- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has experienced a remarkable 27% increase over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Verra Mobility (NasdaqCM:VRRM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verra Mobility Corporation offers smart mobility technology solutions and services across the United States, Australia, Canada, and Europe with a market cap of approximately $3.92 billion.

Operations: The company generates revenue through three primary segments: Parking Solutions ($83.45 million), Commercial Services ($403.56 million), and Government Solutions ($381.71 million).

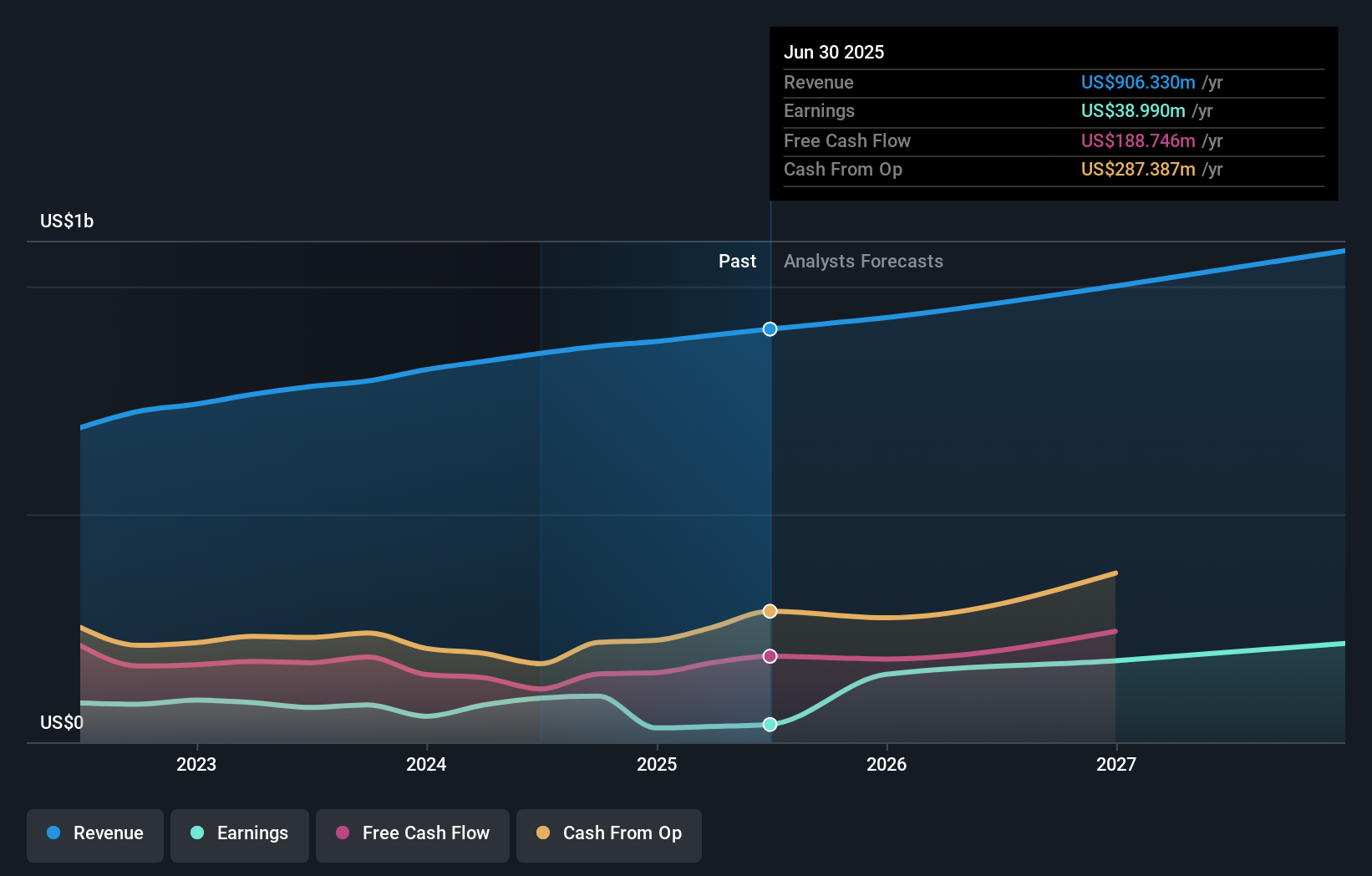

Verra Mobility's strategic expansions and technological innovations are shaping its trajectory in the high-growth tech landscape. With a 23% increase in annual earnings, outpacing the Professional Services industry's growth of 10.8%, the company demonstrates robust financial health. Recent initiatives, such as enhancing electronic toll payment systems in Italy and implementing a pioneering speed safety program in San Francisco, underscore its commitment to leveraging technology for scalable solutions. These efforts are complemented by a strong forecast of 23.46% annual earnings growth and an impressive projected return on equity of 35.4%. Despite revenue growth forecasts (6.5% per year) trailing the US market average (9.1%), Verra Mobility's recent $100 million boost to its buyback plan reflects confidence in its financial strategy and future prospects.

- Take a closer look at Verra Mobility's potential here in our health report.

Gain insights into Verra Mobility's historical performance by reviewing our past performance report.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles in the United States and internationally, with a market cap of $3.91 billion.

Operations: The company generates revenue primarily from its U.S. Marketplace segment, contributing $709.19 million, and its Digital Wholesale segment with $120.31 million.

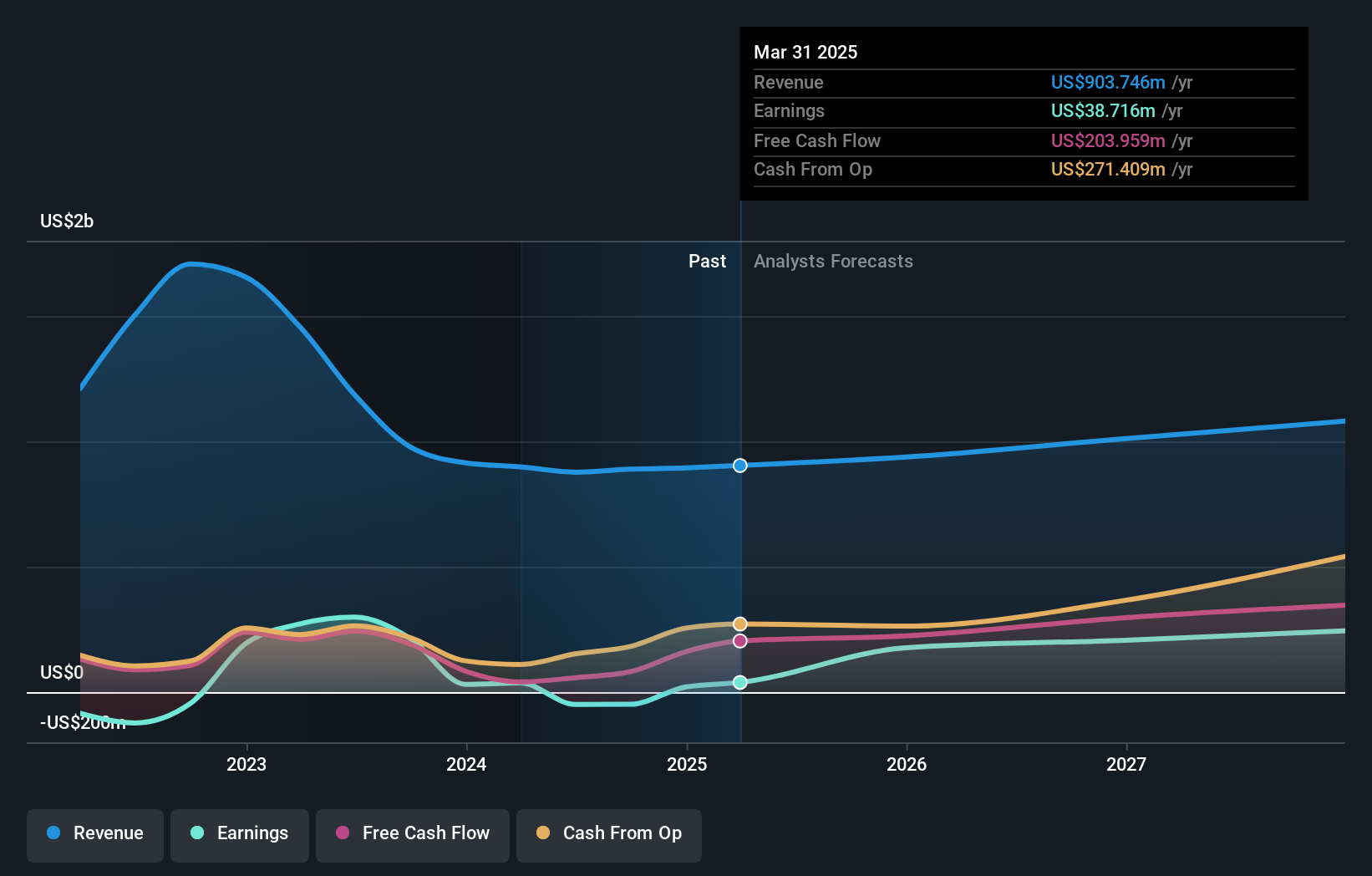

CarGurus demonstrates resilience and strategic foresight in the competitive tech landscape, evidenced by its recent earnings report showing a revenue increase to $231.36 million from $219.42 million year-over-year and maintaining a stable net income of $22.51 million. The company's commitment to innovation is highlighted by its new digital retail solution, 'CarGurus Digital Deal,' enhancing dealer-consumer interactions in Canada—a move likely to boost efficiency and sales conversions. Additionally, CarGurus' proactive share repurchase program, with $146.11 million spent on buying back shares, signals strong confidence in its financial health and future growth prospects amidst market challenges.

- Unlock comprehensive insights into our analysis of CarGurus stock in this health report.

Review our historical performance report to gain insights into CarGurus''s past performance.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions globally, with a market cap of approximately $1.04 billion.

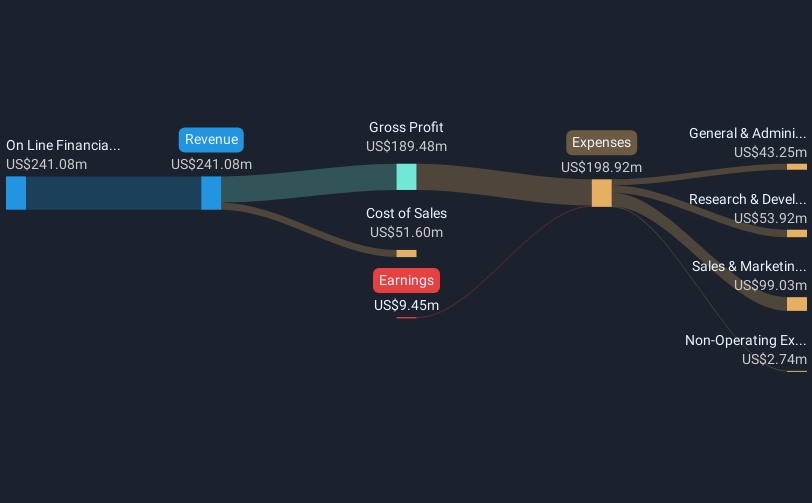

Operations: The company generates revenue primarily through its online financial information provider segment, which accounts for $241.08 million.

Similarweb, amidst a challenging tech landscape, has shown promising signs of growth and resilience. In its recent earnings update, the company reported a significant reduction in net loss to $2.57 million from $4.84 million year-over-year for Q3 2024, alongside an increase in sales to $64.71 million from $54.83 million. This performance is underscored by an impressive annual revenue growth rate of 13.9%, with projections indicating potential profitability within three years due to expected earnings growth of 126.3% per annum. The firm's strategic focus on expanding its digital offerings could position it favorably against industry norms where software firms are increasingly adopting SaaS models for stable revenue streams.

- Dive into the specifics of Similarweb here with our thorough health report.

Explore historical data to track Similarweb's performance over time in our Past section.

Summing It All Up

- Embark on your investment journey to our 237 US High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe.

Reasonable growth potential with acceptable track record.