- United States

- /

- Software

- /

- NasdaqCM:RDVT

We Take A Look At Why Red Violet, Inc.'s (NASDAQ:RDVT) CEO Compensation Is Well Earned

We have been pretty impressed with the performance at Red Violet, Inc. (NASDAQ:RDVT) recently and CEO Derek Dubner deserves a mention for their role in it. Coming up to the next AGM on 26 May 2021, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for Red Violet

Comparing Red Violet, Inc.'s CEO Compensation With the industry

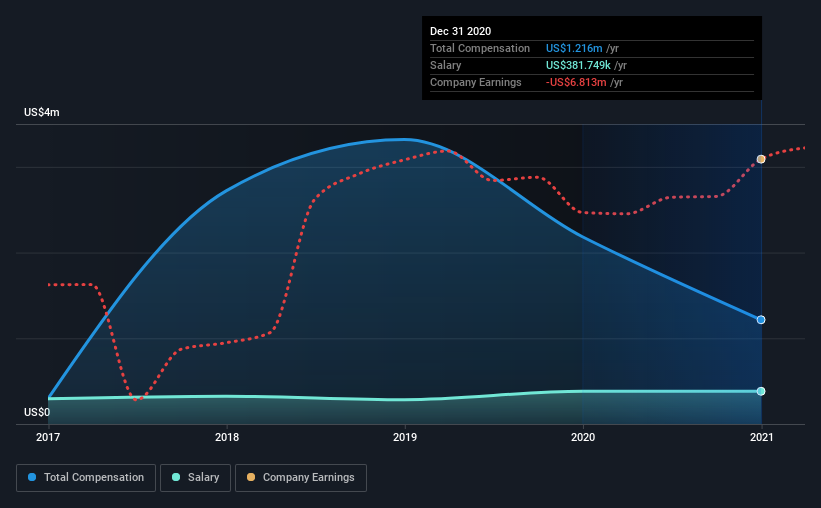

According to our data, Red Violet, Inc. has a market capitalization of US$243m, and paid its CEO total annual compensation worth US$1.2m over the year to December 2020. That's a notable decrease of 44% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$382k.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$1.2m. So it looks like Red Violet compensates Derek Dubner in line with the median for the industry. What's more, Derek Dubner holds US$6.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$382k | US$382k | 31% |

| Other | US$834k | US$1.8m | 69% |

| Total Compensation | US$1.2m | US$2.2m | 100% |

Talking in terms of the industry, salary represented approximately 23% of total compensation out of all the companies we analyzed, while other remuneration made up 77% of the pie. According to our research, Red Violet has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Red Violet, Inc.'s Growth Numbers

Red Violet, Inc. has seen its earnings per share (EPS) increase by 23% a year over the past three years. It achieved revenue growth of 4.9% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Red Violet, Inc. Been A Good Investment?

We think that the total shareholder return of 153%, over three years, would leave most Red Violet, Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Red Violet that investors should think about before committing capital to this stock.

Important note: Red Violet is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Red Violet, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:RDVT

Red Violet

An analytics and information solutions company, specializes in proprietary technologies and applying analytical capabilities to deliver identity intelligence in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026