- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

How Investors May Respond To Verisk Analytics (VRSK) Acquisition of AccuLynx and Rising Debt Concerns

Reviewed by Sasha Jovanovic

- Recently, Verisk Analytics announced the acquisition of AccuLynx, a software platform, for US$2.35 billion, leading analysts to raise concerns about increased financial risk due to anticipated debt financing.

- This move sparked analyst downgrades, highlighting how major acquisitions can prompt reevaluation of risk and financial outlook within the insurance data analytics sector.

- To assess how the AccuLynx acquisition may affect Verisk’s growth and risk profile, we’ll examine its implications for the current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Verisk Analytics Investment Narrative Recap

To have confidence in Verisk Analytics as a shareholder, you need to believe in its ability to drive steady revenue growth by deepening its technology offerings and expanding its insurance data analytics footprint. The recent AccuLynx acquisition, financed with significant new debt, has raised questions about Verisk’s balance sheet risk, but unless this leads to further unplanned borrowing, the most important short-term catalyst remains the successful integration of AccuLynx and its impact on earnings; the key risk is rising interest expense pressuring margins. Among Verisk’s recent product launches, the introduction of Commercial Rebuild in the U.K. stands out for its direct relevance to ongoing insurance sector challenges like underinsurance and rising rebuild costs. This sort of targeted innovation showcases the company’s commitment to supporting insurers’ pressing needs, feeding into the broader catalyst of strengthening relationships and driving revenue growth within its core market. In sharp contrast, investors should be aware that higher debt commitments could expose Verisk to additional margin pressure if interest rates remain elevated or earnings growth slows...

Read the full narrative on Verisk Analytics (it's free!)

Verisk Analytics' outlook anticipates $3.9 billion in revenue and $1.2 billion in earnings by 2028. This scenario assumes 9.1% annual revenue growth and a $290.7 million increase in earnings from the current $909.3 million.

Uncover how Verisk Analytics' forecasts yield a $299.82 fair value, a 29% upside to its current price.

Exploring Other Perspectives

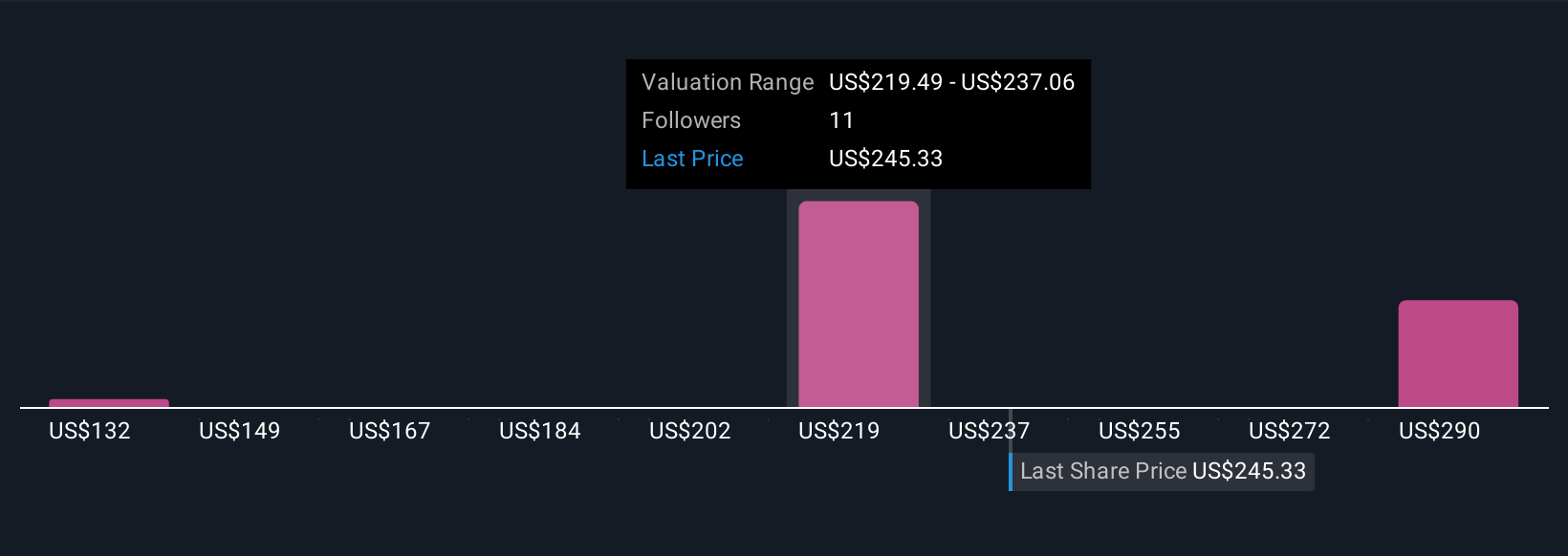

Five members of the Simply Wall St Community estimate Verisk’s fair value between US$131.67 and US$299.82. While an expanding product suite is expected to support revenue, borrowing costs remain a closely watched factor for results and valuation shifts.

Explore 5 other fair value estimates on Verisk Analytics - why the stock might be worth 43% less than the current price!

Build Your Own Verisk Analytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verisk Analytics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verisk Analytics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verisk Analytics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives