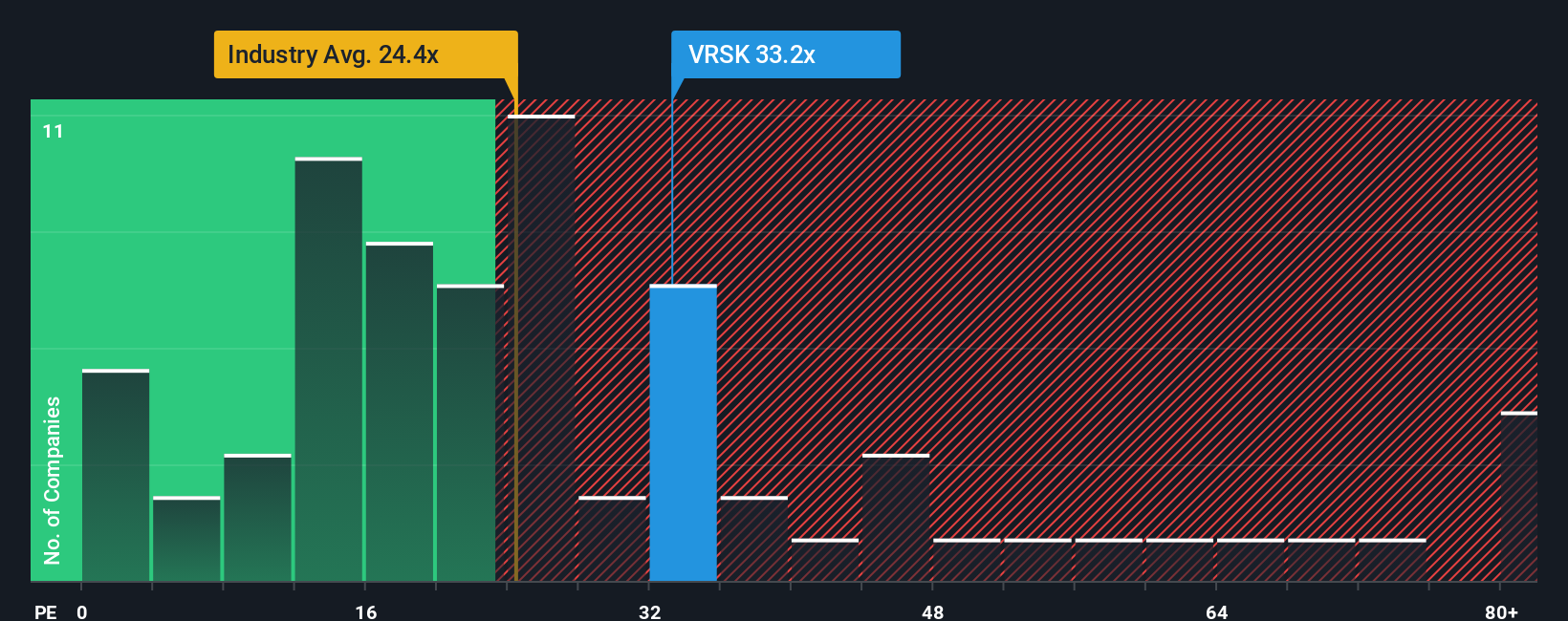

Looking at valuation through earnings multiples, Verisk trades at a price-to-earnings ratio of 38.3x. This is above both the US Professional Services industry average of 26.7x and its peer average of 36.6x, and also overshoots its own fair ratio of 29.9x. This suggests investors are paying a premium, potentially increasing downside risk if expectations shift. Will the premium prove justified, or could the market move closer to that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verisk Analytics Narrative

If you’d rather dive into the data and reach your own verdict, you can craft a personal narrative in just a few minutes using Do it your way.

A great starting point for your Verisk Analytics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at a single stock? Seize the chance to get ahead with unique opportunities hand-picked by our screeners. These could change your outlook for good.

- Tap into powerful growth potential by joining early investors in next-generation technology with these 24 AI penny stocks making waves across industries.

- Strengthen your portfolio with stable returns by targeting these 19 dividend stocks with yields > 3% that consistently pay out above-average yields.

- Accelerate your search for hidden bargains by uncovering these 896 undervalued stocks based on cash flows the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives