- United States

- /

- Professional Services

- /

- NasdaqGS:RGP

RGP (RGP) Forecasts 134% Annual Earnings Growth, Lags Peers With 1.8% Revenue Outlook

Reviewed by Simply Wall St

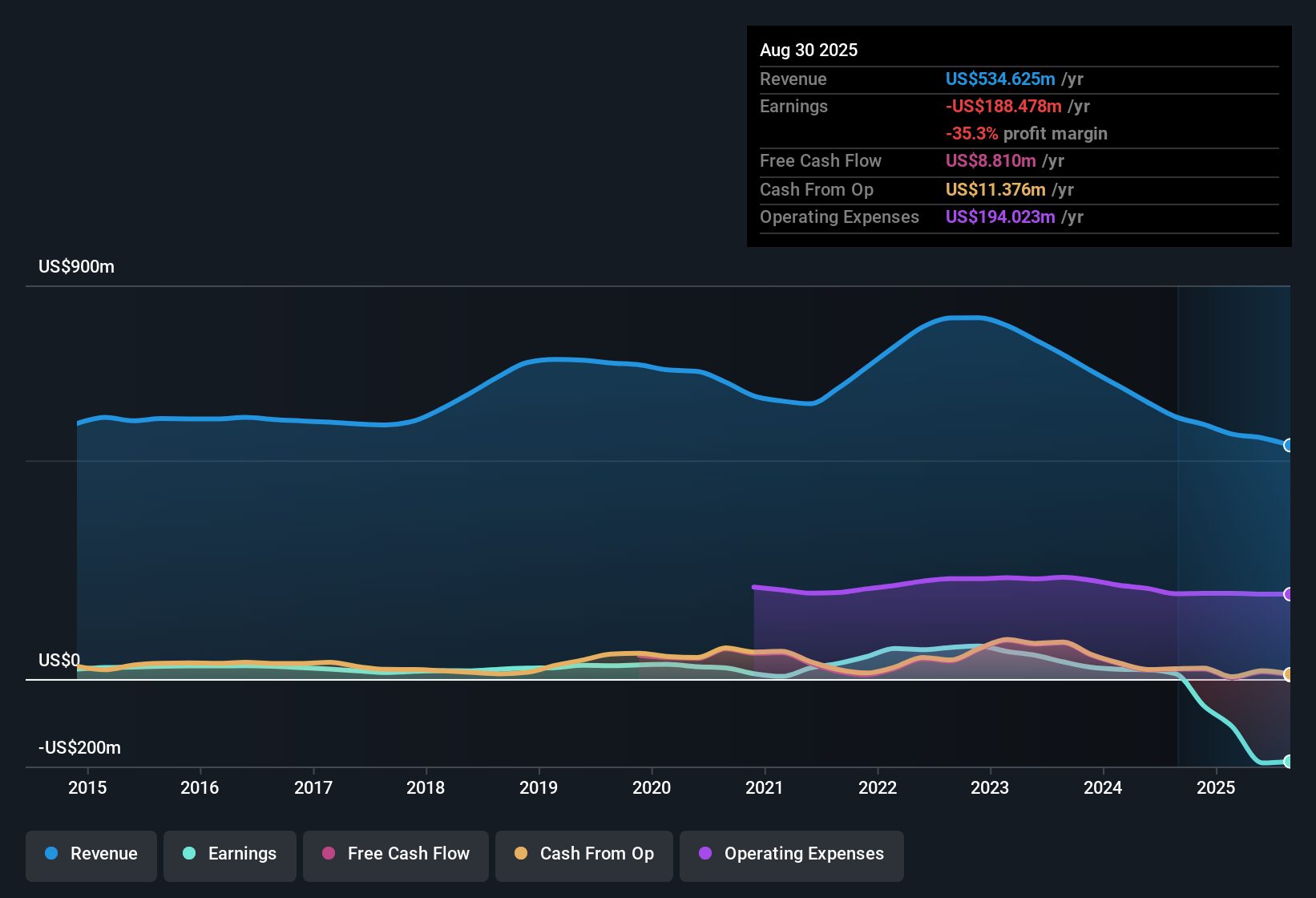

Resources Connection (RGP) posted a net loss with losses having increased at an annual rate of 55.1% over the past five years. However, the company is forecast to see earnings soar by 134.11% per year and reach profitability within the next three years. With a Price-To-Sales Ratio of just 0.3x, significantly below both peer and industry averages, and estimates suggesting RGP trades under its calculated fair value, investors may see plenty of potential. That said, concerns about the sustainability of RGP’s dividend still linger, adding a note of caution for income-focused shareholders.

See our full analysis for Resources Connection.Next up, we will see how these earnings results align or contrast with the most widely held narratives about RGP. The numbers sometimes tell a different story than the market. Let’s see where they sync up and where they diverge.

See what the community is saying about Resources Connection

Margins Poised for a Major Turnaround

- Analysts estimate profit margins will swing from -34.8% today to 4.5% in three years, a dramatic shift pointing toward sustainable profitability for RGP if forecasts materialize.

- Analysts' consensus view links this expected margin recovery to RGP's ongoing pivot toward digital advisory and higher-value consulting engagements.

- Consensus narrative notes a shift to transformation-focused services and digital modernization is raising bill rates and gross margins, setting the stage for longer-term earnings durability and a less volatile earnings base.

- International market expansion and tech adoption are expected to diversify revenue and mitigate risk from U.S. market cycles, supporting smoother profitability ahead.

Consensus sees margin growth as the foundation for a sustained reversal. Find out how the broader analyst view fits the latest data. 📊 Read the full Resources Connection Consensus Narrative.

Revenue Forecast Lags Market Averages

- RGP's projected annual revenue growth of 1.8% falls well behind the broader U.S. market average of 9.9%, flagging a major challenge in keeping up with sector peers.

- Analysts' consensus view cautions that persistent declines in core U.S. consulting and on-demand segments, including recent double-digit drops and guidance for further contraction, underscore structural headwinds for top-line growth.

- Consensus narrative highlights that macroeconomic uncertainty and delayed project decisions are driving down core segment revenues, making revenue gains from tech-enabled and international channels even more critical.

- The company’s risk of revenue stagnation is amplified as some clients tap internal resources and lengthen deal cycles, threatening both short- and long-term growth targets.

Valuation: Deep Discount to Peers and DCF Fair Value

- RGP’s Price-To-Sales Ratio sits at just 0.3x compared to a peer average of 17.9x and an industry average of 1.3x. The $4.75 share price trades below the DCF fair value of $6.52, creating a double-discount for value investors to scrutinize.

- Analysts' consensus view claims the depressed valuation reflects both near-term unprofitability and concerns about dividend sustainability, but also points to potential upside if profitability targets are met by 2028.

- The consensus price target of $8.13 suggests nearly 71% upside versus the current share price, provided that RGP delivers forecasted $27.8 million in earnings and achieves a 12.8x PE multiple as projected.

- However, the gap between analyst targets and the low multiple signals ongoing skepticism about RGP’s ability to fully bridge operational challenges and deliver sustained margin improvements in a competitive landscape.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Resources Connection on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a unique angle? Take just a few minutes to shape your perspective and make it part of the story: Do it your way

A great starting point for your Resources Connection research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While RGP shows potential for margin recovery, its sluggish revenue growth and ongoing risks of stagnation make consistent expansion uncertain when compared to sector peers.

If you want companies with a more reliable growth trajectory, check out stable growth stocks screener to uncover those delivering steady top-line and earnings performance through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGP

Resources Connection

Engages in the provision of consulting services to business customers under the Resources Global Professionals (RGP) name in North America, the Asia Pacific, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives